In the evolving world of Web3 sports betting platforms, Base Chain stands out for its scalability and cost-efficiency, making it an ideal foundation for base chain sports betting innovations. As of February 14,2026, the Base Protocol (BASE) price sits at $0.1245, reflecting a modest 24-hour gain of and $0.0179 or and 0.1683%, with a daily high of $0.1340 and low of $0.1065. This stability underscores Base’s maturity as a Layer 2 solution, attracting developers building on-chain sports dapps base that prioritize user control and transparency over centralized intermediaries.

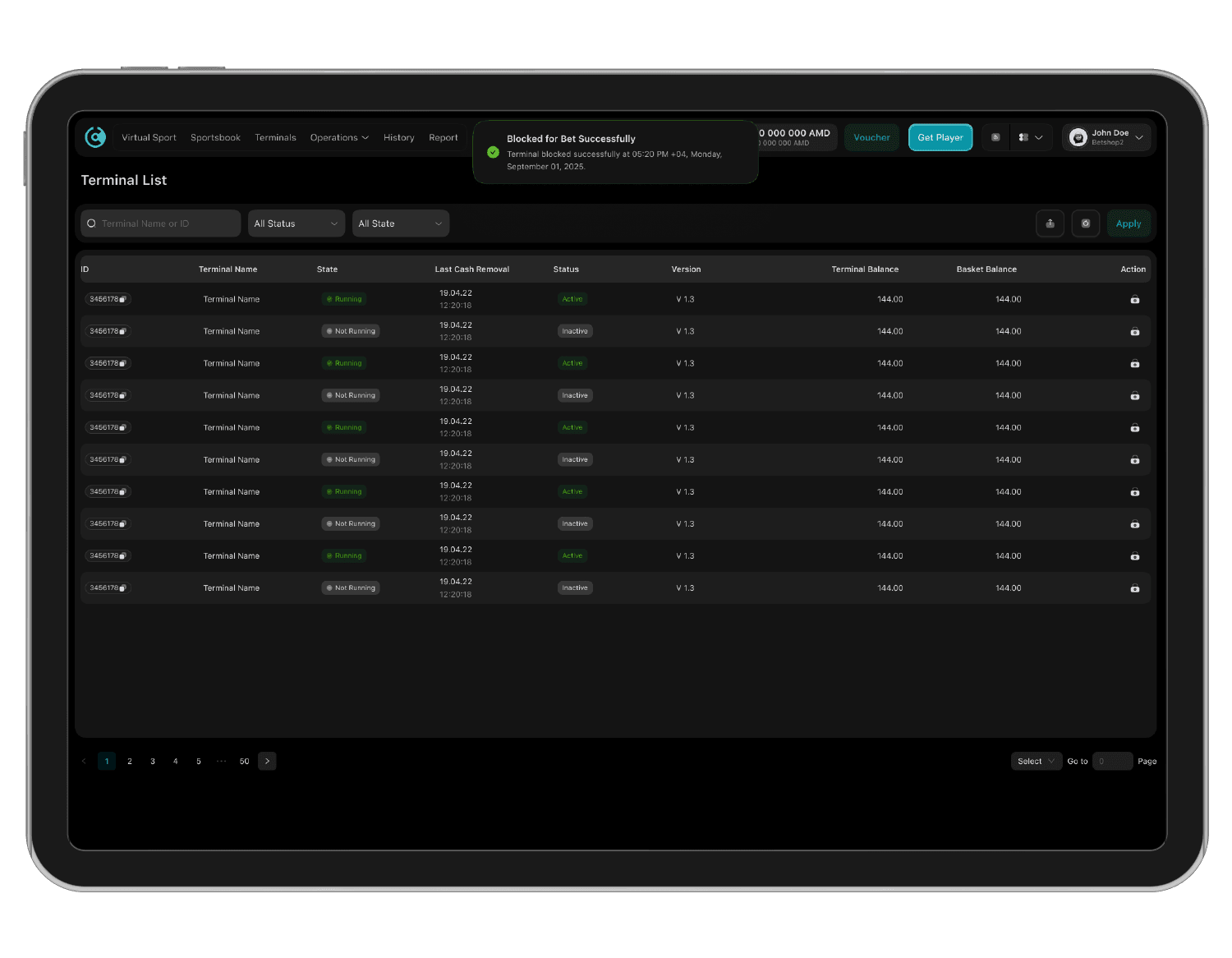

At the forefront of this shift is Hyperbet, a decentralized platform that has captured attention since its Q1 2026 launch of the $HBET token, currently priced at $0.000348. Hyperbet redefines hyperbet decentralized betting by centering three pillars: playing on-chain casino games, building custom games via AI tools, and owning a stake in the ecosystem’s value accrual. Wallet-based onboarding eliminates KYC hurdles, while instant payouts secured on Base and Ethereum networks ensure trustless execution. This model not only appeals to crypto enthusiasts but also mitigates common risks in traditional betting, such as withheld winnings or opaque odds.

Hyperbet’s Core Mechanics and Risk-Adjusted Appeal

Hyperbet’s architecture leverages Base Chain’s low fees and high throughput to deliver seamless gameplay. Users wager on classics like blackjack or roulette directly from their wallets, with every outcome verifiable on-chain. The $HBET token, tied to Virtuals Protocol and elements of AI agent societies, incentivizes participation through staking, governance, and revenue shares. From a risk management perspective, this is a step forward: smart contracts automate settlements, reducing counterparty risk that plagues offshore sportsbooks.

Hyperbet is bringing a new era to on-chain gaming, where players bet on classic games, create their own, and share in the value.

Yet, as an FRM-certified advocate for conservative strategies, I caution that while Hyperbet’s TVL growth signals promise, volatility in tokens like $HBET demands disciplined position sizing. Allocate no more than 2-5% of your portfolio to such high-upside, high-variance assets, always prioritizing liquidity and exit strategies.

Base Chain’s Edge in Decentralized iGaming for 2026

What sets Base apart in the decentralized iGaming base 2026 landscape is its seamless integration with Ethereum’s security while slashing gas costs by orders of magnitude. Platforms like Dexsport, now live on Base, exemplify this synergy. Dexsport’s integration enhances its decentralized sports betting with faster transactions and lower fees, covering major leagues from NFL to NBA. Users retain full custody of funds, betting peer-to-peer without house edges that erode long-term returns.

This infrastructure supports emerging DApps poised to disrupt Web3 sports betting platforms. DappRadar’s tracking of Base gambling DApps reveals rising activity, from casino hybrids to prediction markets. Dexsport, for instance, emphasizes provable fairness via oracles and blockchain verifiability, aligning with my belief in transparent systems that empower informed bettors. However, diversification remains key; no single chain or DApp should dominate exposure amid regulatory uncertainties.

Hyperbet Token (HBET) Price Prediction 2027-2032

Conservative (Bearish), Base Case, and Bullish Scenarios Based on On-Chain Sports Betting Adoption Metrics on Base Chain

| Year | Minimum Price (Conservative) | Average Price (Base Case) | Maximum Price (Bullish) |

|---|---|---|---|

| 2027 | $0.0005 | $0.002 | $0.010 |

| 2028 | $0.001 | $0.006 | $0.035 |

| 2029 | $0.002 | $0.018 | $0.100 |

| 2030 | $0.004 | $0.045 | $0.250 |

| 2031 | $0.008 | $0.110 | $0.600 |

| 2032 | $0.015 | $0.280 | $1.500 |

Price Prediction Summary

HBET is forecasted to see progressive growth from 2027-2032, fueled by Hyperbet’s AI-driven game builder, prediction markets, and Base Chain expansion. Conservative estimates account for market downturns and competition, base case assumes steady adoption, and bullish scenarios project explosive growth with regulatory tailwinds and crypto bull cycles, potentially yielding 800x+ returns from current $0.000348 levels by 2032.

Key Factors Affecting Hyperbet Token Price

- Rapid adoption of on-chain sports betting and casino games on Base Chain

- Launch of AI Game Builder and Prediction Markets in Q2 2026 driving utility

- Base Chain’s scalability improvements enabling low-fee, high-volume betting

- Crypto market cycles with 2028 Bitcoin halving boosting altcoin rallies

- Regulatory developments favoring decentralized gaming platforms

- Competition from emerging dApps like Dexsport and overall DeFi gaming growth

- Technological integrations with AI agents and Virtuals Protocol ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

AI-Driven Expansions Poised to Reshape On-Chain Betting

Looking to Q2 2026, Hyperbet’s rollout of an AI Game Builder and Prediction Markets will elevate Base Chain’s offerings. Imagine designing bespoke sports betting games or wagering on real-world events like Super Bowl outcomes through peer-to-peer markets, all settled on-chain. This convergence of AI and blockchain, as seen in integrations like Gora Network’s visions, promises dynamic odds and personalized experiences without centralized manipulation.

From a portfolio construction standpoint, these features could drive $HBET demand, but temper enthusiasm with historical precedents: early on-chain gaming tokens often face pump-and-dump cycles. Monitor metrics like daily active users and oracle reliability before scaling positions. Base’s $0.1245 price stability provides a solid base for such growth, yet sustainable adoption hinges on user education and robust risk controls.

Emerging DApps on Base are broadening the scope beyond Hyperbet, fostering a competitive ecosystem that benefits users through innovation and choice. Dexsport’s recent integration exemplifies this momentum, delivering decentralized iGaming base 2026 with coverage of NFL, NBA, and college sports. By harnessing Base’s scalability, Dexsport processes bets at fractions of Ethereum’s cost, while oracles ensure real-time data feeds for live wagering. This setup minimizes latency risks, a critical factor for in-play betting where seconds dictate outcomes.

Navigating Risks in On-Chain Sports Betting Ecosystems

Despite these advances, on-chain sports betting carries inherent volatilities that demand rigorous risk assessment. Tokens like $HBET at $0.000348 exhibit sharp swings, amplified by low liquidity and speculative fervor. Base Protocol’s steady $0.1245 price offers a counterbalance, but chain-specific exploits or oracle failures could cascade across DApps. My 16 years in institutional finance reinforce a simple tenet: treat these platforms as high-beta allocations within a diversified DeFi portfolio.

Consider oracle dependencies; while Gora Network’s AI-blockchain fusion hints at resilient data layers, single points of failure persist. Bettors must verify smart contract audits and liquidity depths before committing funds. Platforms rewarding long-term holders via $HBET staking present yield opportunities, yet impermanent loss in liquidity pools warrants hedging. A measured approach involves starting with small positions, scaling only as TVL and user metrics validate sustainability.

Risk Management Checklist

-

Secure Your Wallet: Use a hardware wallet like Ledger or Trezor for Base Chain interactions on Hyperbet and Dexsport. Enable 2FA and never share seed phrases.

-

Bankroll Discipline: Never risk more than 1-5% of your total bankroll per bet. Set strict personal limits before connecting your wallet.

-

Verify Platform Audits: Confirm Hyperbet and Dexsport have undergone smart contract audits by firms like PeckShield or Certik. Check official docs.

-

Monitor Gas Fees: Base Chain offers low fees (~$0.01/tx), but track network congestion via Basescan before large bets.

-

Research Odds Thoroughly: Compare lines across Hyperbet, Dexsport, and other Base dApps. Avoid bets with poor value or high house edge.

-

Use Betting Limits: Leverage platform tools on Dexsport for deposit, loss, and session limits to enforce self-control.

-

Avoid Phishing Scams: Access Hyperbet via playhyperbet.com and Dexsport officially. Bookmark and verify URLs.

-

Track On-Chain Activity: Review all transactions on Basescan post-bet to ensure no unauthorized activity.

Building a Conservative Portfolio Around Web3 Sports Betting

Integrating Web3 sports betting platforms into your strategy requires blending passion for sports with financial prudence. Allocate conservatively: 1-3% to $HBET for exposure to Hyperbet’s growth, paired with stablecoin positions for betting capital. Base’s ecosystem, bolstered by its $0.1245 valuation and 24-hour resilience between $0.1065 and $0.1340, supports this without excessive drawdowns. Track DappRadar for emerging contenders, prioritizing those with proven throughput and community governance.

Hyperbet’s Q2 2026 AI Game Builder stands to democratize content creation, allowing users to craft prediction markets on niche events like esports tournaments or player props. This user-owned model disrupts traditional sportsbooks, where houses skim 5-10% vig. Peer-to-peer dynamics on Base could yield superior odds, but success pivots on adoption. Dexsport’s multi-sport focus complements this, offering a gateway for traditional bettors transitioning to crypto.

Base Chain’s low fees and Ethereum security make it the go-to for scalable, transparent on-chain sports dapps base.

Regulatory horizons add another layer. While Base’s compliance-friendly design aids longevity, global crackdowns on crypto gambling loom. Favor platforms with optional KYC for fiat ramps, but default to non-custodial wallets. In my view, the true edge lies in education: understand gas optimization, slippage tolerances, and tax implications of on-chain wins.

Hyperbet and peers are pioneering a future where sports fandom meets verifiable ownership. With $HBET at $0.000348 and Base at $0.1245, the entry point rewards patience over FOMO. Engage thoughtfully, diversify exposures, and let blockchain’s transparency guide your bets toward steady gains.