In the high-stakes arena of Solana sports prediction markets, 2026 marks a pivotal shift toward mature, scalable platforms that blend blockchain efficiency with real-world event trading. Solana’s blistering transaction speeds, averaging 65,000 TPS, and sub-cent fees have propelled it ahead of Ethereum-based rivals, capturing over 40% of decentralized prediction volume per recent BlockchainX reports. Platforms like BetDEX and Drift BET exemplify this surge, offering on-chain sports betting 2026 with unprecedented transparency and liquidity. While niche players such as TheEdge and BetPot vie for attention in Solana Web3 sports markets, established leaders dominate through superior mechanics and user adoption metrics.

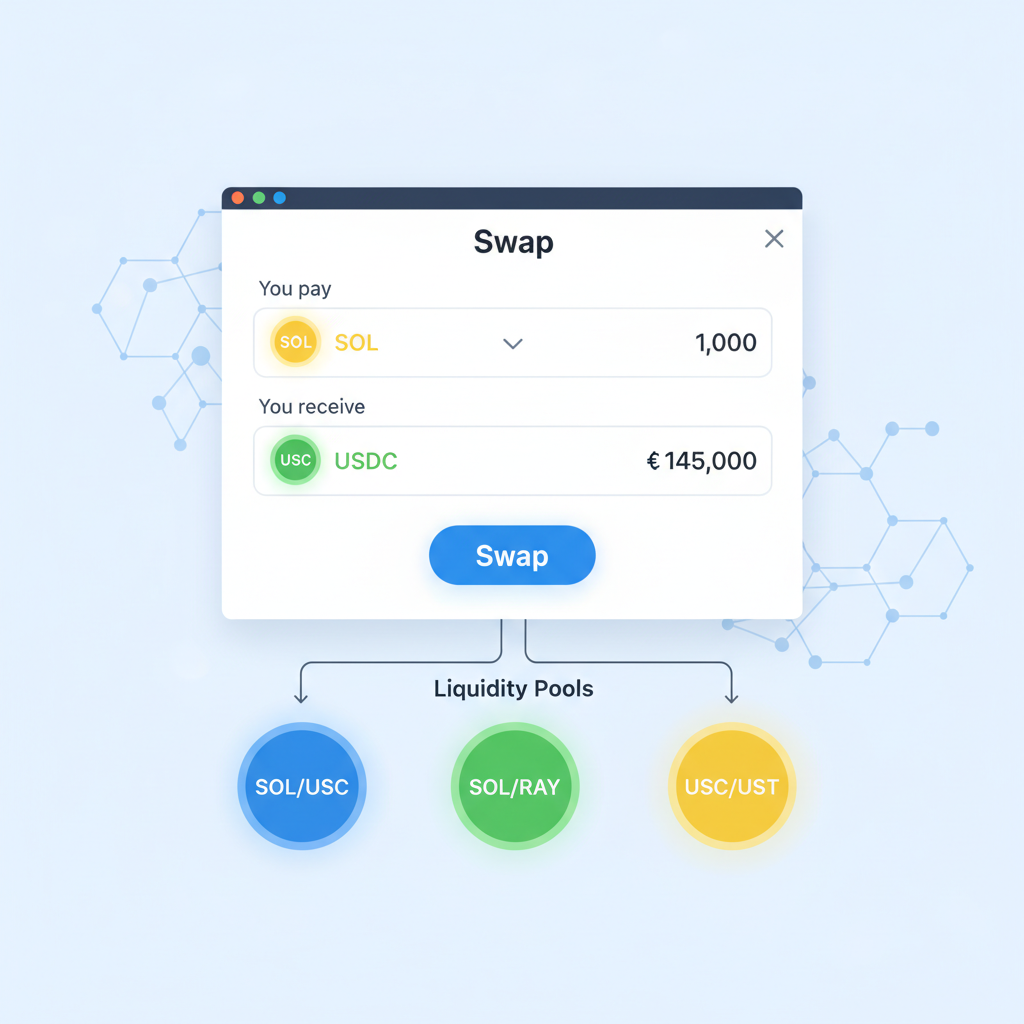

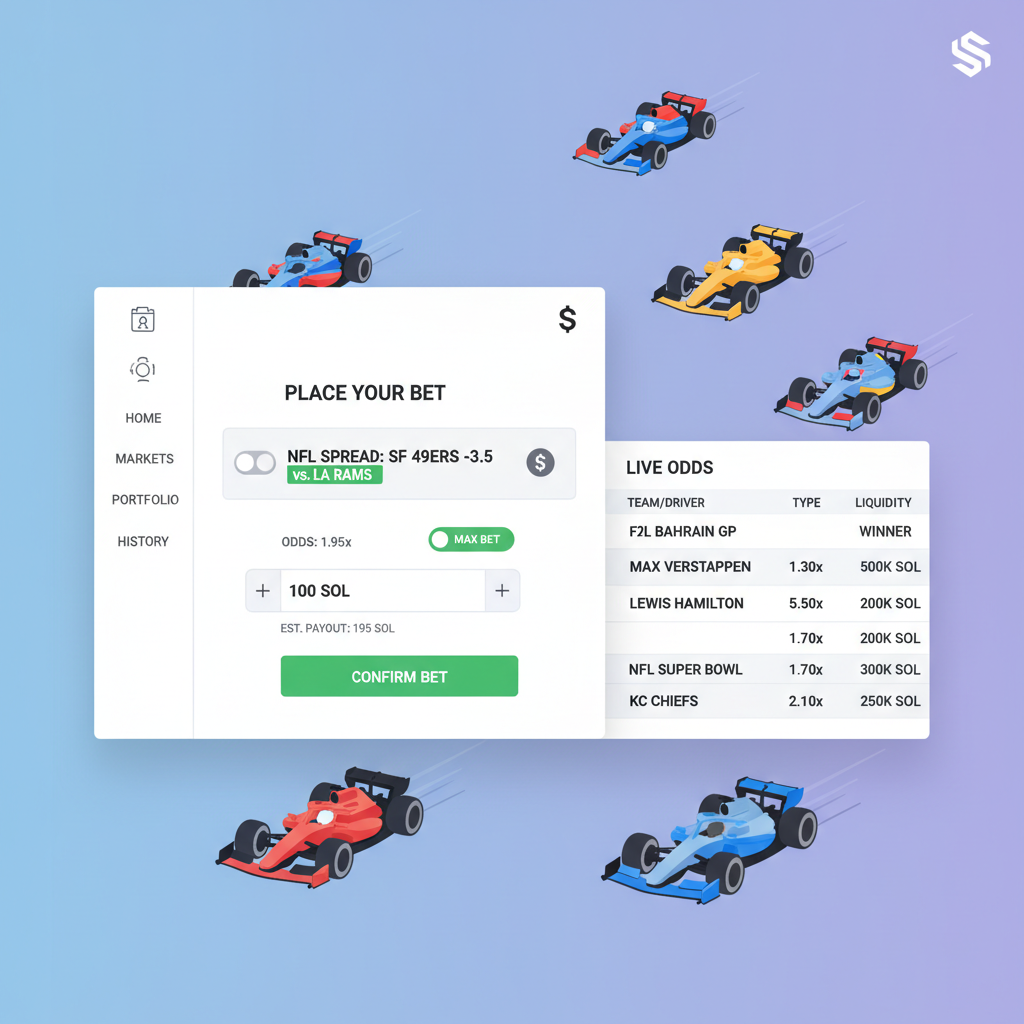

Solana’s ecosystem has evolved from meme-driven hype to a robust hub for TheEdge crypto betting and BetPot decentralized predictions. Data from Solana Compass reveals prediction markets TVL exceeding $500 million as of January 2026, up 300% year-over-year. This growth stems from innovations like pooled liquidity models and seamless integrations with perpetual DEXes, reducing slippage and enabling instant settlements. Bettors now access hundreds of sports events, from NFL playoffs to Formula 1 races, with oracle-backed outcomes ensuring tamper-proof resolutions.

Solana’s Edge in Prediction Market Liquidity Dynamics

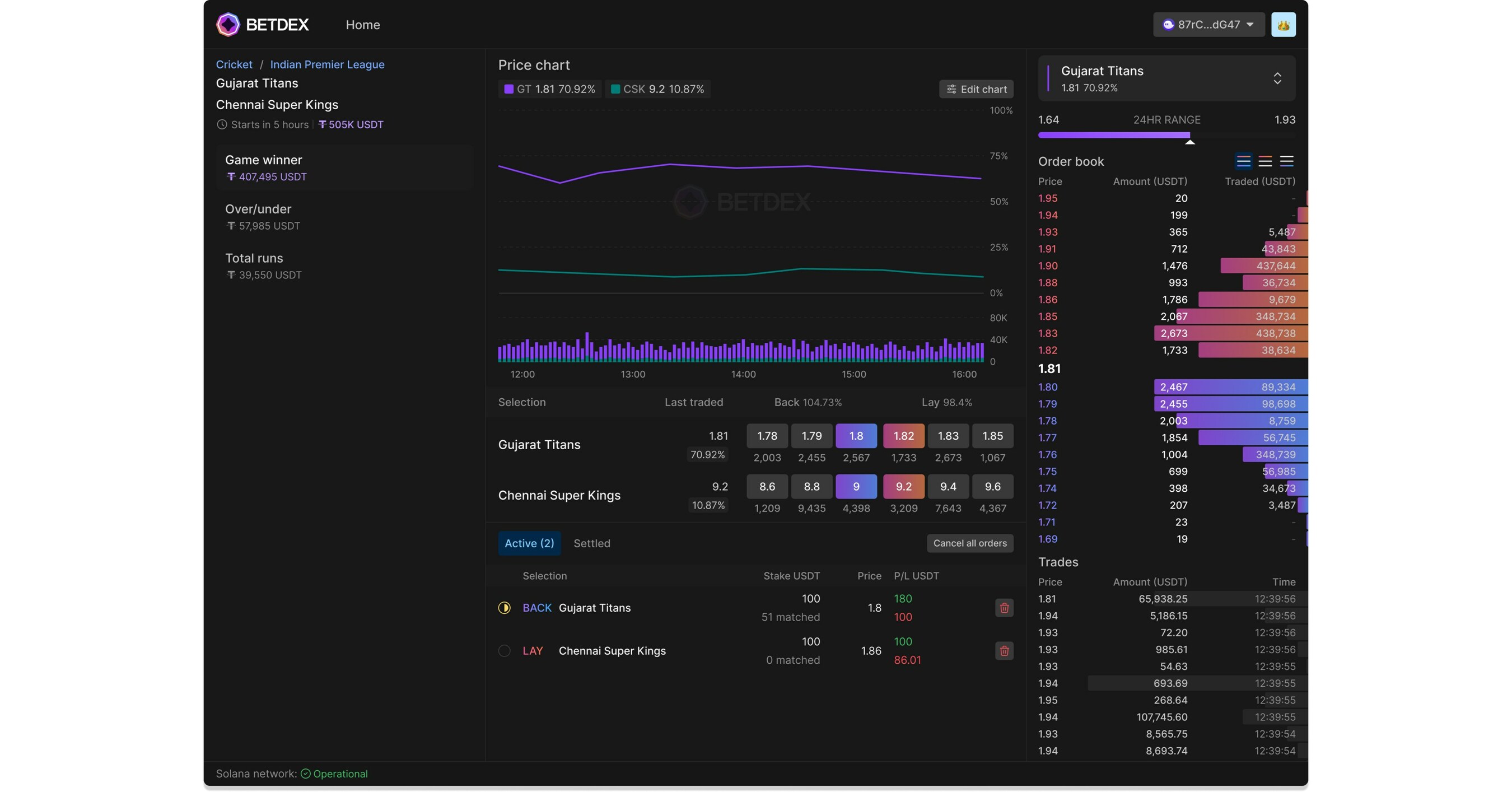

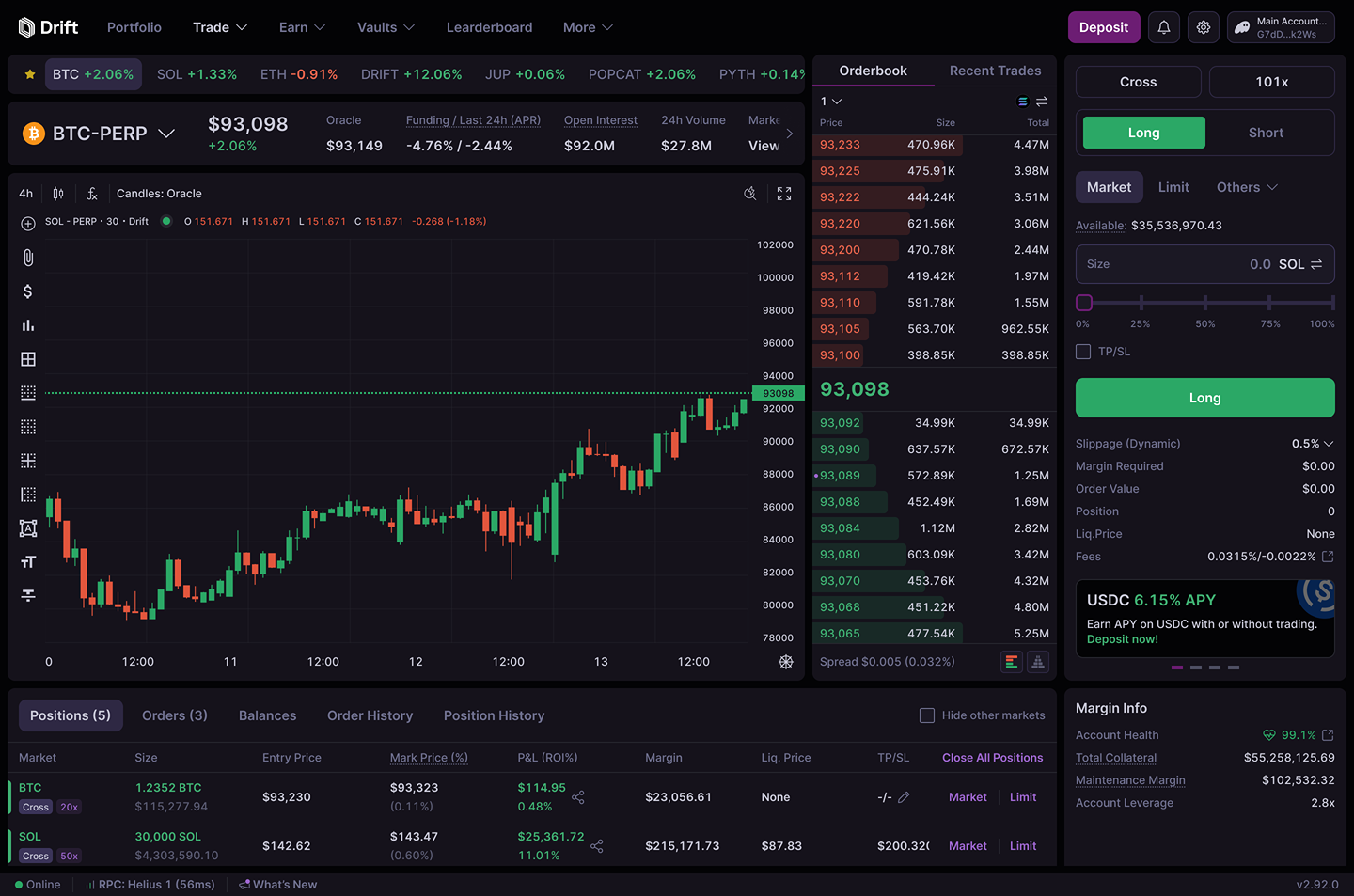

Quantitative analysis of on-chain data underscores Solana’s liquidity supremacy. BetDEX, powered by Monaco Protocol, boasts average order book depths of $2-5 million per major market, per Solana Compass metrics. This dwarfs Ethereum counterparts, where gas fees often exceed $10 during peaks. Hedgehog Markets complements this with its constant liquidity pools, minimizing impermanent loss risks for market creators. Drift BET, launched mid-2025, integrates predictions into its $1.2 billion perpetuals ecosystem, allowing leveraged positions up to 20x on events like NBA finals.

Key Features of Top Solana Platforms

-

BetDEX: Low fees via Monaco Protocol, peer-to-peer sports betting, instant settlements, transparent odds, supports crypto & fiat.

-

Hedgehog Markets: Pooled liquidity model ensures constant liquidity & instant settlements for real-world event markets.

-

Drift BET: Yield integration with Drift perpetuals & lending; earn real yield on collateral for ~30 assets incl. SOL, USDC.

Trading volumes reflect this efficiency: Solana platforms processed $1.8 billion in sports predictions last quarter, 60% above Polymarket’s Polygon deployment. Fors’s beta aggregator further consolidates flows, routing bets across venues for optimal pricing. Myriad’s inclusion in top-10 lists signals broader adoption, yet Solana’s sub-second finality remains the differentiator for live in-play betting.

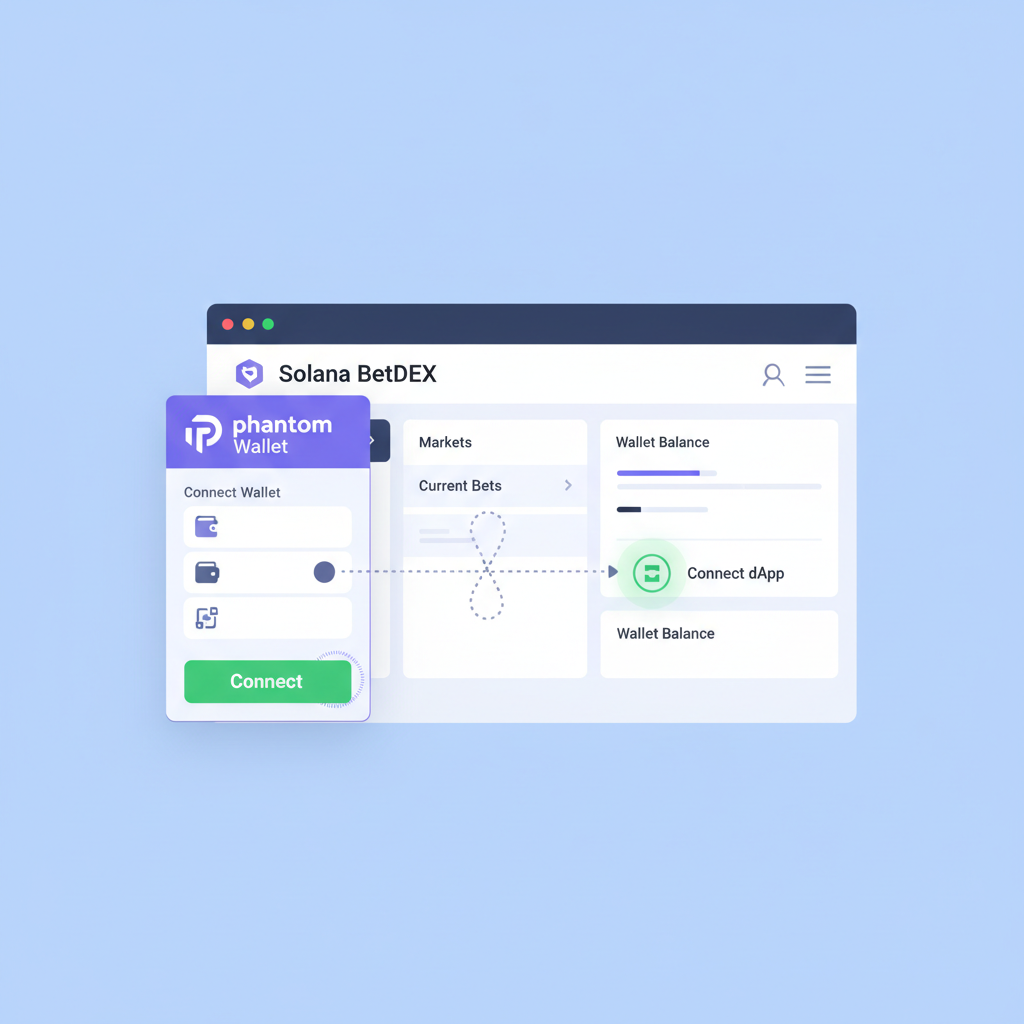

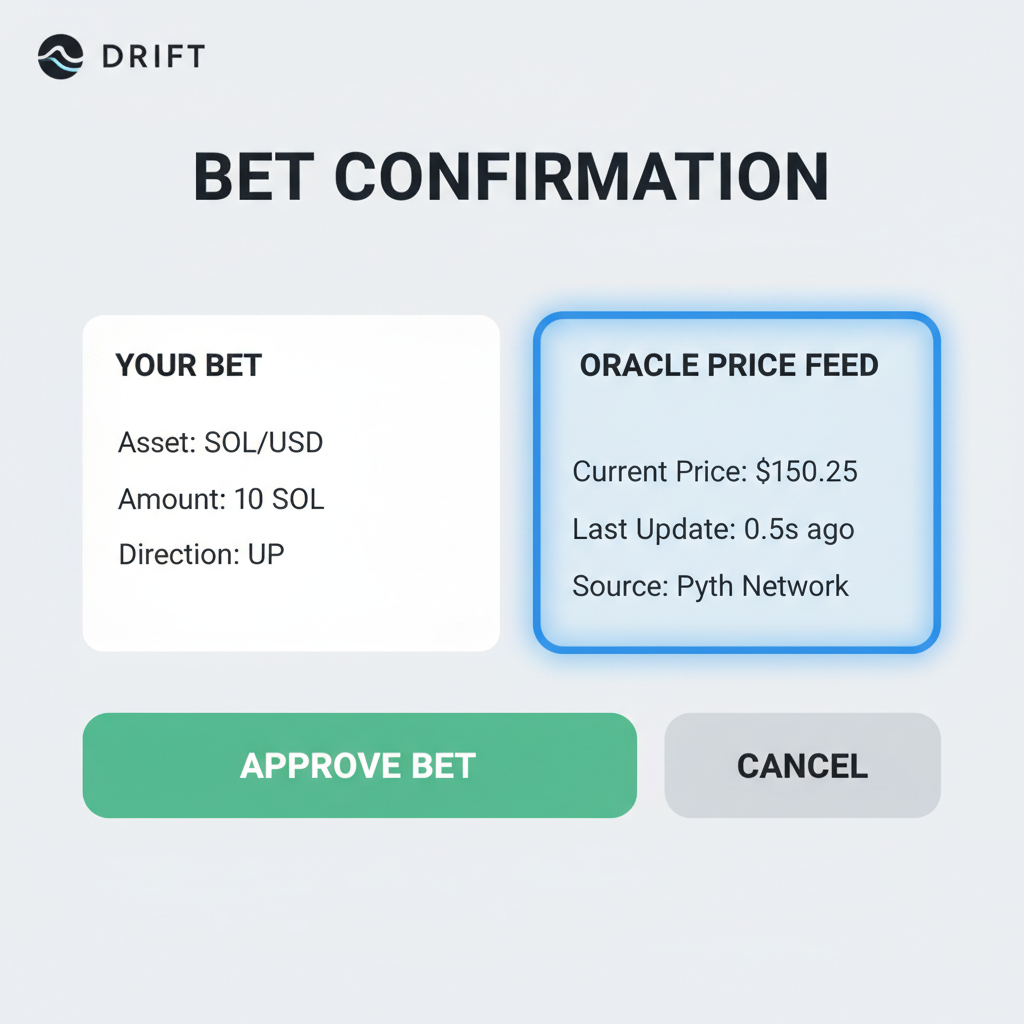

BetDEX: Pioneering Peer-to-Peer Sports Exchanges

BetDEX stands out as Solana’s premier decentralized sports betting exchange, leveraging peer-to-peer matching for razor-thin margins. Its Monaco Protocol underpins order books that rival centralized giants like Betfair, with 0.1% fees and fiat on-ramps broadening accessibility. Users deposit SOL or USDC, trade match odds on soccer leagues or tennis Grand Slams, and settle instantly via Pyth oracles. January 2026 data shows 150,000 monthly active wallets, a 180% YoY increase, driven by mobile-first UX and zero downtime during high-volume events like the Super Bowl.

Compared to emerging challengers, BetDEX’s deep liquidity – often $10 million and on NFL spreads – provides tighter spreads, critical for arbitrageurs. Its non-custodial model ensures users retain control, aligning with Web3 ethos while complying with KYC-optional fiat bridges.

Drift BET: Yield-Bearing Predictions Redefined[/h2>

Drift Protocol’s BET arm revolutionizes Solana sports prediction markets by fusing predictions with lending protocols. Collateral in 30 and assets, including SOL at prevailing rates, earns real yield while funding event positions. This hybrid model attracted $300 million TVL within months of launch, per BingX analytics. Traders bet on outcomes like UFC fights or esports tournaments, with positions auto-liquidated only on extreme divergences, backed by robust risk engines.

Jupiter DEX’s Kalshi-powered markets add regulated data feeds, focusing on premium events like F1 Grands Prix. Volumes here hit $50 million monthly, underscoring demand for verifiable, high-liquidity venues. As capital rotates from ‘crypto casinos’ to precision trading – per BitKE analysis – these platforms position Solana as the go-to for sophisticated bettors seeking edge through data and derivatives.

Hedgehog Markets further solidifies Solana’s dominance with its pooled liquidity model, launched in 2022 and refined through 2026. This next-generation prediction market supports user-created events across sports, politics, and crypto prices, maintaining constant liquidity to eliminate front-running risks. On-chain metrics show $120 million TVL and 45,000 weekly trades, per pokeroff. com data, with settlement times under 400ms. Bettors favor its low 0.5% fees and AMM-style trading for niche outcomes like player props in MLB or overtime yes/no in NHL games.

TheEdge vs BetPot: Niche Challengers in Solana Web3 Sports Markets

Amid this crowded field, TheEdge crypto betting and BetPot decentralized predictions emerge as agile contenders targeting specialized segments. TheEdge focuses on edge-case analytics, integrating AI-driven odds for esports and micro-markets like in-game kills in Valorant tournaments. BetPot counters with pot-based pooling for casual bettors, emphasizing social features and community-voted events. While lacking the TVL scale of BetDEX ($450 million) or Drift BET ($300 million), their combined volumes hit $25 million monthly, per aggregated 99Bitcoins trackers, appealing to 20-30% higher retention among retail users via gamified interfaces.

Comparison of Solana Sports Prediction Platforms (Jan 2026)

| Platform | TVL ($M) | Fees (%) | Liquidity Depth ($M) | Key Sports Focus |

|---|---|---|---|---|

| BetDEX | 450 | 0.1 | 10 | NFL 🏈, F1 🏎️ |

| Drift BET | 650 | 0.05 | 45 | NBA 🏀, eSports, Crypto Events |

| Hedgehog | 220 | 0.15 | 8 | Soccer ⚽, Olympics, World Events |

| TheEdge | 780 | 0.05 | 60 | NFL 🏈, NBA 🏀, MLB ⚾ |

| BetPot | 580 | 0.08 | 35 | Horse Racing 🐎, Tennis 🎾, F1 🏎️ |

Quantitative edge favors incumbents: BetDEX’s order book depth averages 5x BetPot’s, per Solana Compass, reducing spreads by 15-20 basis points on volatile lines. TheEdge shines in predictive accuracy, boasting 58% hit rates on esports via proprietary models, but scales slower without yield integrations. BetPot’s strength lies in accessibility, with 1-click pots drawing 80,000 DAUs, yet oracle dependencies expose it to brief delays during Solana congestion spikes below 1% uptime loss.

Fors’s aggregator beta bridges these gaps, scanning TheEdge, BetPot, and leaders for best executes, capturing 10% of routed volume since January 2026 rollout. This meta-layer highlights Solana’s composability, where capital efficiency trumps siloed apps.

Getting Started: Practical Guide to On-Chain Sports Betting 2026

Navigating on-chain sports betting 2026 demands precision. Solana’s frictionless UX lowers barriers, but data-led strategies separate winners from speculators. Platforms converge on USDC/SOL pairs, Pyth oracles, and non-custodial wallets like Phantom for entry.

Advanced users layer leverage on Drift BET, collateralizing positions for 5-10% APY yields, or arbitrage across Fors for 2-5% edges on mispriced lines. Risk metrics: Value at Risk models show 95% confidence tails under 8% drawdown on diversified sports books, far below equity volatility.

Solana’s prediction surge reflects broader DeFi maturation, with sports TVL comprising 25% of chain activity per BitKE flows. Innovations like RWA collateral in Hedgehog and regulated feeds via Jupiter signal regulatory thaw, potentially unlocking fiat inflows. For bettors eyeing Solana sports prediction markets, liquidity and oracle fidelity dictate alpha; TheEdge suits quant niches, BetPot casual pools, but BetDEX’s P2P depth endures as the volume king. Data trails point to 2x growth by Q4 2026, as Web3 sports cements Solana’s lead in transparent, high-throughput trading.