Peer-to-peer on-chain betting is quietly reshaping the sports betting landscape, offering a radically different experience from traditional sportsbooks. Instead of betting against a house that sets odds and takes a margin, peer-to-peer (P2P) exchanges allow users to bet directly against each other, setting their own odds and terms. This model not only eliminates the house edge but also introduces features like tradable positions and often results in more competitive odds for bettors.

Why Peer-to-Peer On-Chain Betting Is Gaining Momentum

The core appeal of P2P on-chain sports exchanges lies in their transparency, efficiency, and user empowerment. By leveraging blockchain technology, these platforms record every transaction on a public ledger, making outcomes verifiable and reducing the risk of manipulation. Smart contracts automate settlement, ensuring trustless execution without reliance on intermediaries.

But perhaps the most compelling aspect is the removal of the house edge. Traditional sportsbooks build in a margin (often called the “vig” or “juice”) to guarantee profit over time. On P2P exchanges, users propose and accept bets with each other directly; there is no bookmaker to set lines or take a cut from every wager. This structure allows for better odds and greater flexibility in how positions are managed.

The Power of Tradable Positions

One feature that sets leading P2P exchanges apart is the ability to trade open bets before an event concludes. Much like financial markets, this introduces liquidity and hedging opportunities into sports betting. If market sentiment shifts after you place a wager – say a star player gets injured or weather conditions change – you can sell your position to another user at updated odds rather than being locked in until settlement.

This dynamic approach transforms betting into an active marketplace where risk can be managed in real time. It also fosters more sophisticated strategies for those who want to treat sports betting as an investment portfolio rather than just entertainment.

Three Leading Peer-to-Peer On-Chain Sports Betting Exchanges

Top Peer-to-Peer On-Chain Sports Betting Exchanges

-

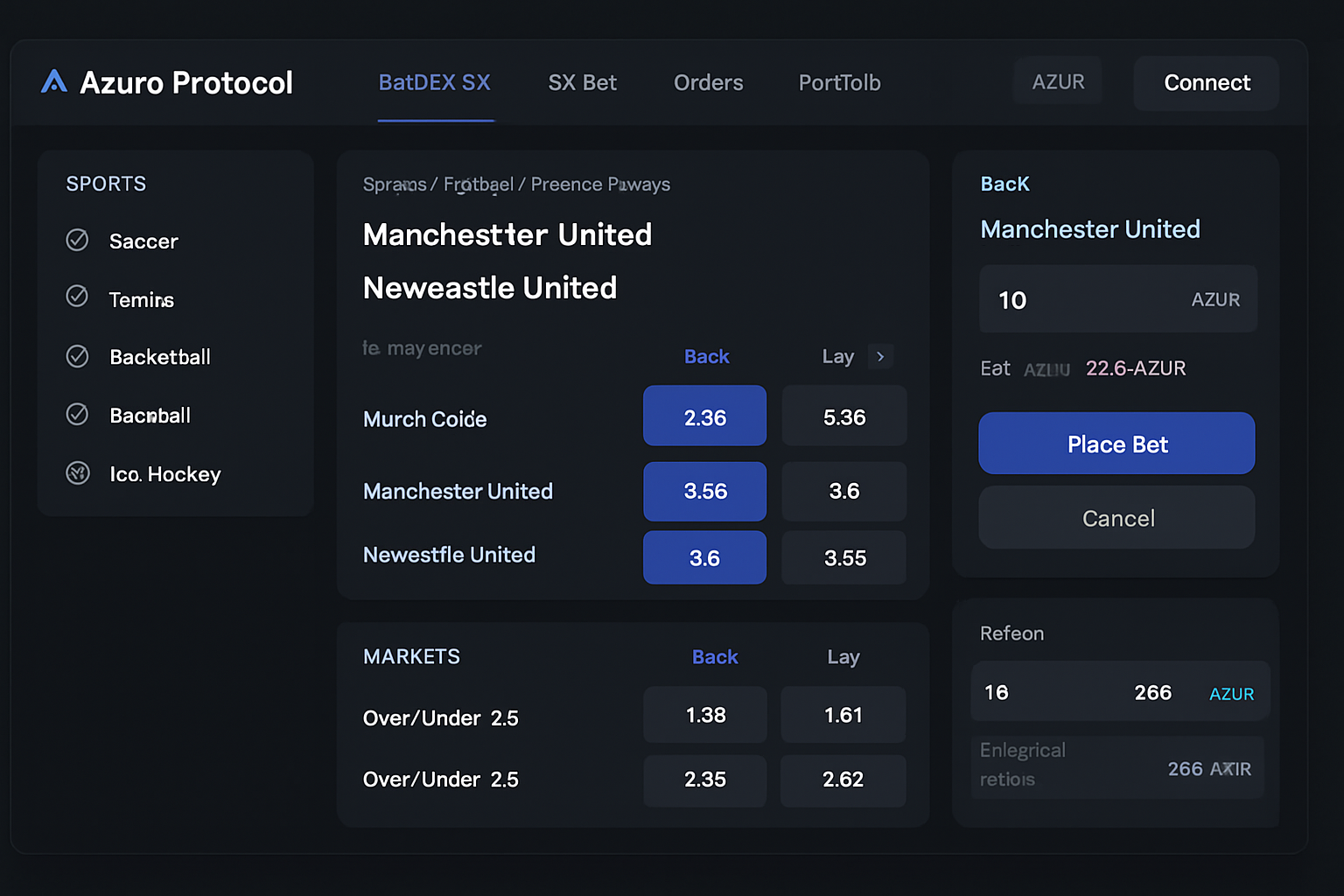

Azuro Protocol is a leading decentralized betting protocol built on blockchain, enabling peer-to-peer sports betting with no house edge. It offers tradable positions via liquidity pools and oracles, allowing users to set and accept odds directly. Azuro’s transparent smart contracts ensure fairness, and its open architecture supports integration with various front-end platforms, enhancing liquidity and user choice.

-

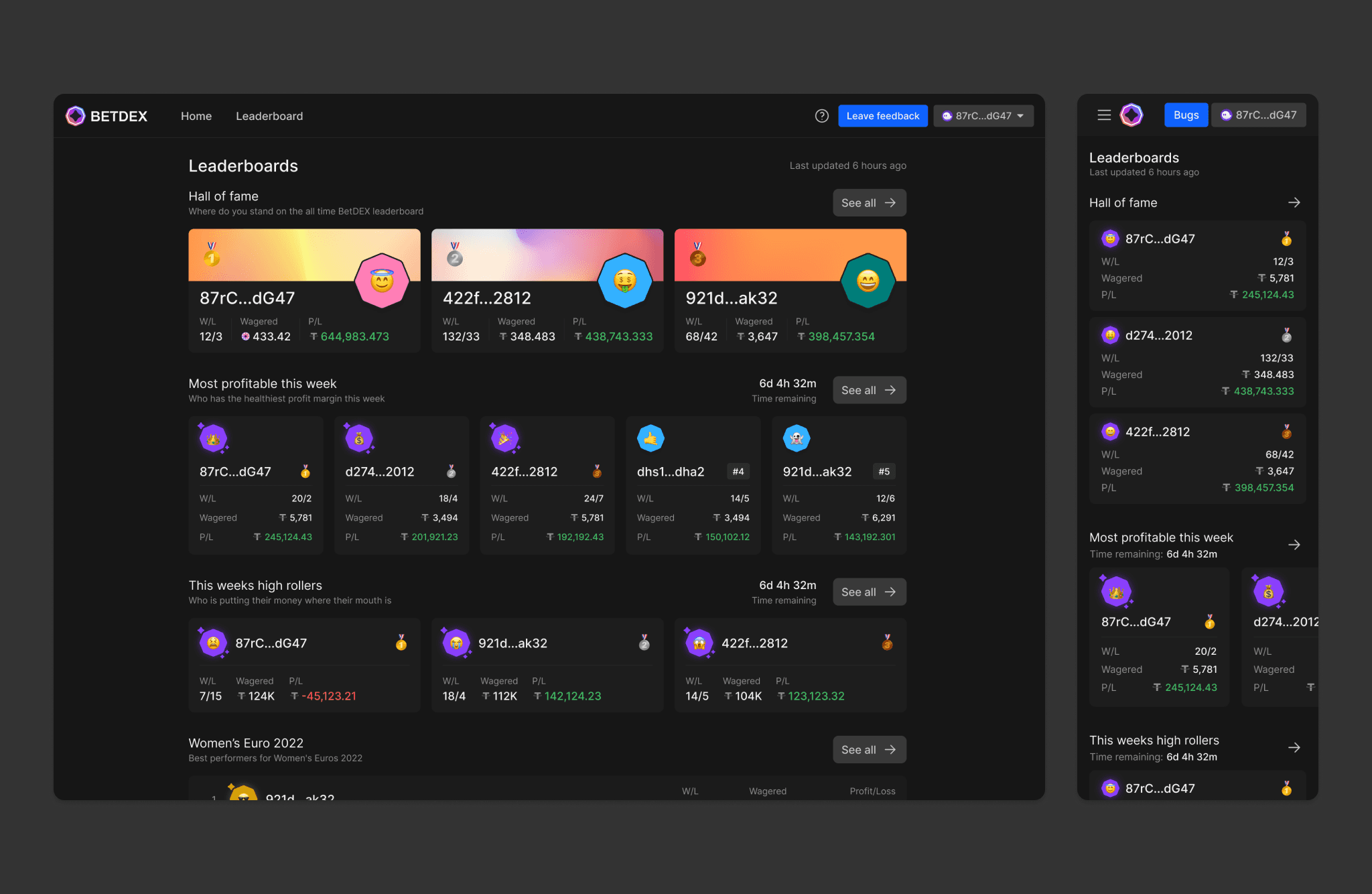

BetDEX Exchange operates as a fully on-chain, peer-to-peer betting exchange on the Solana blockchain. BetDEX eliminates the traditional bookmaker’s margin, providing users with better odds and the ability to trade positions in real-time. Its decentralized model ensures transparency, low fees, and global accessibility, making it a standout in the new wave of blockchain-powered sports betting.

-

SX Bet (formerly SportX) is a decentralized sports betting exchange on Polygon and Ethereum, allowing users to bet directly against each other with no house edge. SX Bet features tradable betting positions through its open order book, letting users buy, sell, or cash out bets before events conclude. Its on-chain settlement and governance token (SX) provide transparency, low fees, and community-driven development.

Let’s examine three standout platforms at the forefront of this movement:

- Azuro Protocol: Azuro operates as an open-source liquidity layer for decentralized prediction markets. It enables anyone to create or join markets without relying on centralized bookmakers. Azuro’s architecture supports deep liquidity pools that enhance market efficiency while keeping fees low due to its non-custodial design.

- BetDEX Exchange: Built atop the Solana blockchain for speed and minimal transaction costs, BetDEX offers a seamless P2P experience with zero house edge. Users can back or lay outcomes across major sporting events with instant settlement via smart contracts. The platform emphasizes low fees and fast order matching – crucial for active traders seeking real-time market action.

- SX Bet (formerly SportX): SX Bet has carved out its niche by allowing users not only to create custom markets but also to trade existing positions before events finish. Operating primarily on Polygon for low gas fees, SX Bet’s approach empowers users with flexibility while maintaining full transparency through open-source smart contracts.

Together, these platforms exemplify how peer-to-peer on-chain exchanges are delivering what traditional sportsbooks cannot: true market-driven pricing, transparent records of all wagers, instant settlements, and global access regardless of geography or banking status.

For users, the practical implications are significant. With no house edge, every dollar wagered goes into the pool, and odds are set by supply and demand rather than a centralized bookmaker. This means that sharp bettors and casual fans alike can often find better value on their wagers, especially in high-liquidity markets where competition for odds is fierce.

Tradable positions add another layer of sophistication. If you’ve backed a team and their prospects improve mid-game, you’re not locked in until the final whistle. Instead, you can sell your position to another user at a profit or cut your losses if things turn sour. This mirrors the flexibility of financial derivatives markets, providing active bettors with tools to manage risk dynamically.

Risks and Considerations for Peer-to-Peer On-Chain Betting

While the advantages of peer-to-peer on-chain betting exchanges are clear, from better odds to greater transparency, there are nuances that users should consider before diving in. Regulatory uncertainty remains an ongoing issue; laws governing online betting vary widely between jurisdictions, and decentralized platforms may not always fit neatly into existing frameworks.

Liquidity is another factor: while top exchanges like Azuro Protocol, BetDEX Exchange, and SX Bet have made strides in attracting active communities, some niche markets may lack sufficient counterparties to ensure fast order matching or tight spreads. Additionally, managing digital wallets and interacting with smart contracts requires baseline crypto literacy, mistakes can be costly if funds are sent to the wrong address or private keys are lost.

The Road Ahead: Innovation and User Empowerment

The evolution of peer-to-peer on-chain sports betting is far from over. As these platforms mature, expect continued innovation around liquidity incentives (such as staking pools), more granular market creation tools for users, and improved user interfaces that abstract away blockchain complexity for mainstream adoption.

Azuro Protocol, for example, is pioneering modular infrastructure that allows developers to launch new prediction markets with minimal friction, expanding beyond sports into esports and even non-sporting events. BetDEX Exchange‘s focus on ultra-low latency order matching is drawing in sophisticated traders accustomed to traditional financial exchanges. Meanwhile, SX Bet‘s model of tradable positions continues to blur the lines between betting and investing.

The upshot? Peer-to-peer on-chain sports betting is redefining what it means to wager online. By aligning incentives through transparent smart contracts and giving users control over both pricing and risk management, these platforms offer an experience that is not only fairer but also fundamentally more engaging than legacy sportsbooks.