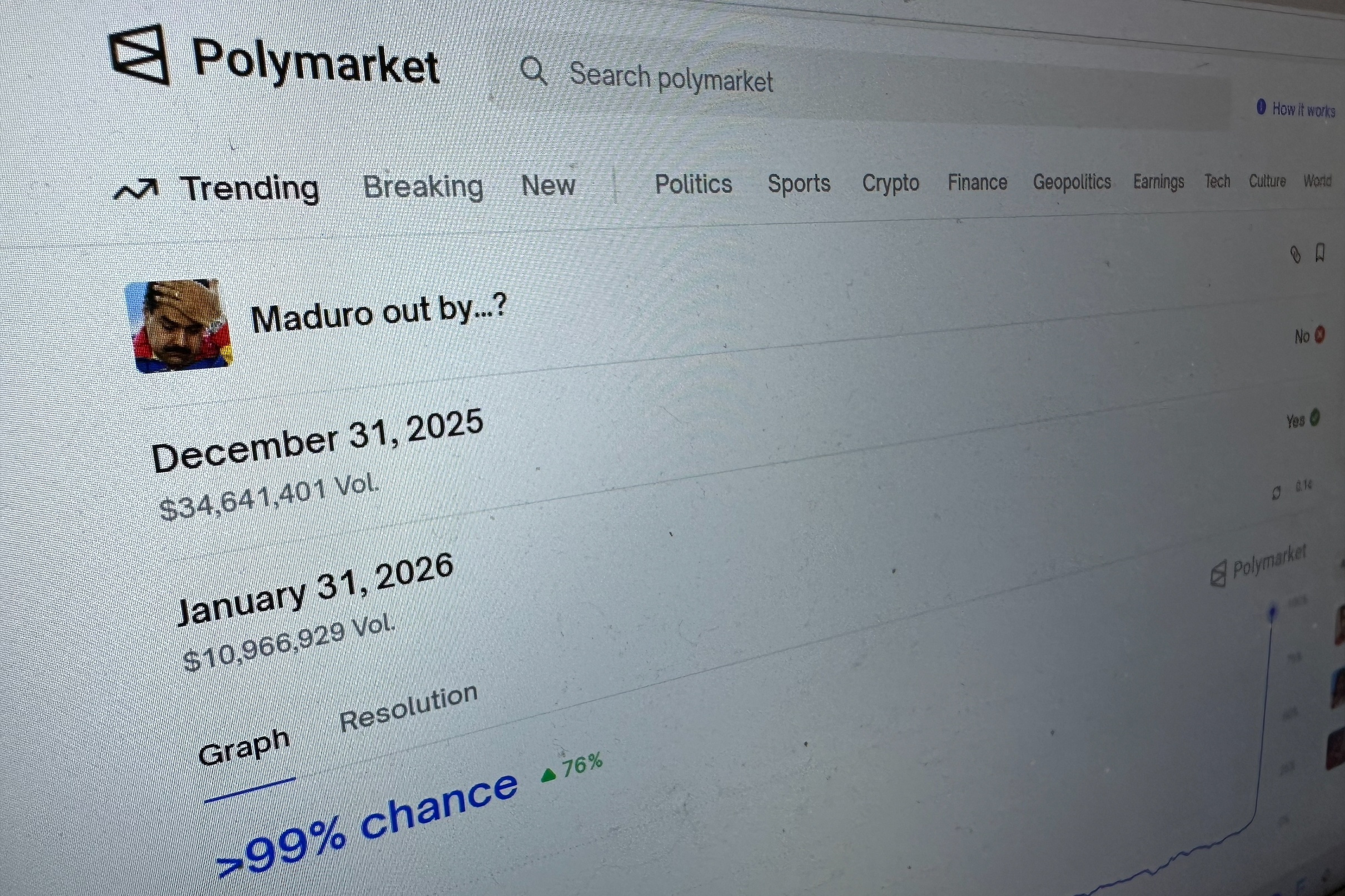

In the evolving landscape of decentralized sports trading NBA enthusiasts are turning to platforms like Polymarket to craft sophisticated on-chain parlays Polymarket that blend blockchain precision with the adrenaline of NBA action. Imagine stringing together bets on player props, game spreads, and totals, all settled transparently on Polygon without intermediaries skimming the top. Polymarket’s recent innovations, including PolyParlays, are pushing the boundaries of blockchain NBA betting terminals, offering a glimpse into a future where sports wagering is as programmable as DeFi yields.

Polymarket has solidified its position as the world’s largest prediction market, particularly after its strategic acquisition of derivatives exchange QCX for $112 million. This move cleared the path for legal U. S. operations, reigniting interest in Polymarket parlays crypto. Users can now stake USDC on NBA outcomes, from Lakers vs. Warriors over/unders to MVP races, with markets updating in real-time. The platform’s PolyParlays feature lets bettors bundle multiple predictions into high-payout combos, echoing traditional parlays but with on-chain verifiability. Yet payouts here often trail sportsbooks due to efficient market pricing, a trade-off for the immutability that prevents disputes.

Navigating Regulatory Wins and State Challenges

The Commodity Futures Trading Commission’s nod to platforms like Polymarket marks a pivotal shift, framing them as hedging tools rather than mere gambles. This endorsement bolsters confidence amid state-level pushback alleging unlicensed activities. Polymarket’s Polygon foundation ensures low fees and fast settlements, crucial for live NBA betting where odds shift faster than a fast break. Still, bettors must weigh these frictions; while transparency shines, accessibility varies by jurisdiction. For those in supported areas, it’s a balanced bet: superior data integrity against occasional legal turbulence.

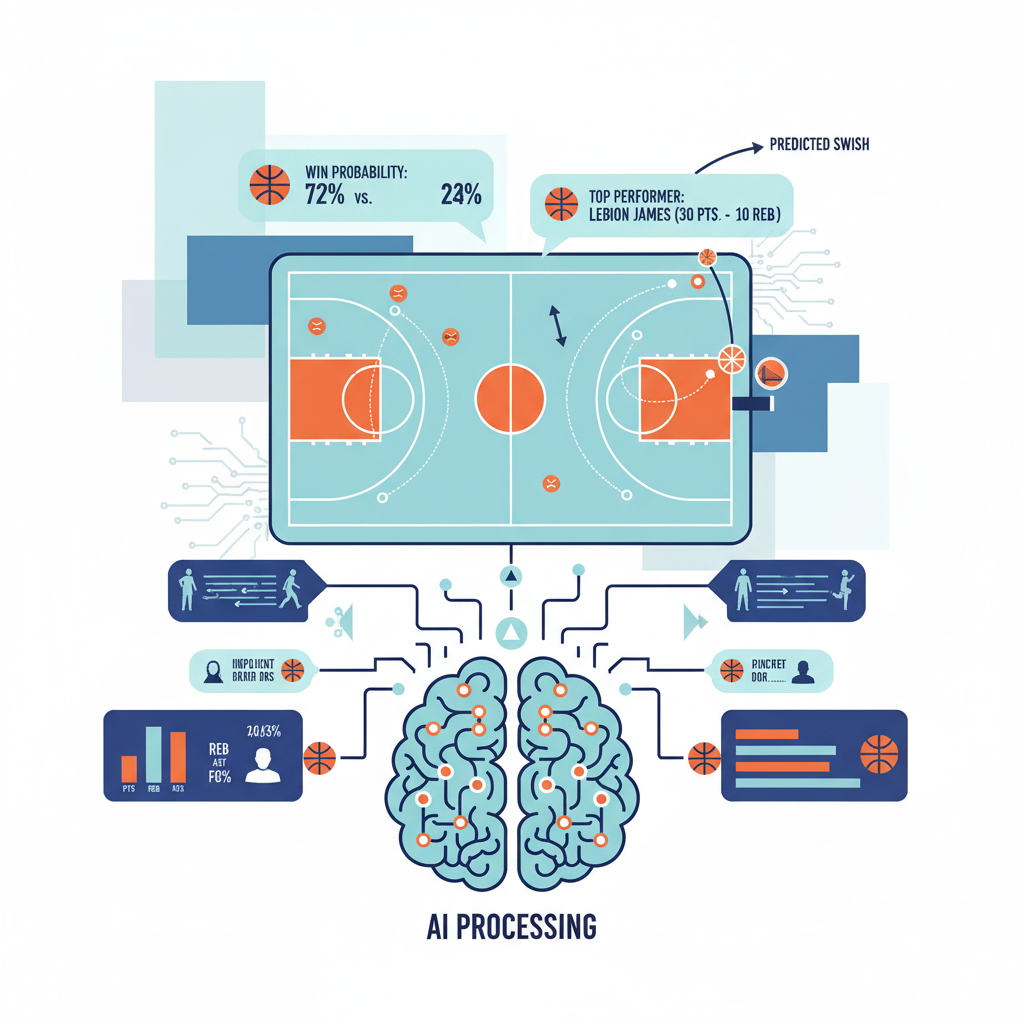

Tools within the Polymarket ecosystem amplify this edge. PolyPredict AI delivers real-time fair value analyses for NBA markets, spotting mispricings before they correct. Polytrader integrates sentiment from social feeds and automated strategies, turning raw prediction data into actionable trades. These on-chain sports betting platforms foster a ecosystem where over 170 bots and analytics compete, sharpening odds through collective intelligence. It’s not hype; it’s arbitrage in motion, where speed and data access yield the real alpha.

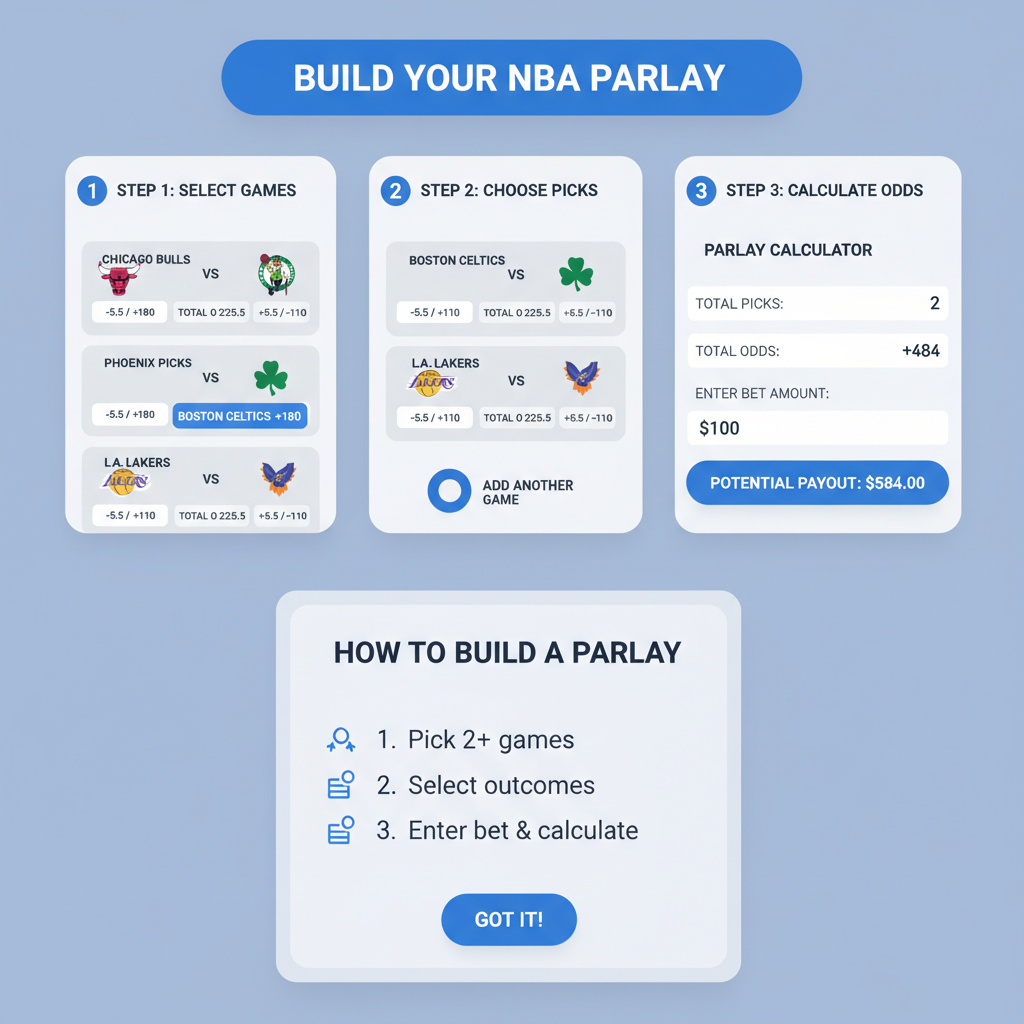

Dissecting PolyParlays for NBA Precision

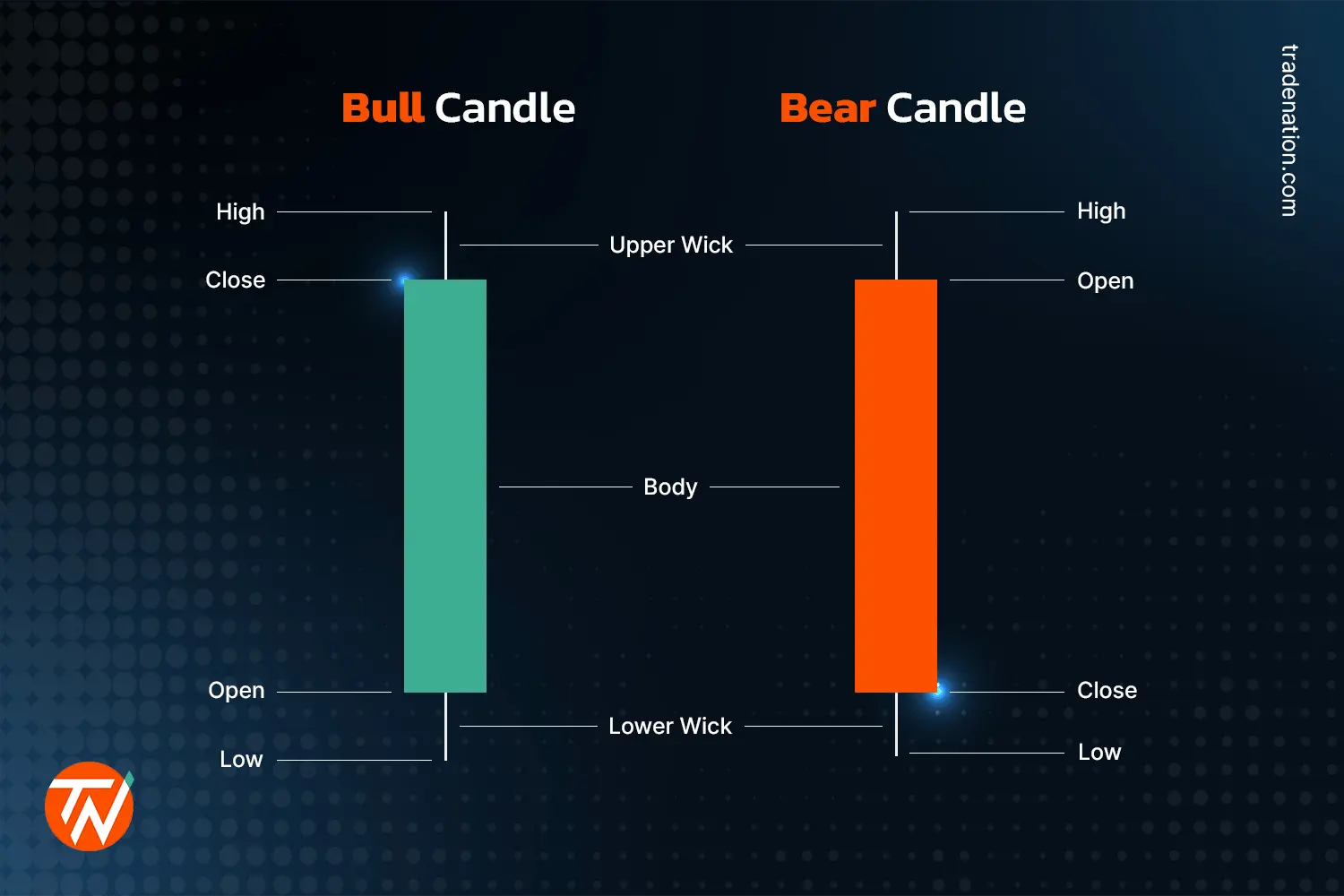

Traditional parlays demand every leg hits perfectly, juicing payouts exponentially but crashing on one miss. Polymarket’s version mirrors this via combinatorial markets: bet Yes on Celtics moneyline, over 220.5 total, and Tatum 30 and points, all resolved by oracles pulling NBA stats. The blockchain twist? No house edge beyond fees, and liquidity pools reflect crowd wisdom instantly. Recent volumes show NBA markets dominating sports predictions, with odds as fresh as February 21,2026, snapshots. Polymarket incentivizes creativity too, dangling up to $350 for parlays sparking big action, democratizing market creation.

Polymath (POLY) Price Prediction 2027-2032

Short-term forecasts from current $0.0213 level, factoring in Polymarket ecosystem growth, PolyParlays adoption, and prediction market trends

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $0.0120 | $0.0280 | $0.0450 | +31.5% |

| 2028 | $0.0180 | $0.0420 | $0.0750 | +50.0% |

| 2029 | $0.0250 | $0.0650 | $0.1200 | +54.8% |

| 2030 | $0.0350 | $0.0950 | $0.1800 | +46.2% |

| 2031 | $0.0450 | $0.1400 | $0.2800 | +47.4% |

| 2032 | $0.0600 | $0.2000 | $0.4000 | +42.9% |

Price Prediction Summary

POLY price is expected to see steady growth from $0.0213, driven by Polymarket’s expansion into U.S. markets, innovative features like PolyParlays, and increasing adoption of decentralized prediction markets for NBA and sports betting. Average prices could multiply over 9x by 2032 in bullish scenarios, with min/max reflecting bearish regulatory hurdles and extreme bull runs.

Key Factors Affecting Polymath Price

- Polymarket’s $112M acquisition of QCX enabling U.S. operations and PolyParlays for NBA bets

- CFTC support for prediction markets boosting legitimacy and adoption

- AI-driven tools like PolyPredict providing real-time NBA odds and analytics

- Polygon blockchain integration enhancing DeFi liquidity and low-cost trading

- Crypto market cycles with potential 2028-2029 bull run amid broader adoption

- Regulatory risks in certain states and competition from traditional sportsbooks

- Overall prediction market volume growth tied to sports events and user incentives up to $350 for parlays

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Critically, these aren’t casino slots; they’re information markets where edges emerge from structural quirks. Retail bettors chasing Vegas lines overlook how Polymarket’s decentralized order books enable cross-market arb, like pairing NBA props with election overlays for uncorrelated plays. I’ve watched portfolios compound here by treating it as alpha capture, not gambling. Yet balance tempers enthusiasm: liquidity thins on niche parlays, and oracle risks linger, though audits mitigate them effectively.

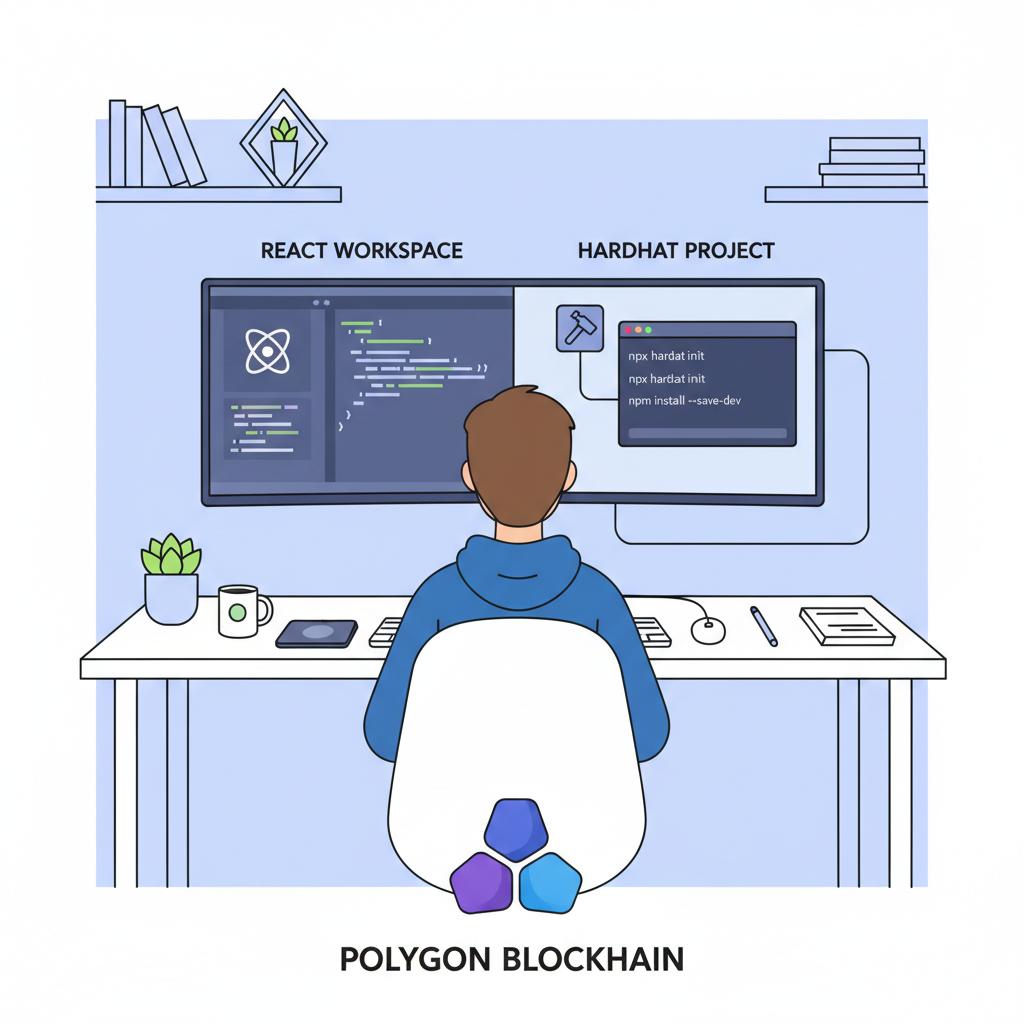

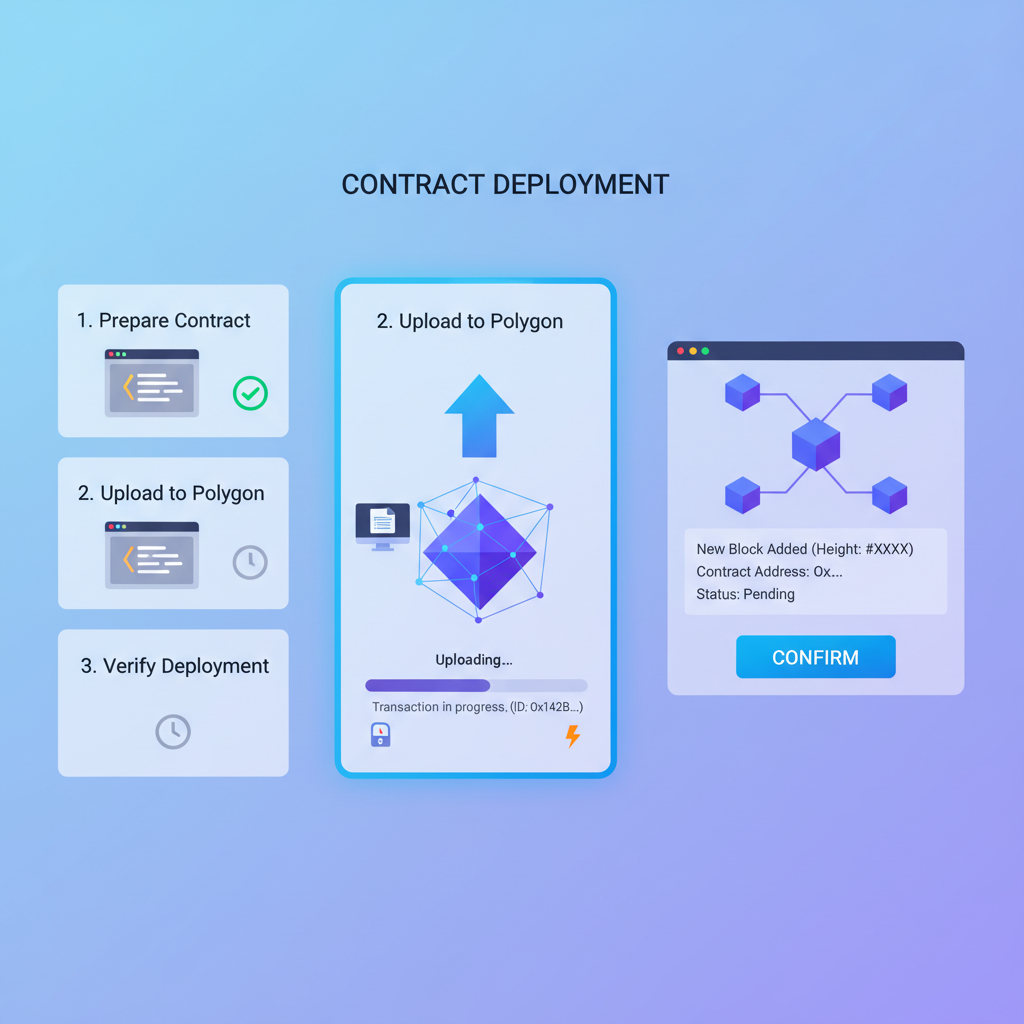

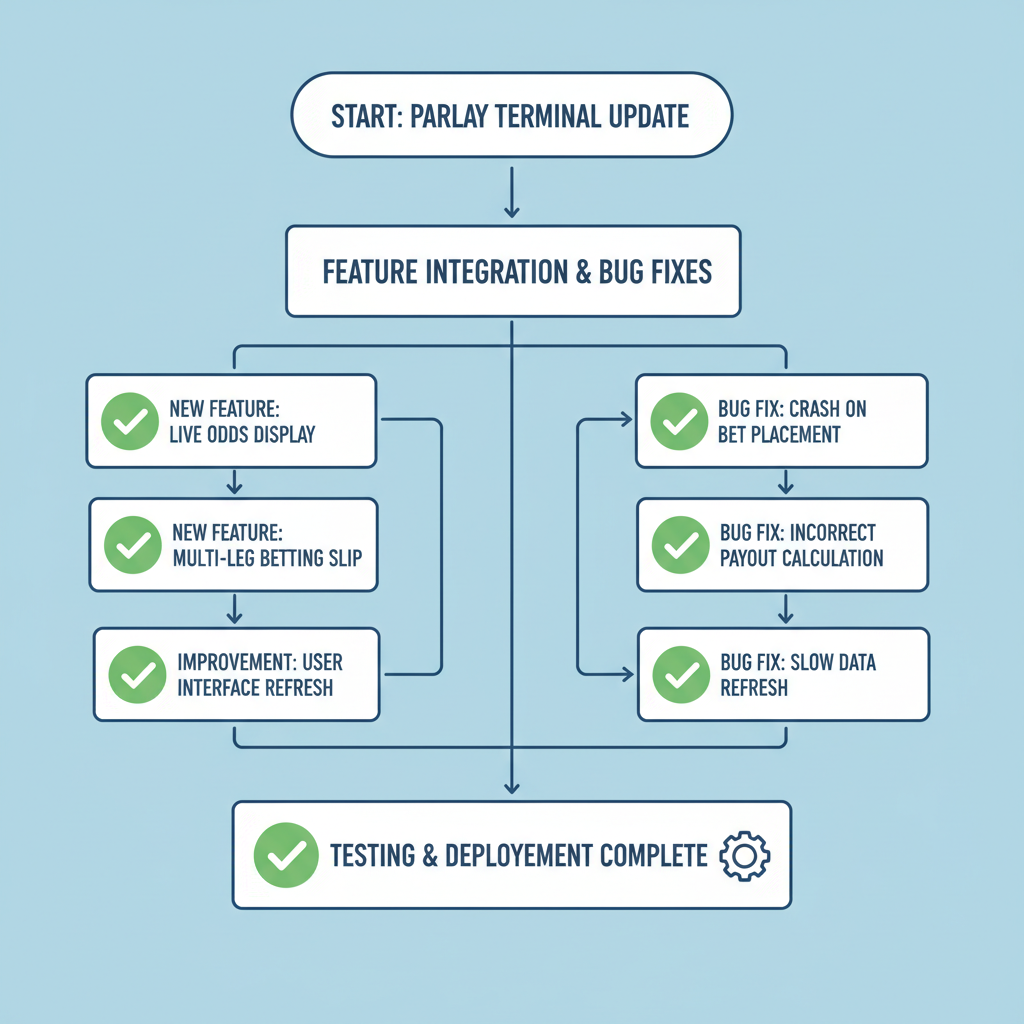

Crafting Custom Decentralized Trading Terminals

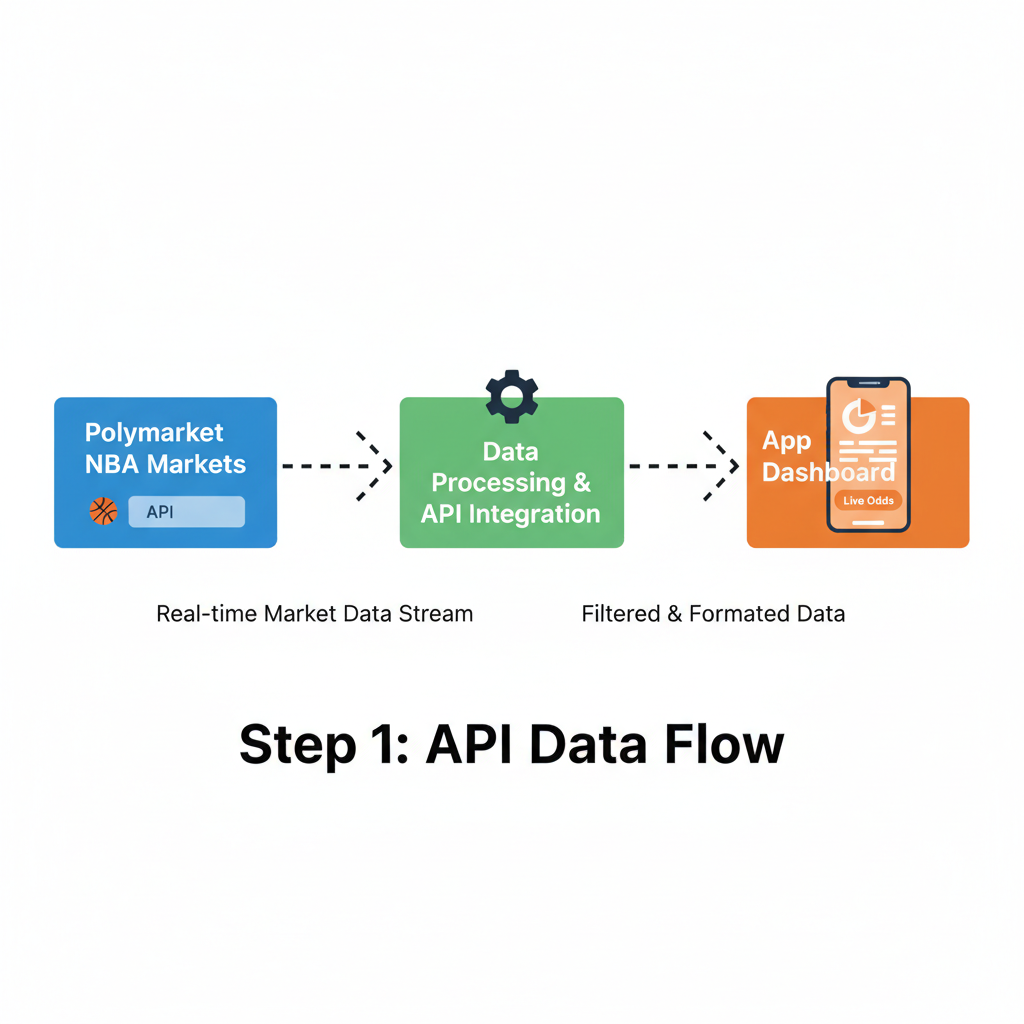

Building decentralized sports trading NBA terminals starts with Polymarket’s APIs, layering on frontends for parlay builders. Developers fork Polytrader templates, embed PolyPredict feeds, and deploy on Polygon for gasless UX via account abstraction. Picture a dashboard visualizing NBA schedules, auto-generating correlated parlays via AI, and executing via limit orders. This isn’t distant; ecosystem guides detail integrations with DeFi for leveraged positions, turning passive viewers into active traders. The result? Terminals rivaling Bloomberg setups, but open-source and crypto-native.

Hands-on implementation reveals the power of these setups. By chaining Polymarket’s oracle feeds with front-end libraries like Wagmi, developers craft interfaces that simulate live NBA trading floors. Add sentiment scrapers from Farcaster or X, and you’ve got a terminal pulsing with real-time edges, all while Polymath’s ecosystem token hovers at $0.0213, underscoring the broader Polygon vitality with a modest 24-hour gain of and 0.0517%.

Once deployed, these terminals unlock structural advantages absent in centralized sportsbooks. Bettors spot arb opportunities between Polymarket’s crowd-sourced odds and Vegas lines, often pocketing discrepancies before they vanish. PolyPredict AI shines here, crunching NBA stats for fair value reads; a recent analysis flagged a Warriors over as 8% undervalued, prompting volume spikes. Yet discipline reigns: overleveraging erodes edges, and oracle delays, though rare, demand vigilant position sizing.

JavaScript: Fetch NBA Markets, Build Parlay, and Simulate Payout with Polymarket SDK

To integrate Polymarket markets into a decentralized sports trading terminal, we can use their JavaScript SDK and public APIs. This example thoughtfully demonstrates fetching real-time NBA game markets, constructing a simple two-leg parlay object, and simulating the payout calculation based on current prices. It’s a clear starting point, balancing simplicity with real-world applicability while highlighting key considerations like error handling.

// Example using Polymarket's CLOB client and Gamma API

// npm install @polymarket/clob-client @polymarket/sdk ethers

import { ClobClient } from '@polymarket/clob-client';

async function fetchNBAMarketsAndSimulateParlay() {

// Initialize the CLOB client (requires a funded wallet private key)

const clobClient = new ClobClient({

host: 'https://clob.polymarket.com',

key: process.env.PRIVATE_KEY, // Replace with your Polygon wallet private key

chainId: 137, // Polygon mainnet

});

try {

// Fetch active NBA markets via Polymarket's Gamma API

// Filter for NBA-tagged markets (e.g., today's Lakers vs. Warriors game)

const response = await fetch(

'https://gamma.api.polymarket.com/markets?active=true&limit=100&tag=nba',

{ method: 'GET' }

);

const marketsData = await response.json();

const nbaMarkets = marketsData.data || [];

// Select specific markets for parlay (e.g., Lakers win and over total points)

const lakersWinMarket = nbaMarkets.find(m =>

m.question.toLowerCase().includes('lakers') && m.question.includes('win')

);

const overPointsMarket = nbaMarkets.find(m =>

m.question.toLowerCase().includes('over') && m.question.includes('points')

);

if (!lakersWinMarket || !overPointsMarket) {

throw new Error('NBA markets not found. Check available markets.');

}

// Build parlay object: select 'Yes' outcomes for both markets

const parlay = {

markets: [

{

tickerId: lakersWinMarket.tickerId,

outcome: 'Yes',

price: parseFloat(lakersWinMarket.yesPrice),

},

{

tickerId: overPointsMarket.tickerId,

outcome: 'Yes',

price: parseFloat(overPointsMarket.yesPrice),

},

],

};

// Simulate parlay payout

// Convert prices (implied probs) to decimal odds and multiply

const odds1 = 1 / parlay.markets[0].price;

const odds2 = 1 / parlay.markets[1].price;

const parlayOdds = odds1 * odds2;

const stake = 100; // USDC stake

const grossPayout = stake * parlayOdds;

const netPayout = grossPayout - stake; // Profit

console.log('Parlay Details:', parlay);

console.log(`Combined Odds: ${parlayOdds.toFixed(2)}`);

console.log(`Potential Gross Payout for ${stake} stake: ${grossPayout.toFixed(2)}`);

console.log(`Potential Profit: ${netPayout.toFixed(2)}`);

// In production, use clobClient to create sized orders for each token

// to build the parlay with equal payout across outcomes

return { parlay, simulatedPayout: grossPayout };

} catch (error) {

console.error('Error:', error.message);

return null;

}

}

// Run the example

fetchNBAMarketsAndSimulateParlay();

This simulation uses market prices to estimate parlay odds without executing trades—actual on-chain parlays require proportional token purchases via the CLOB for balanced payouts. Always verify market data, incorporate fees, and test thoroughly on testnet. This approach empowers balanced risk assessment in your NBA betting terminal.

On-chain parlays Polymarket thrive on this interplay of data and decentralization. Unlike paltry traditional payouts critiqued in industry reports, PolyParlays scale with liquidity, rewarding sharp combinatorial bets. I’ve modeled scenarios where bundling three correlated props, say, Jokic triple-double, Nuggets spread, and under total, yields 15x returns at efficient pricing. The $350 bounty for viral ideas further fuels innovation, with top submissions driving NBA market depth.

Edges in the Polymarket Ecosystem

Over 170 tools populate this space, from Polytrader’s bots to AI sentiment analyzers, creating a Darwinian edge hunt. Speed matters: sub-second Polygon confirms outpace legacy books, letting you front-run sentiment shifts post-Twitter buzz. Structural arb blooms too, pair NBA overs with macro events for diversification. Polymath’s steady $0.0213 price, amid a 24-hour range of $0.0202 to $0.0324, mirrors the ecosystem’s resilience, even as CFTC support clashes with state scrutiny.

PolyParlays NBA Betting Advantages

-

Transparent Settlements: On-chain verification on Polygon ensures tamper-proof, verifiable outcomes for NBA bets.

-

No House Edge: Peer-to-peer prediction markets eliminate traditional sportsbook vig, maximizing user payouts.

-

AI-Driven Fair Value: Tools like PolyPredict AI deliver real-time predictions and fair value analysis for NBA games.

-

Custom Combos: Build personalized parlay markets on NBA events, with rewards up to $350 for high-volume ideas.

-

Real-Time Liquidity: Trade shares instantly with live odds and deep liquidity on the world’s largest prediction market.

Balanced risks temper the upside. Liquidity dips on obscure parlays, amplifying slippage, while regulatory gray zones persist despite QCX’s $112 million buyout enabling U. S. access. Oracle fidelity, battle-tested on elections, holds for NBA stats, but black swan events like injuries test resilience. Savvy users hedge via DeFi protocols, blending prediction markets with perpetuals for nuanced exposure.

Visionaries see these terminals evolving into full-stack platforms, embedding VR highlights and social leaderboards. Polymarket’s NBA dominance, with markets refreshing as of February 21,2026, signals maturity. For crypto-savvy fans, it’s more than betting, it’s owning a slice of sports intelligence, programmable and borderless. As adoption swells, expect refined oracles and deeper liquidity to solidify decentralized sports trading NBA as the new standard, where every fast break fuels financial alpha.