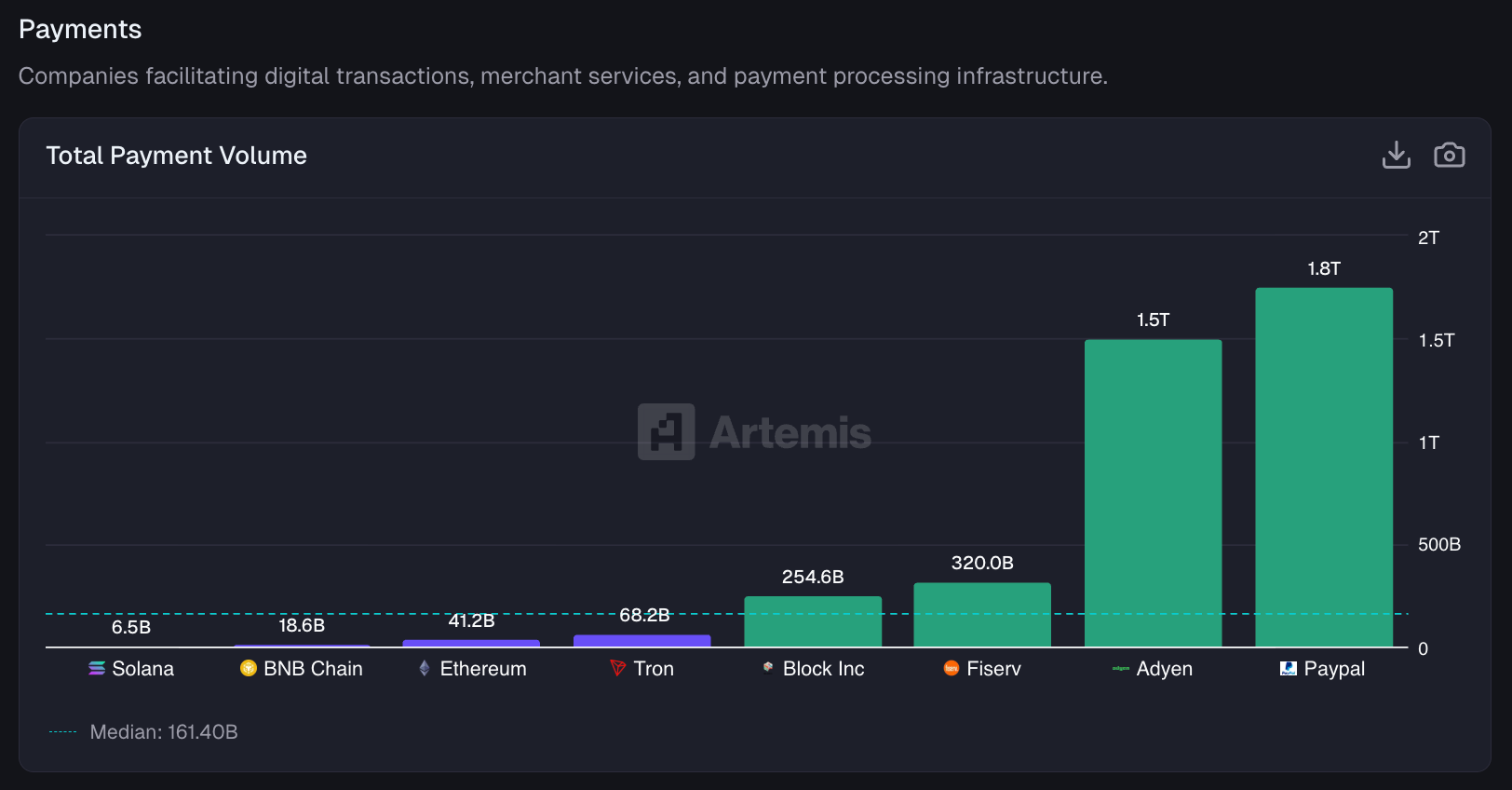

Picture this: it’s 2026, and the sports betting world is flipping upside down. On-chain sports betting platforms are surging ahead, clocking over $60 billion in volume by mid-2025 alone. Traditional sportsbooks, those clunky giants like DraftKings, are feeling the heat from blockchain-powered upstarts offering lightning-fast settlements and razor-sharp odds. As a day trader who’s seen volatility shake markets to their core, I can tell you this shift isn’t hype, it’s a game-changer for efficiency and bettor value.

![]()

These decentralized platforms leverage smart contracts to automate everything from bet placement to payouts, slashing settlement times from days to seconds. No more waiting on bookies to cough up your winnings or dealing with shady intermediaries. Lower operational costs mean they pass savings directly to you through tighter margins, hovering around 4.0% compared to the 4.5% to 6.0% vig traditional books squeeze out. If you’re tired of juice eating your profits, on-chain is calling your name.

On-Chain Platforms Supercharge Betting Efficiency

Let’s cut to the chase: efficiency is where blockchain sports odds comparison really shines. Traditional sportsbooks rely on massive back-end teams, compliance headaches, and centralized servers prone to outages or disputes. On-chain sports betting flips the script with immutable ledgers and self-executing contracts. Check out how these platforms use smart contracts for crystal-clear transparency, and you’ll see why bettors are migrating en masse.

Take liquidity: decentralized sports prediction markets pool global capital instantly, ensuring deep markets even for niche events. No more lopsided lines because some Vegas sharp tanked the book. And security? Blockchain’s tamper-proof nature means results are oracle-fed and verified on-chain, dodging the fraud scandals that plague legacy operators. In high-volatility games like NBA playoffs or UFC fights, this real-time edge lets you strike while the iron’s hot.

On-Chain Efficiency Superpowers

-

Instant Payouts via smart contracts: Cash out winnings immediately, no middlemen delays – over $60B in volume proves it!

-

Ultra-Low Costs at 4.0% margins: Beat traditional sportsbooks’ 4.5-6.0% vig for better value on every bet.

-

Global Liquidity Pools: Access worldwide capital for tighter odds and non-stop action, anytime.

-

No KYC Delays: Jump in and bet fast – skip endless ID verification headaches.

-

Immutable Transparent Results: Blockchain logs every outcome forever, total trust without disputes.

Odds Battle: Why Crypto Sports Wagering Delivers Better Value

Now, the juicy part, blockchain sports odds comparison. Traditional books pad their margins to cover overhead, marketing blitzes, and executive bonuses, leaving you with worse payouts. On-chain platforms? They run lean. That 4.0% house edge matches the best offshore books but adds trustless execution. Platforms like Polymarket sports betting are proving it, chipping away at DraftKings’ turf as Kalshi hits one-fifth their size with sports contracts.

Prediction markets aggregate crowd wisdom for hyper-accurate lines, often beating oddsmakers. Public sentiment drives prices, not some backroom algorithm. Studies show these markets nail outcomes better than polls, translating to value bets you won’t find on FanDuel. In 2026, with multi-chain support, you’re wagering across ecosystems seamlessly, dodging geo-blocks and fees.

Adoption Surge Fuels On-Chain Momentum

Volume doesn’t lie: $60 billion by mid-2025 screams adoption. Hybrid models are emerging, blending sportsbook polish with decentralized fragmentation, per industry forecasts. Yet challenges like regulatory fog linger, demanding liquidity for stable markets. Still, for crypto-savvy fans, the thrill of on-chain sports betting outweighs the risks.

Polymarket and kin aren’t just nibbling at edges; they’re redefining crypto sports wagering efficiency. Traditional books offer promotions, sure, but at what cost to your odds? On-chain delivers pure, unadulterated value, fortune favoring the bold who adapt now.

But let’s get granular with a direct blockchain sports odds comparison. On-chain platforms like those powering decentralized sports prediction markets don’t just talk a big game; their numbers back it up. Traditional sportsbooks might flash promo codes, but they bury you in fees and delays. Crypto sports wagering efficiency? It’s all about those lean operations translating to real edges.

On-Chain Sports Betting Platforms vs Traditional Sportsbooks: Key Comparison

| Metric | On-Chain Platforms | Traditional Sportsbooks |

|---|---|---|

| Settlement Time | Seconds (smart contracts) ⚡ | Days (manual review) ⏳ |

| House Edge | 4.0% | 4.5-6.0% |

| Liquidity | Global pools | Regional limits |

| Transparency | Immutable ledger | Centralized disputes |

| Costs to Bettor | Low/no vig | High promotions trap |

Look at the data: that 4.0% margin on on-chain books keeps more green in your pocket over a season of bets. Factor in no KYC hurdles or geo-fencing, and you’re playing on your terms. I’ve traded enough volatile assets to know when a market’s ripe, and right now, Polymarket sports betting is pulling users from DraftKings by offering lines that reflect true crowd-sourced probabilities. Kalshi’s growth to one-fifth DraftKings’ size proves prediction markets aren’t fringe anymore; they’re stealing share with superior price discovery.

Head-to-Head: Real-World Efficiency Wins

Picture betting the Super Bowl: traditional books freeze lines amid injury news, then drag payouts through compliance mazes. On-chain? Oracles pipe in verified results, smart contracts fire instantly. No fraud flags or account limits because some algo flagged your hot streak. This setup shines in fast-paced action like soccer or esports, where seconds count. Global liquidity means even obscure leagues like K-League have tight spreads, unlike Vegas books that ghost low-volume props.

Traditional Sportsbook Stocks: 6-Month Performance vs. DraftKings

Real-time comparison of DraftKings (DKNG) and peer gaming stocks amid the rise of on-chain betting platforms (Data as of 2026-02-18)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| DraftKings (DKNG) | $23.36 | $47.18 | -50.5% |

| MGM Resorts International (MGM) | $37.05 | $35.46 | +4.5% |

| Caesars Entertainment Inc. (CZR) | $21.31 | $27.07 | -21.3% |

| PENN Entertainment Inc. (PENN) | $13.25 | $13.25 | +0.0% |

| Wynn Resorts Ltd. (WYNN) | $117.99 | $128.54 | -8.2% |

| Las Vegas Sands Corp. (LVS) | $59.10 | $53.88 | +9.7% |

| Boyd Gaming Corporation (BYD) | $84.80 | $84.80 | +0.0% |

Analysis Summary

DraftKings (DKNG) has sharply declined by 50.5% over the past 6 months, underperforming peers like Las Vegas Sands (LVS) which gained 9.7% and MGM Resorts (MGM) up 4.5%, reflecting sector volatility as on-chain platforms gain traction with better efficiency and odds.

Key Insights

- DKNG’s -50.5% drop underscores pressures on traditional sportsbooks from decentralized competitors.

- LVS (+9.7%) and MGM (+4.5%) show relative strength, possibly due to diversified casino operations.

- CZR (-21.3%) and WYNN (-8.2%) also declined, indicating broader challenges.

- PENN and BYD remained flat at 0.0%, stable but not growing amid market shifts.

Utilizes exact real-time data from MarketBeat (DKNG, dated 2026-02-18T17:58:57Z) and CNBC for peers; 6-month prices approximate 6 months prior, with percentage changes as provided.

Data Sources:

- Main Asset: https://www.marketbeat.com/stocks/NASDAQ/DKNG/chart/

- MGM Resorts International: https://www.cnbc.com/quotes/MGM

- Caesars Entertainment Inc.: https://www.cnbc.com/quotes/CZR

- PENN Entertainment Inc.: https://www.cnbc.com/quotes/PENN

- Wynn Resorts Ltd.: https://www.cnbc.com/quotes/WYNN

- Las Vegas Sands Corp.: https://www.cnbc.com/quotes/LVS

- Boyd Gaming Corporation: https://www.cnbc.com/quotes/BYD

Disclaimer: Stock prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Regulatory headwinds? Sure, they spook traditional operators too, but blockchain’s pseudonymity dodges much of the red tape. Forecasts point to three paths ahead: consolidation where big books buy in, fragmentation with niche chains thriving, or hybrids mashing the best of both. I’m betting on hybrids, given how platforms are layering user-friendly apps over decentralized cores. Volume at $60 billion by mid-2025 isn’t slowing; it’s accelerating as multi-chain bridges solve liquidity silos.

Challenges persist, no doubt. Liquidity dips can widen spreads temporarily, and oracles aren’t infallible yet. But compare that to sportsbooks’ outage-prone servers during March Madness or bonus disputes that tie up funds. On-chain flips those pain points into strengths. As a trader glued to charts, I see the pattern: early adopters win big. Platforms blending prediction market wisdom with sports polish are your ticket to better value.

Stake your claim in this evolution. With lower costs, instant action, and odds honed by global smarts, on-chain sports betting isn’t replacing traditional books overnight. It’s outpacing them, one transparent bet at a time. Jump in before the masses dilute those edges, fortune favoring the bold who spot the shift early.