Decentralized leveraged sports betting is no longer a futuristic concept – it’s rapidly redefining how fans, traders, and crypto enthusiasts engage with on-chain sports wagering. At the heart of this disruption is a new breed of platforms like LEVR Bet, which blend the familiar excitement of traditional sports betting with the transparency and composability of DeFi. By allowing users to amplify their exposure with up to 5x leverage, these exchanges are unlocking new strategies and risk profiles previously unavailable in the sports betting world.

What Makes Decentralized Leveraged Sports Betting Different?

Traditional sportsbooks have long been criticized for lack of transparency, high fees, and limited user control. Decentralized leveraged sports betting platforms flip this model by harnessing smart contracts and decentralized oracles. Every bet is recorded immutably on-chain, ensuring that odds are fair, settlements are automatic, and payouts happen without delay or middlemen.

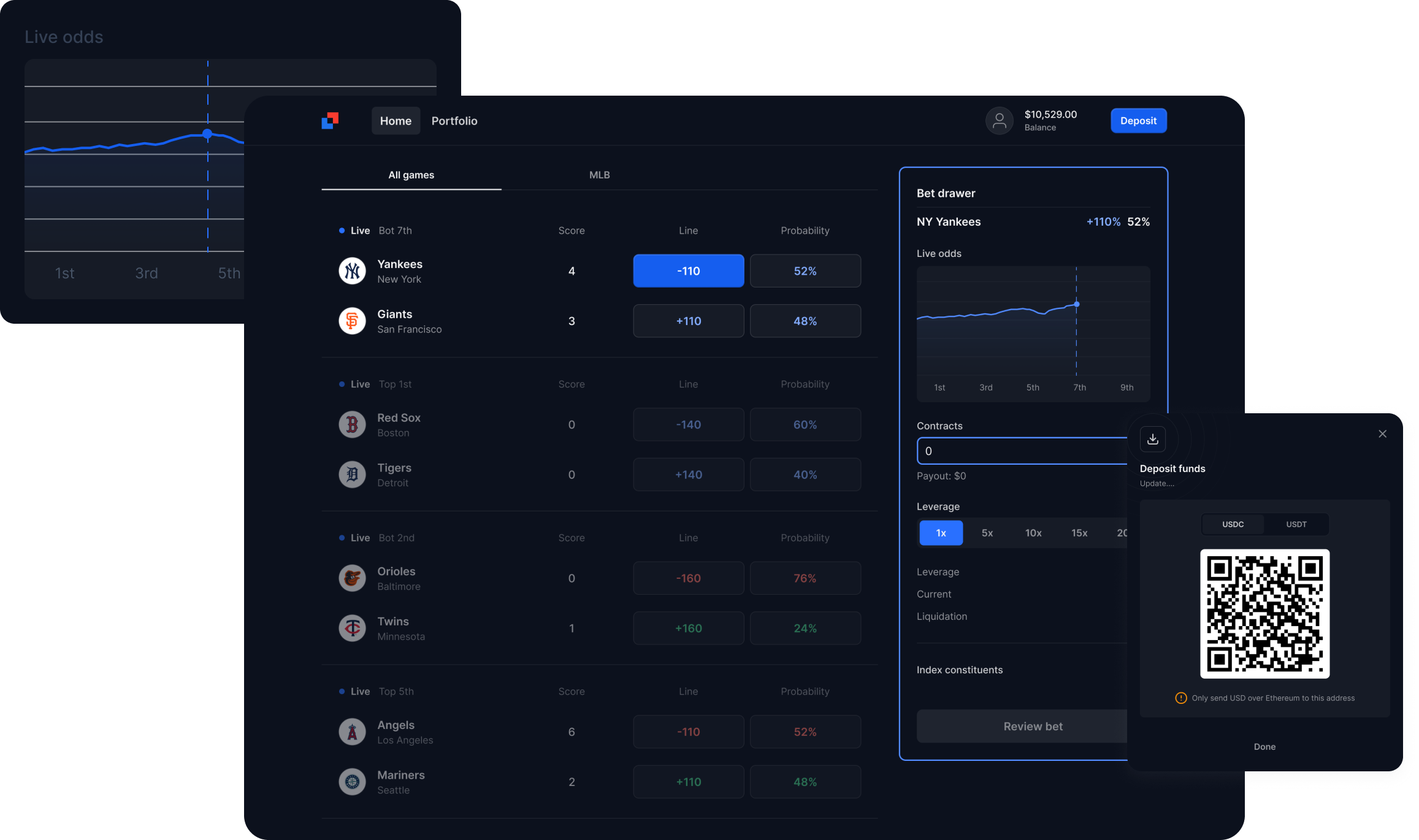

LEVR Bet stands out by integrating an orderbook-based exchange interface reminiscent of perpetual DEXs in DeFi. This means users can trade in and out of positions during live events, adjusting their exposure as odds shift in real time. The familiar experience of trading perps meets the thrill of live sports – all underpinned by transparent smart contracts.

The Technology Powering On-Chain Sports Wagering

The recent multichain expansion by LEVR Bet – now live on Avalanche, Monad, and Hyperliquid – showcases why blockchain infrastructure matters for this sector. High throughput networks provide near-instant transaction finality and low fees, both critical for real-time position management during fast-paced games. This technical edge allows platforms to handle high-volume betting without lag or bottlenecks.

Orderbook mechanics also play a crucial role. Unlike parimutuel pools or fixed-odds books, an orderbook sports betting exchange lets users set their own prices or take existing offers. This flexibility mirrors what advanced traders expect from DeFi perps markets but tailored to the nuances of sporting events.

Top Advantages of Decentralized Leveraged Sports Betting

-

Enhanced Transparency: All bets, odds, and payouts are recorded on public blockchains, ensuring full transparency and eliminating hidden fees or unfair practices.

-

User-Controlled Funds: Platforms like LEVR Bet allow users to maintain custody of their assets, removing the need to trust centralized sportsbooks with deposits.

-

Leveraged Betting Options: Decentralized platforms offer up to 5x leverage on live sports events, enabling users to amplify potential returns—something rarely available in traditional sportsbooks.

-

Lower Fees and Faster Payouts: By leveraging blockchain networks like Avalanche, Monad, and Hyperliquid, these platforms provide low transaction fees and near-instant payouts compared to conventional betting sites.

-

Fair Odds & Automated Settlements: Smart contracts and decentralized oracles guarantee fair odds and automatic settlement of bets, reducing the risk of operator manipulation or delayed payments.

-

Global Accessibility: Decentralized betting platforms are accessible worldwide without regional restrictions, allowing anyone with an internet connection and crypto wallet to participate.

Growth Signals: User Adoption and Market Momentum

The numbers speak volumes about where on-chain wagering is headed. In just five months, LEVR Bet’s beta attracted over 600,000 unique wallets placing more than 5 million bets – a testament to surging demand for user-centric alternatives to legacy sportsbooks (source). Backed by $3 million in funding from Blockchain Capital and Maven 11 (for a total raise of $5.3 million), LEVR Bet is well-positioned to continue scaling as multichain support brings even more liquidity and player diversity.

This growth isn’t just about numbers; it’s about shifting power back to bettors who demand transparency and control over their funds at all times. As more platforms adopt similar models leveraging smart contracts for instant settlement and fair odds calculation (source), the days of opaque house rules may be numbered.

As decentralized leveraged sports betting platforms mature, we’re witnessing a blurring of lines between DeFi trading and sports speculation. The ability to go long or short on teams, trade in and out of positions during live events, and use leverage to amplify conviction is fundamentally changing how users interact with sports markets. This isn’t just a UX upgrade – it’s a paradigm shift that empowers both casual fans and professional traders alike.

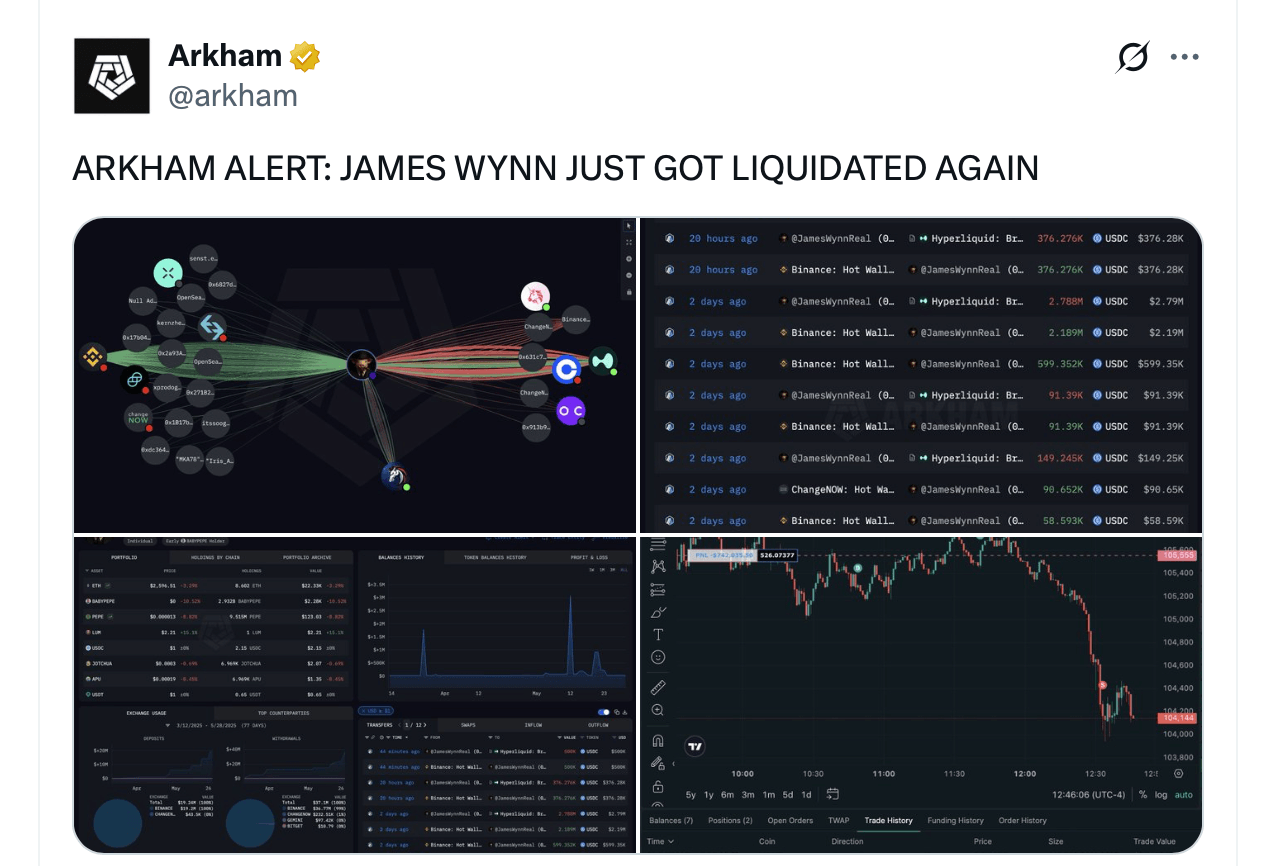

Challenges, Risks, and What’s Next

Of course, with innovation comes new risks. Leverage can magnify losses as much as gains, so risk management tools are essential for responsible wagering. Leading platforms like LEVR Bet incorporate features such as stop-loss orders, real-time margin checks, and clear liquidation thresholds to help users manage exposure. As always in DeFi and on-chain betting, education is key: understanding how leverage interacts with rapidly changing odds is vital for anyone looking to participate.

Regulatory uncertainty also looms over the sector. While decentralized protocols offer censorship resistance and borderless access, they must navigate evolving legal frameworks across different jurisdictions. The open-source nature of these platforms means that community governance will play an increasingly important role in adapting to new compliance requirements while preserving user autonomy.

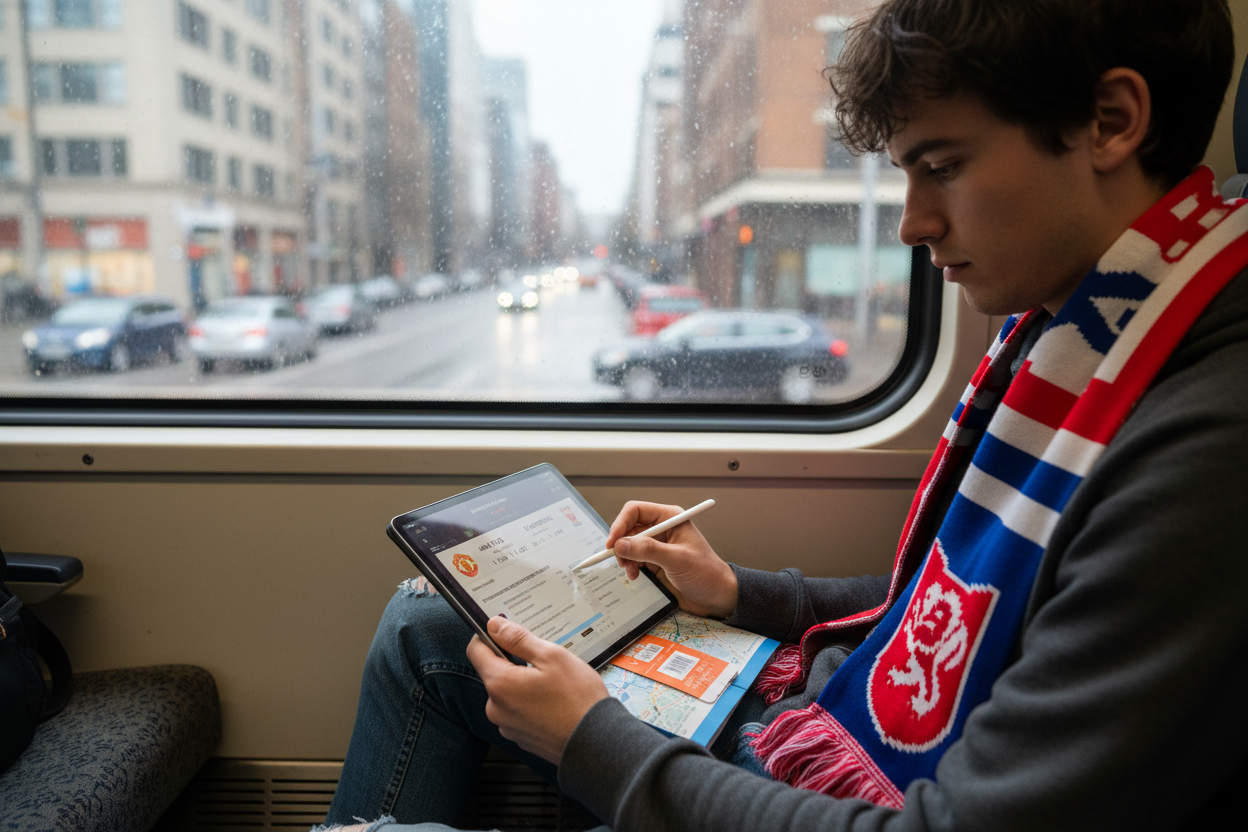

Why User Experience Is Winning Converts

Perhaps most importantly for mainstream adoption, the user experience on leading Web3 sports betting platforms now rivals – or even surpasses – that of traditional sportsbooks. Intuitive interfaces, real-time odds feeds, rapid settlement via smart contracts, and seamless wallet integration all contribute to a frictionless journey from deposit to payout. The days when DeFi apps were only for tech-savvy power users are fading fast; today’s decentralized leveraged sports betting exchanges are designed for everyone who loves the game.

Top Features Attracting Users to Web3 Sports Betting

-

Leveraged Betting with Up to 5x Multipliers: Platforms like LEVR Bet allow users to amplify their potential returns by placing bets with leverage, offering multipliers of up to 5x on live sports events.

-

Decentralized Order Book and Perpetual Trading: Web3 platforms integrate familiar perpetuals order book DEX mechanics, letting users trade sports bets in real time, similar to crypto trading on decentralized exchanges.

-

Transparent Smart Contracts and Fair Odds: Bets are executed via auditable smart contracts, ensuring fair odds, secure transactions, and immediate payouts without intermediaries.

-

Low Fees and Near-Instant Finality: By leveraging high-throughput blockchains like Avalanche, Monad, and Hyperliquid, platforms offer low transaction fees and real-time settlement for live betting.

-

Full User Control and On-Chain Transparency: Users maintain custody of their funds at all times, with all wagers and results visible on-chain, addressing trust and transparency issues common in traditional betting.

-

Multichain Access and High Liquidity: Platforms like LEVR Bet operate across multiple blockchains, providing high liquidity and a seamless betting experience for a global user base.

Ultimately, the rise of decentralized leveraged sports betting marks a pivotal moment for both crypto and sports fans. By fusing the best elements of DeFi with the global passion for live events, these platforms are building something genuinely new: a transparent market where skill, strategy, and conviction meet on equal terms. As liquidity deepens and more blockchains come online, expect even greater innovation – from custom bet types to cross-sport trading strategies – all powered by smart contracts you can trust.