The sports betting landscape is undergoing a radical transformation. Leveraged on-chain sports betting platforms like LEVR Bet are disrupting the status quo by merging decentralized finance (DeFi) mechanics with real-time wagering. This new breed of sportsbook offers users an experience more akin to perpetual trading than traditional betting, giving both crypto enthusiasts and seasoned punters innovative ways to engage with live sports events.

What Sets Leveraged On-Chain Sportsbooks Apart?

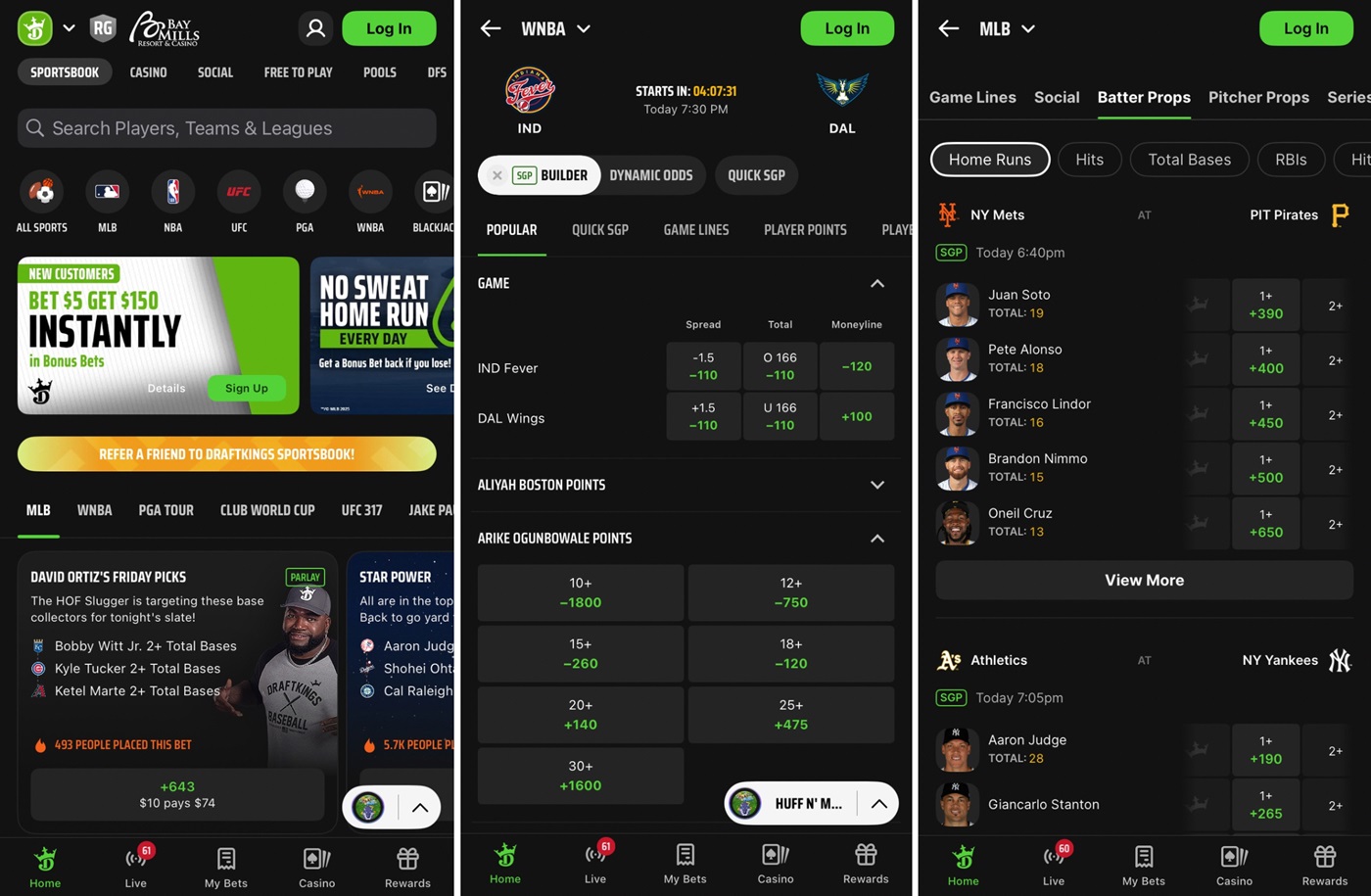

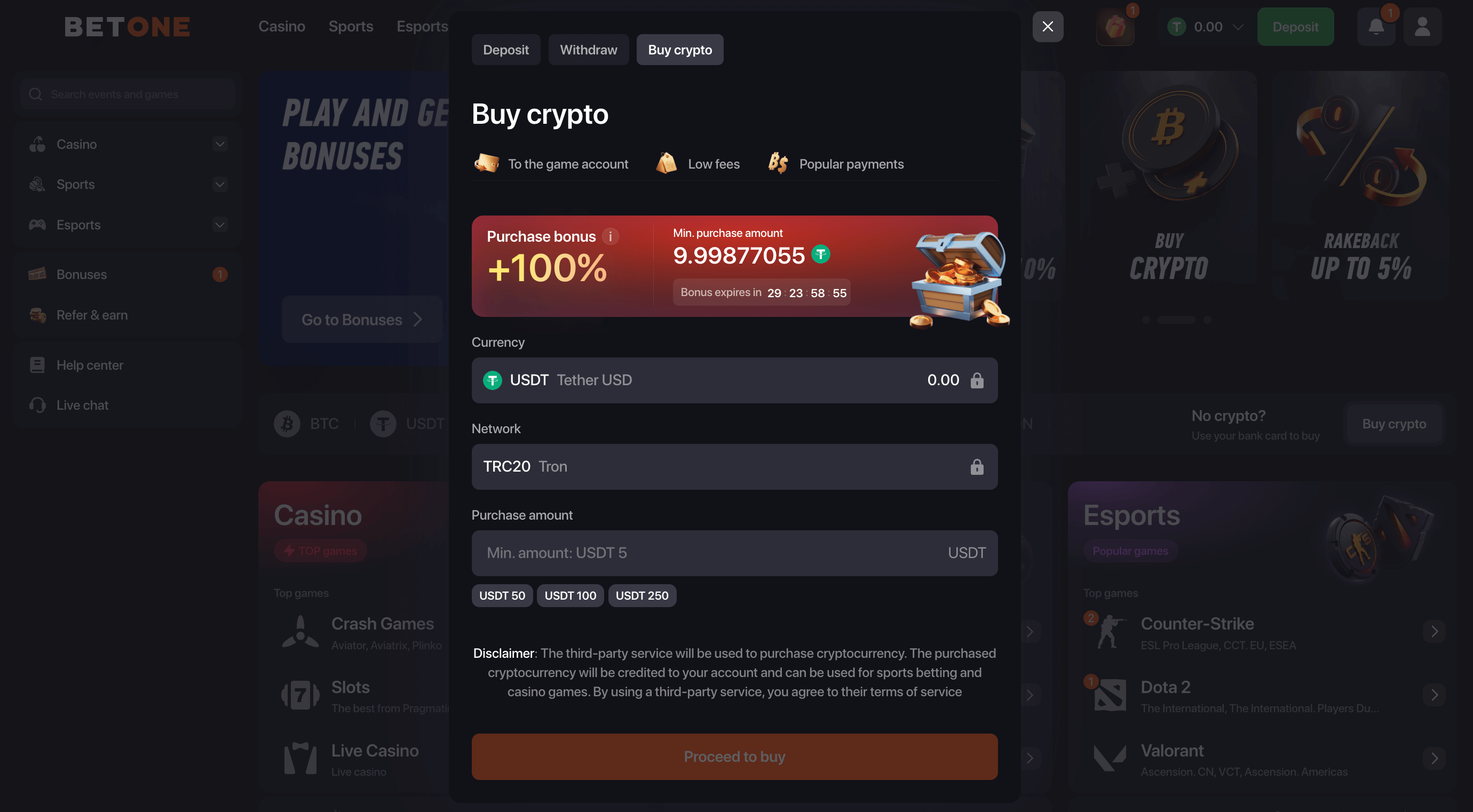

Unlike legacy sportsbooks that rely on custodial accounts and opaque odds-making, leveraged on-chain platforms leverage smart contracts for every transaction. LEVR Bet, for example, operates as a decentralized leveraged sports book exchange across Avalanche, Monad, and Hyperliquid blockchains. This multichain approach ensures low fees, near-instant settlement, and the ability to handle high-volume in-game wagers, crucial for bettors seeking edge in fast-moving markets.

The headline feature is leverage: users can amplify their wagers up to 5x, meaning a correct call can multiply returns but also increases risk exposure. This mirrors the structure of perpetual swaps in crypto trading rather than parlays or fixed odds bets found elsewhere. It’s a seismic shift for risk-tolerant bettors who want both transparency and flexibility.

Transparency and Trust: Blockchain’s Edge

Transparency is at the core of DeFi sports betting platforms. Every bet placed, every position opened or closed, is immutably recorded on-chain. Bettors no longer have to trust centralized operators or worry about payout delays, settlement is automatic and verifiable by anyone.

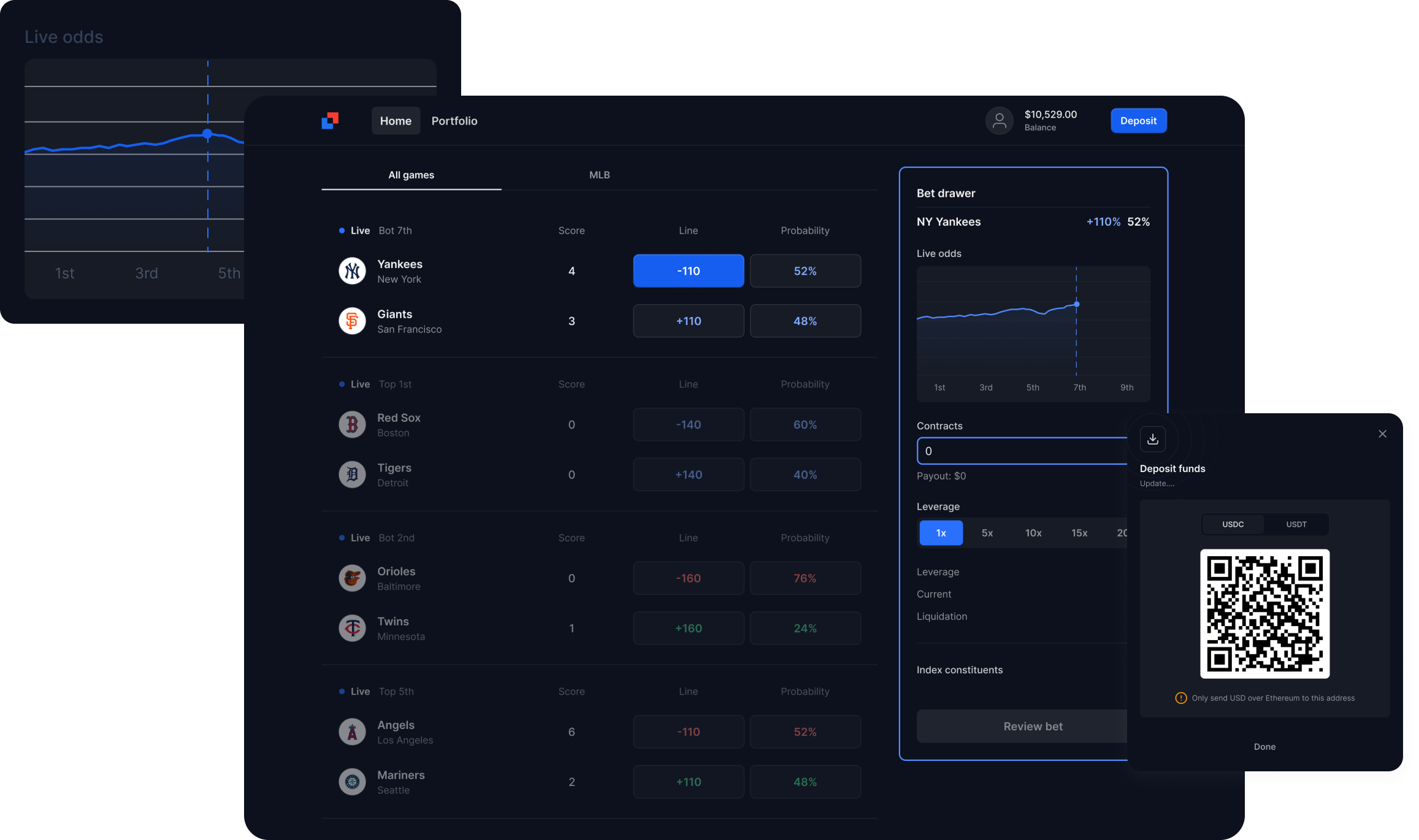

This transparency extends to odds-making as well. With LEVR Bet’s central limit order book (CLOB) model, users can see real-time liquidity and market depth before placing a wager. It’s a data-driven approach that removes hidden margins and allows sharp bettors to identify inefficiencies instantly.

Key Advantages of Decentralized Leveraged Sports Betting

-

On-Chain Transparency: All bets, odds, and payouts are recorded on public blockchains, ensuring full transparency and eliminating hidden fees or manipulation common in traditional sportsbooks.

-

Leverage and Real-Time Position Management: Platforms like LEVR Bet allow users to place bets with up to 5x leverage and adjust positions during live events, a feature rarely available with conventional bookmakers.

-

Lower Fees and Fast Settlement: By operating on high-performance blockchains such as Avalanche and Monad, decentralized platforms offer lower transaction fees and near-instant settlement even during high-volume events.

-

User Ownership and Incentives: Decentralized betting platforms often provide token incentives and governance rights, giving users a stake in the platform’s growth and decision-making—unlike traditional sportsbooks.

-

Enhanced Security and Custody: With self-custody of funds and smart contract-based execution, users retain control over their assets, reducing risks of hacks or withheld payouts seen in centralized betting sites.

Funding Fuels Innovation in DeFi Sports Betting

The pace of innovation is accelerating thanks to significant capital inflows. In early 2025, LEVR Bet secured $3 million in funding led by Blockchain Capital and Maven 11, bringing its total raise since 2024 to $5.3 million (source: Digital Journal). This capital supports rapid product development across new sports markets and feature sets like options-inspired hedging tools.

The influx of resources has allowed platforms like LEVR Bet not only to scale infrastructure but also attract liquidity providers through token incentives, giving users a stake in the platform’s growth while structurally lowering customer acquisition costs compared to Web2 incumbents.

User Experience: Real-Time Control Meets DeFi Flexibility

Bettors are no longer locked into static positions once an event starts. On-chain sportsbooks with leverage allow users to adjust or close positions in real time as games unfold, mirroring the dynamism of crypto trading platforms rather than the rigidity of old-school books.

This flexibility fundamentally changes how risk is managed during live events. For example, if momentum shifts during an NBA game or a key injury occurs mid-match, traders can hedge or exit instantly without waiting for manual intervention from a centralized operator.

Beyond the technical leap, this model puts power back in the hands of users. The smart contract architecture means payouts are non-custodial and instant, eliminating withdrawal delays or disputes that plague traditional operators. This is particularly appealing to high-frequency bettors and those who demand provable fairness.

Moreover, the introduction of token incentives is more than a marketing gimmick. By letting users become stakeholders through governance tokens and liquidity mining, platforms like LEVR Bet align user interests with platform success. This community-driven approach fosters deeper engagement and loyalty while reducing reliance on expensive promotions or affiliate deals, structurally lowering acquisition costs for the business.

Risks and Considerations in Leveraged On-Chain Sports Betting

With increased upside comes amplified risk. Leveraged on-chain sports betting is not for the risk-averse; losses can be multiplied just as quickly as gains. Volatility during live events can lead to rapid liquidation of positions if markets move sharply against a bet. As with perpetual trading, prudent bankroll management and understanding of leverage mechanics are essential.

Security is another critical factor. While blockchain-based platforms benefit from transparency, they’re only as secure as their underlying smart contracts and infrastructure. Users should assess audit reports, review platform history, and avoid overexposure until comfortable with the protocol’s risk controls.

Top Tips for Managing Risk on Leveraged On-Chain Betting

-

Understand Leverage Multipliers: Platforms like LEVR Bet allow users to bet with up to 5x leverage. Higher leverage amplifies both potential gains and losses, so assess your risk tolerance before increasing your exposure.

-

Utilize Real-Time Position Management: Decentralized platforms such as LEVR Bet let you adjust or close bets in real-time during live events. Use this flexibility to limit losses or lock in profits as odds shift.

-

Set Strict Betting Limits: Take advantage of on-chain wallet controls to pre-set maximum wager amounts. This helps prevent overexposure, especially when using leverage.

-

Monitor Transaction Fees and Network Speed: LEVR Bet’s multichain deployment on Avalanche, Monad, and Hyperliquid offers low fees and fast confirmation. Always check network conditions to avoid costly delays or unexpected slippage.

-

Review Smart Contract Audits and Platform Security: Before depositing funds, verify that the platform’s smart contracts have undergone independent security audits. LEVR Bet’s transparency is enhanced by its on-chain operations and published audit reports.

-

Diversify Your Bets: Avoid concentrating all your funds on a single event or outcome. Spread your exposure across different sports or bet types to minimize risk.

-

Stay Informed on Platform Updates: Follow official channels for LEVR Bet and similar platforms to stay updated on new features, rule changes, or technical issues that could affect your betting strategy.

The Road Ahead: Where DeFi Sportsbooks Are Headed

The growth trajectory for leveraged on-chain sportsbooks like LEVR Bet signals a broader trend toward decentralized sports betting with leverage. As these platforms expand into new markets, soccer, e-sports, even niche competitions, expect more sophisticated trading tools akin to those found in decentralized exchanges: options-inspired hedging features, automated market making, and cross-market arbitrage opportunities.

This convergence of DeFi liquidity models with real-world events opens up entirely new strategies for bettors who thrive on volatility and data-driven decision making. For regulators and legacy operators watching from the sidelines, the message is clear: transparency, flexibility, and user empowerment are now table stakes in the next era of sports wagering.

If you’re ready to dive deeper into how protocols like LEVR Bet are changing crypto gambling at its core, and what it means for both punters and liquidity providers, read this comprehensive breakdown: How Leveraged On-Chain Sports Betting Is Changing Crypto Gambling.