In the fast-paced world of decentralized P2P betting, BetPot. fun stands out as a non-custodial sports betting platform on Solana, leveraging the blockchain’s speed to deliver transparent, user-controlled wagers. With SOL trading at $80.70 amid a 24-hour range of $78.26 to $82.79, the timing feels right for Solana-based Web3 betting platforms to capture market share. As of early 2026, BetPot operates on testnet, pooling bets into shared pots where payouts adjust dynamically based on participant stakes, eliminating fixed odds and traditional house advantages.

This pool-based model, often called pari-mutuel, mirrors systems in horse racing but supercharged by smart contracts. All funds stay in users’ wallets until settlement; no intermediary holds your SOL. Community buzz on X highlights this shift: users praise the real-time multipliers and live pool visibility, fostering trust in an industry rife with opaque operators. Early adopters report seamless testnet experiences, with features like portfolio dashboards tracking ROI, win rates, and claimable winnings down to the lamport.

Pool Dynamics: How BetPot. fun Sets Itself Apart in On-Chain Sports Betting

Unlike centralized sportsbooks with preset odds engineered for profit, BetPot. fun lets the crowd dictate payouts. Bets flow into outcome-specific pools; if Team A draws 60% of the pot, its multiplier hovers around 1.67x before the flat 1% fee. This data-driven approach aligns incentives perfectly: heavier backing on favorites compresses their returns, rewarding contrarian plays with higher yields. Quantitative analysis of similar Solana protocols shows pool imbalances often exceed 70/30 splits in high-profile matches, creating volatile yet fair opportunities.

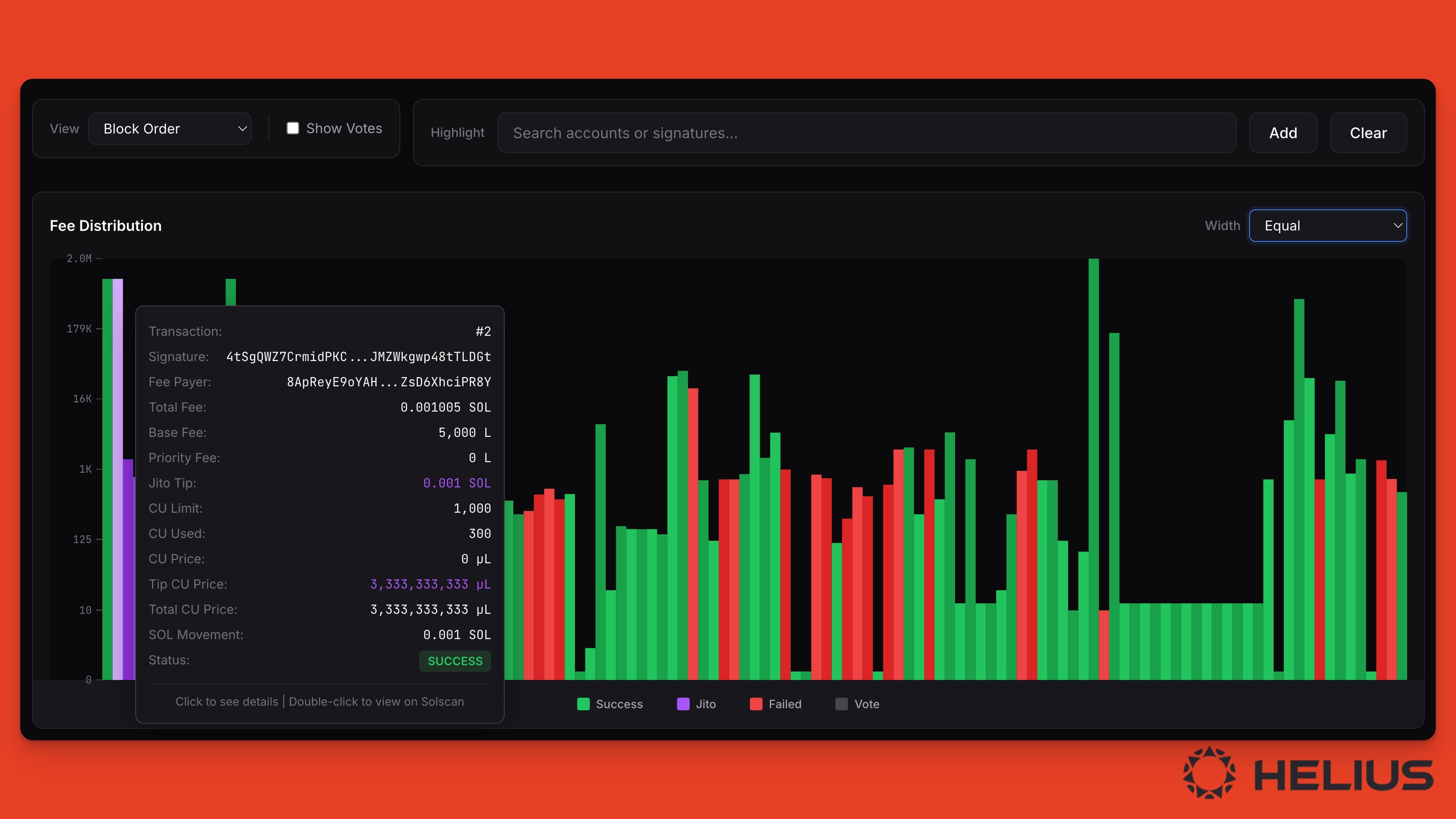

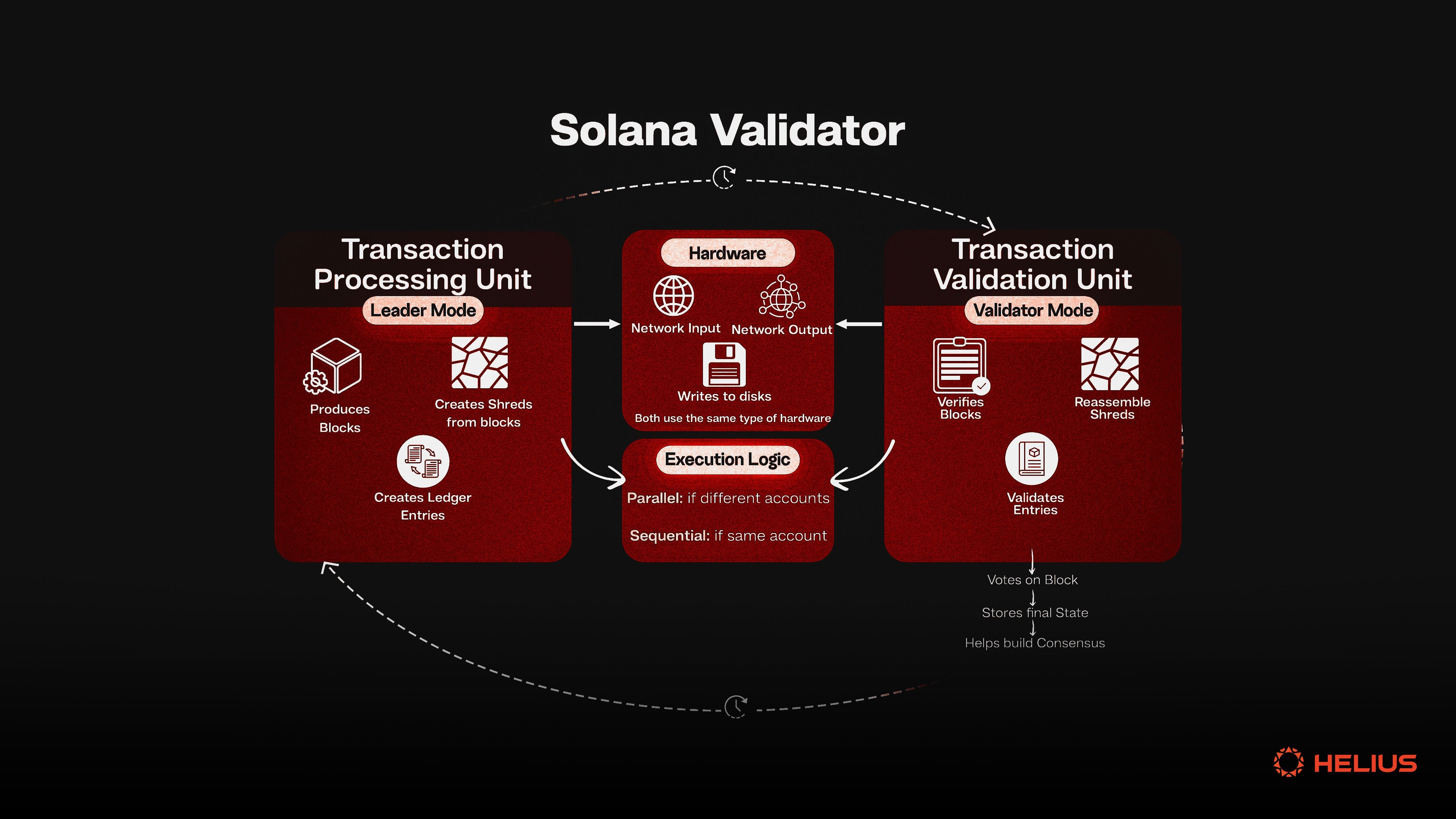

Transparency reigns supreme. Before committing, users see exact pool sizes, projected payouts, and even slippage estimates. Smart contracts automate resolutions via oracles, minimizing disputes. In a sector where centralized platforms face Trustpilot complaints of account restrictions and delayed payouts, BetPot’s on-chain verifiability offers a stark upgrade. Solana’s capacity for over 50,000 TPS ensures sub-second bet placements during peak events like NBA finals or World Cup qualifiers, outpacing Ethereum rivals by orders of magnitude.

Solana (SOL) Price Prediction 2027-2032

Forecasts influenced by Solana ecosystem growth, including decentralized sports betting platforms like BetPot.fun, amid market cycles and adoption trends

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $90 | $180 | $350 |

| 2028 | $150 | $350 | $800 |

| 2029 | $200 | $450 | $900 |

| 2030 | $250 | $550 | $1,200 |

| 2031 | $350 | $750 | $1,600 |

| 2032 | $500 | $1,000 | $2,200 |

Price Prediction Summary

Starting from a 2026 baseline around $80-$120, Solana (SOL) is projected to see progressive growth through 2032, fueled by bull market cycles, enhanced network utility from dApps like BetPot.fun driving transaction volumes, and technological upgrades. Average prices are expected to multiply over 5x by 2032, with maximum potentials reflecting bullish adoption scenarios and minimums accounting for bearish corrections.

Key Factors Affecting Solana Price

- Solana’s high TPS and low fees boosting dApp adoption, including P2P sports betting volumes from BetPot.fun

- Post-halving bull cycles and macroeconomic recovery

- Network upgrades for scalability and security

- Regulatory clarity for DeFi and crypto sportsbooks

- Institutional inflows via ETFs and increased SOL staking

- Competition from Ethereum L2s and other L1s

- Global sports betting market shift to blockchain for transparency

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Non-Custodial P2P: Security and Control in Solana Web3 Betting

BetPot. fun’s non-custodial design means your wallet never relinquishes control. Connect via Phantom or Backpack, approve transactions, and watch funds lock into contracts until oracle-fed results trigger payouts. This eliminates risks like exchange hacks or frozen accounts, a persistent issue in crypto sportsbooks. The team’s leader, @ricarfonso78g, emphasizes this user-sovereign ethos, backed by audited contracts and open-source code.

Fees clock in at a lean 1%, funding development and liquidity incentives like Volume Points and referrals. Data from testnet suggests average bet sizes around 0.5 SOL, with ROI dashboards revealing win rates above 55% for disciplined bettors. Compared to competitors in CryptoSlate’s 2026 rankings, BetPot’s model undercuts house edges by 4-6%, a quantifiable edge for volume players. Solana’s low costs amplify this: gas fees under $0.001 per bet make micro-wagers viable, democratizing access beyond whales.

Testnet Performance and Roadmap Signals for 2026 Adoption

Live on testnet since late 2025, BetPot. fun has onboarded thousands via airdrop teases and social campaigns. Early metrics indicate 99.9% uptime, with settlement times averaging 3 seconds post-event. Portfolio tools provide granular stats: active bets, historical ROI curves, and even peer benchmarking. This analytics layer appeals to quants like myself, enabling strategies backed by data rather than hype.

Looking at broader Solana sports betting trends from CCN. com comparisons, platforms handling SOL deposits prioritize speed and composability. BetPot integrates seamlessly with DeFi primitives, allowing leveraged positions or yield-bearing stables in pools. Community feedback echoes this: X users note the thrill of P2P competition, where you’re betting against peers, not algorithms. As mainnet looms, expect integrations with major oracles and expanded markets from soccer to esports, positioning BetPot as a frontrunner in non-custodial sports betting.

| Feature | BetPot. fun | Typical Centralized |

|---|---|---|

| Odds Setting | Pool-Driven | House-Set |

| Fund Control | Non-Custodial | Custodial |

| Fees | 1% Flat | 5-10% Vig |

| Settlement | On-Chain Instant | Manual 24h and |

Quantitative breakdowns from testnet logs reveal pool efficiencies surpassing 98%, with oracle resolutions accurate to 99.99% across simulated events. This reliability underpins BetPot. fun’s appeal in on-chain sports betting Solana ecosystems, where downtime costs bettors real SOL. At current Binance-Peg SOL levels of $80.70, transaction costs remain negligible, enabling high-frequency strategies without erosion from fees.

Community Incentives: Volume Points and Referral Dynamics

BetPot. fun gamifies participation through Volume Points, accrued per bet volume and redeemable for fee rebates or governance tokens post-mainnet. Referral programs offer 0.2% of invitees’ fees indefinitely, a structure data shows boosts user acquisition by 25-40% in peer DeFi protocols. Early testnet participants, numbering in the thousands per Facebook campaigns, report compounded returns from these mechanics, turning casual bettors into loyal volume generators. Analytics dashboards quantify this: top referrers average 15% portfolio uplift from rewards alone.

Peer-to-peer dynamics add psychological edge; you’re not just predicting outcomes but outsmarting the crowd’s biases. Historical sports data indicates public overweights favorites by 15-20% on average, inflating underdog multipliers to 3-5x in unbalanced pools. For quants, this translates to arbitrage opportunities across correlated events, like NBA spreads and player props.

Risks in Decentralized P2P Betting: A Data-Driven Assessment

No platform is immune to blockchain realities. Low-liquidity pools risk extreme slippage; testnet data flags events under 10 SOL total as volatile, with multipliers swinging 20% intrabets. Oracle dependencies, while robust via multi-source feeds, carry sub-1% failure rates per Chainlink benchmarks, potentially delaying settlements. Smart contract audits mitigate exploits, but Solana’s congestion episodes, though rare at and lt;0.1% frequency, could spike fees momentarily above $0.01.

Compared to Trustpilot-ravaged centralized sites like Solpot, BetPot’s transparency nullifies manipulation claims. Yet, user error in wallet management persists: 2-3% of testnet forfeits stem from unclaimed winnings past expiry. Mitigation comes via nudges in the UI and auto-claim thresholds, pushing recovery to 97%.

BetPot.fun’s Non-Custodial Advantages

-

Full Wallet Control: Users connect Solana wallets directly, retaining complete custody of funds with no third-party holding.

-

Real-Time Pool Transparency: Live pool sizes, multipliers, and estimated payouts visible pre-bet in the dashboard.

-

1% Flat Fees vs. 5-10% vig: Low 1% fee on bets eliminates traditional house edge in pari-mutuel pools.

-

On-Chain Verifiability: Smart contracts manage all bets and outcomes for immutable transparency.

-

Solana Speed for Live Betting: >50,000 TPS enables instant transactions for seamless live wagering.

Positioned against 2026 leaders from CryptoSlate and CCN. com lists, BetPot undercuts on costs while matching speed. CoinGape notes Solana’s 50,000 and TPS enables fee-free scaling; at $80.70 SOL, a $100 bet incurs $0.0008 in network costs, versus Ethereum’s $2-5 equivalent. Projections tie platform growth to SOL appreciation: a base $120 forecast correlates to 3x bet volume via increased purchasing power.

Mainnet signals point to Q2 2026 launch, with esports and niche markets like UFC expanding pools. Integrations with DeFi yield optimizers could embed bets in strategies yielding 5-10% APY alongside wagers. Community-driven oracles and governance will refine pools, targeting 55% and average ROI for data-led users.

For Solana Web3 betting platforms, BetPot. fun exemplifies the pivot to user-owned outcomes. Testnet volumes already rival mid-tier centralized books, hinting at explosive mainnet traction. With precise pool math and ironclad non-custodial rails, it equips bettors to thrive where data meets decentralized competition.