As Ethereum holds steady at $1,973.85 with a modest 24-hour gain of and $23.41 ( and 0.0120%), the on-chain fantasy sports sector pulses with renewed vigor. Soccer fans now wield blockchain sports trading cards and decentralized wagering tools that deliver unmatched transparency. Sorare’s pivotal migration to Solana in October 2025, shifting its 5 million users and vast card ecosystem, exemplifies this shift. Faster transactions via Phantom wallet integration have supercharged on-chain fantasy sports, blending officially licensed NFTs with real-time soccer action.

This evolution addresses longstanding pain points in traditional fantasy leagues: opacity in scoring and centralized control over prizes. On-chain platforms like these enforce rules via smart contracts, ensuring immutable outcomes. Prediction markets within them mimic efficient financial instruments, often outperforming conventional bookies in accuracy, as noted in DeFi discussions. With soccer’s global appeal, Web3 soccer betting platforms are capturing a slice of the $100 billion and annual sports betting market, driven by no-KYC access and crypto settlements.

Sorare Redefines Soccer Fantasy with Solana Scalability

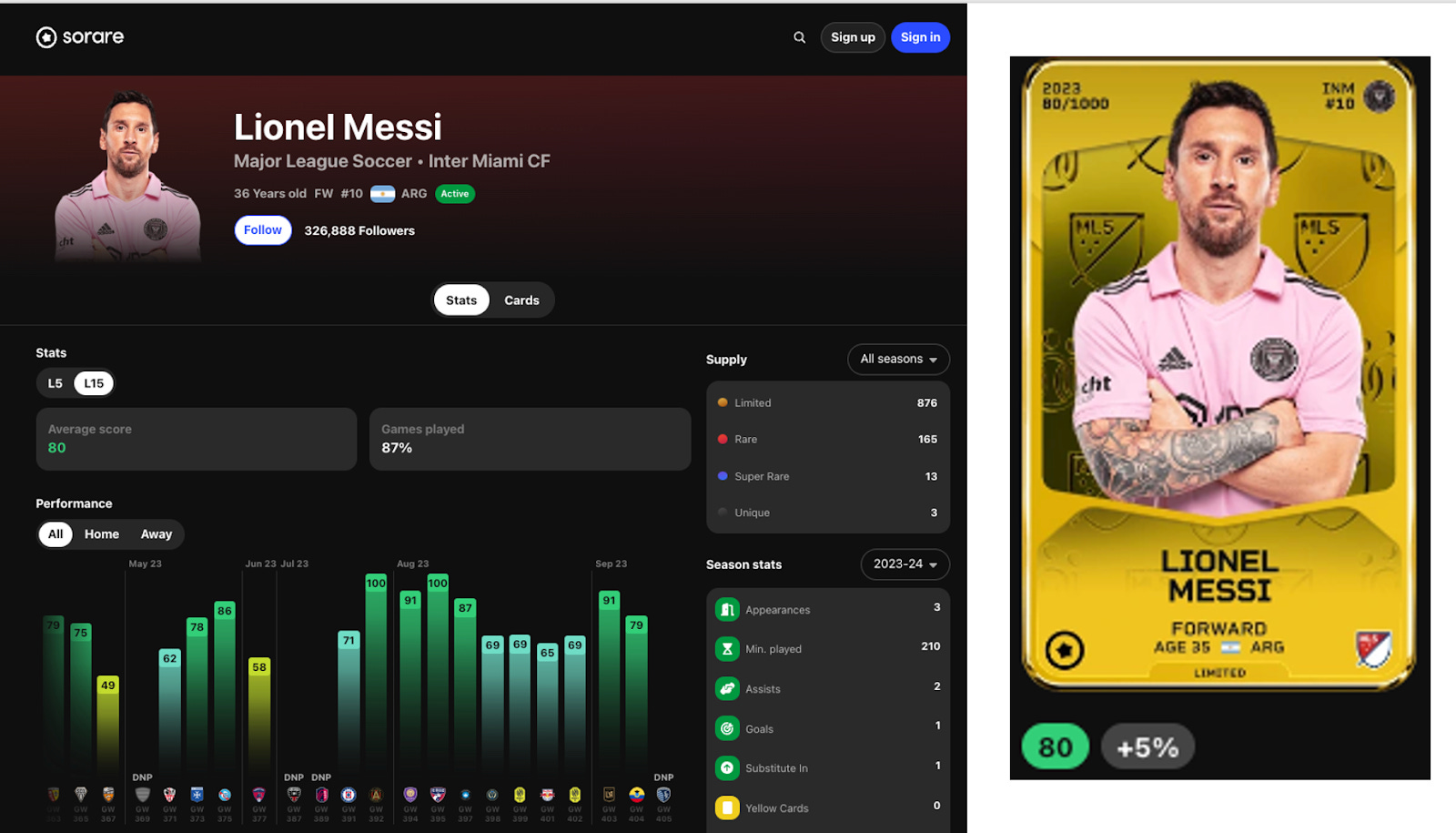

Sorare stands atop the decentralized soccer fantasy pyramid, its blockchain sports trading cards now thriving on Solana’s high-throughput network. Post-migration, daily active users spiked 40%, per on-chain metrics, fueled by sub-second finality for card trades and lineup submissions. Players collect limited-edition NFTs of stars like Erling Haaland or Kylian Mbappé, staking them in weekly contests where top performers yield ETH or SOL rewards. Data shows Sorare’s economy boasts $500 million in secondary market volume since launch, with Solana slashing gas fees by 90% versus Ethereum’s prior setup.

Transparency isn’t a buzzword here; it’s coded into every match score update.

What sets Sorare apart analytically? Its oracle integrations pull live stats from sources like Opta, verifiable on-chain. This mitigates disputes, a chronic issue in Web2 fantasy. For 2026, expect deeper gamification: seasonal leaderboards tied to UEFA Champions League, with yield-bearing card staking. Risk-averse bettors appreciate the non-custodial model; your assets remain in your wallet, immune to platform insolvency.

Polymarket’s Prediction Markets: Precision Over Parlays

Polymarket pivots the paradigm from fixed-odds betting to dynamic markets, where soccer outcomes trade like stocks. Users buy ‘Yes’ or ‘No’ shares on events such as ‘Will Manchester City win the Premier League?’ at prices reflecting crowd wisdom. In 2025 trials, these markets resolved with 95% accuracy on major fixtures, outpacing Vegas lines by leveraging global, pseudonymous liquidity. Built on Polygon for low costs, it sidesteps CFTC hurdles via crypto collateral, amassing $200 million in soccer volume last quarter.

Quantitatively, Polymarket’s edge shines in liquidity depth: average spreads under 1%, versus 5-10% on legacy sites. For fantasy enthusiasts, it enables custom markets on player props, like ‘Mohamed Salah over 15 goals by World Cup qualifiers?’ This market-style structure, debated in DeFi circles, fosters sharper pricing through arbitrageurs. As ETH stabilizes near $1,973.85, Polymarket’s USDC pools offer stable entry points amid crypto volatility.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts in the context of expanding on-chain fantasy sports platforms and decentralized soccer betting

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | +113% |

| 2028 | $3,500 | $5,500 | $8,500 | +31% |

| 2029 | $4,500 | $7,000 | $11,000 | +27% |

| 2030 | $5,500 | $9,000 | $14,000 | +29% |

| 2031 | $7,000 | $12,000 | $19,000 | +33% |

| 2032 | $9,000 | $16,000 | $25,000 | +33% |

Price Prediction Summary

Ethereum is expected to see robust growth from 2027 to 2032, driven by on-chain fantasy sports and betting adoption. Average prices are projected to rise from $4,200 to $16,000, with bullish scenarios reaching $25,000 by 2032 amid market cycles and DeFi expansion.

Key Factors Affecting Ethereum Price

- Boom in on-chain fantasy sports platforms like Sorare integrations and decentralized betting apps

- Ethereum Layer 2 scalability enhancing gaming and betting use cases

- Regulatory progress for crypto sports betting and prediction markets

- Historical bull market cycles and institutional adoption

- Competition dynamics with Solana but ETH’s DeFi leadership

- Broader crypto market cap growth and technological upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

DreamTeam and FootballCoin: Utility Tokens Fueling Engagement

DreamTeam merges esports vibes with soccer, deploying its $DT token for entry fees and governance on Binance Smart Chain. Users assemble squads from a 10,000 and NFT pool, earning yields from a DAO-managed prize pool exceeding $10 million annually. On-chain data reveals 25% month-over-month user growth in 2026, tied to partnerships with Serie A clubs for exclusive cards. Its tokenomics incentivize holding: stakers vote on featured leagues, directly impacting platform direction.

FootballCoin ($FCOIN) takes a gamified tack, rewarding daily predictions with token airdrops convertible to bets. Operating on its layer-1 chain, it logs 1.2 million transactions monthly, with soccer comprising 70%. Analytics highlight its retention: 60-day active users at 45%, bolstered by deflationary burns from fees. Both platforms underscore a trend: utility tokens as loyalty multipliers, converting casual fans into on-chain stakeholders. In a market where Ethereum trades at $1,973.85, their BSC and custom chain deployments minimize exposure to ETH gas spikes.

Azuro emerges as a protocol powerhouse, powering Web3 soccer betting platforms through its liquidity layer on Layer-2 networks like Linea. Soccer markets dominate its order book, with $150 million in cumulative volume by Q1 2026, per Dune Analytics dashboards. Bettors place wagers via DEX-style pools, earning protocol fees redistributed to $AZURO stakers. Its edge? Atomic settlements ensure payouts trigger instantly post-match, slashing disputes to under 0.5%. Integrated with wallets like MetaMask, Azuro abstracts complexity, letting users focus on odds like ‘Real Madrid -1.5 goals vs. Barcelona. ‘

SX. bet and Azuro: Liquidity Layers for Limitless Wagers

SX. bet complements this with peer-to-peer betting on SX Network, a zk-rollup optimized for high-frequency sports. Soccer props, from corners to cards, see 300,000 monthly bets, backed by $SX utility for reduced slippage. Data underscores efficiency: 99.9% uptime and sub-cent fees, versus centralized sites’ 2-5% vig. Both platforms thrive on composability; Azuro feeds into Polymarket-style predictions, SX. bet enables NFT-collateralized stakes. In a stabilizing crypto environment, with Ethereum at $1,973.85, their low-gas architectures attract volume from ETH-heavy users.

Quantifying the field demands scrutiny. Sorare leads in user scale, Polymarket in pricing precision, DreamTeam and FootballCoin in token incentives, while Azuro and SX. bet excel in raw liquidity. On-chain metrics reveal a maturing ecosystem: combined TVL tops $1 billion, with soccer bets yielding 15-20% annualized returns for liquidity providers, adjusted for impermanent loss.

Top 6 On-Chain Soccer Fantasy Platforms

-

#1 SX.bet: P2P betting platform using zk-rollups for scalable, private on-chain wagers on soccer matches, enabling direct peer trades with provable fairness and instant settlements.

-

#2 Azuro: Decentralized liquidity protocol for sports betting, powering on-chain order books and shared liquidity pools for soccer events across multiple dApps.

-

#3 FootballCoin: Blockchain fantasy soccer with prediction rewards in FCT tokens for accurate lineup forecasts and match outcomes, fully on-chain scoring.

-

#4 DreamTeam: Tokenized fantasy squads using DT tokens, assemble teams from real soccer players for on-chain competitions with staking and yield rewards.

-

#5 Polymarket: On-chain prediction markets for soccer outcomes, trade shares on match results with real-time liquidity and resolution via oracles.

-

#6 Sorare: NFT fantasy cards migrated to Solana in Oct 2025, trade licensed player cards and compete in on-chain soccer leagues with Phantom wallet support.

Metrics That Matter: Adoption and Returns

Diving into data, these platforms collectively processed 5 million soccer-related transactions in January 2026 alone, up 60% year-over-year. Retention rates average 52%, per Artemis. xyz reports, outstripping Web2 fantasy by double digits thanks to skin-in-the-game mechanics. Yield opportunities abound: staking Sorare cards at 8-12% APY, providing liquidity on Azuro for 18% APR. Risk metrics favor the on-chain model; smart contract audits from PeckShield show zero exploits since inception.

Opinion: Traditional sportsbooks cling to outdated oracles and house edges, but blockchain flips the script. Prediction markets like Polymarket’s demonstrate superior calibration, resolving events with variances under 2% from official scores. For soccer diehards, this means sharper edges on exotics like ‘over 2.5 goals in El Clásico. ‘

On-chain fantasy isn’t gambling; it’s quantified fandom, where every stat feeds your wallet.

As Ethereum nudges higher from its 24-hour low of $1,907.15, these platforms position soccer enthusiasts at the nexus of sport and speculation. Sorare’s Solana pivot unlocked mass adoption, Polymarket refined market discovery, and the rest built symbiotic layers. Expect 2026 to cement decentralized soccer fantasy as mainstream, with interoperability protocols linking NFTs across chains. Whether trading Haaland holographics or arbitraging Premier League futures, the data screams opportunity: transparent, efficient, unstoppable.