In 2025, the landscape of sports betting is undergoing a radical transformation. The rise of multichain sports betting platforms is not just a technological trend – it is a direct response to persistent industry pain points: fragmented liquidity and opaque operations. By leveraging the strengths of multiple blockchains and advanced DeFi protocols, these platforms are rewriting the rules for how liquidity flows and how transparency is enforced in on-chain wagering.

Multichain Integration: Unlocking Deep Liquidity Pools

Liquidity has long been the Achilles’ heel of both traditional and single-chain crypto sportsbooks. In 2025, leading platforms such as LEVR Bet have embraced multichain deployment, launching simultaneously on Avalanche, Monad, and Hyperliquid. This strategy enables them to tap into diverse user bases and aggregate liquidity from across the Web3 ecosystem. For example, Avalanche’s recent C-Chain upgrade slashed transaction fees by 96% and reduced deployment costs by an astonishing 99.9%. These cost efficiencies are not trivial – they directly empower platforms like LEVR Bet to offer tighter spreads, lower fees, and more robust markets for bettors.

By operating across several chains, these next-generation sportsbooks sidestep the issue of isolated liquidity pools that plagued earlier decentralized betting solutions. Instead, liquidity becomes dynamic and accessible wherever users are most active – whether that’s on Ethereum mainnet or a high-speed L2 like Monad. The result? Bettors enjoy deeper markets with less slippage and faster bet matching regardless of their preferred blockchain.

Transparency by Design: Public Bet Desks and On-Chain Records

Transparency has shifted from being an aspirational buzzword to an operational imperative in decentralized sports betting. Platforms like Dexsport. io now run public live bet desks where every wager is logged on-chain in real time for all to see. This open ledger approach eliminates the possibility of hidden odds manipulation or off-chain settlement disputes – anyone can audit outcomes or verify payouts instantly.

This level of radical transparency builds trust not just between users but also between platforms and liquidity providers. By exposing all bets and results transparently on-chain, these sportsbooks invite independent verification from third-party analysts and community watchdogs alike. For those interested in exploring how blockchain ensures fair play in decentralized betting environments, resources such as this guide offer further insights.

The DeFi Engine: AMMs, Oracles and Peer-to-Pool Betting

The integration of DeFi protocols marks another leap forward for on-chain sports betting liquidity. Projects like Azuro have pioneered hybrid oracle/AMM solutions that blend peer-to-pool mechanics with market-driven pricing algorithms. Here’s how it works: users contribute capital to shared liquidity pools (much like providing funds to a DEX) and earn APY as bets are placed against those pools. Odds are determined algorithmically based on current pool balances rather than being set by centralized bookmakers.

This model offers two major advantages over legacy systems:

- Guaranteed Payout Liquidity: Since payouts draw directly from pooled capital held in smart contracts, there’s no risk of operator insolvency or delayed withdrawals.

- User Incentives: Liquidity providers earn passive returns from trading fees (and sometimes protocol tokens), incentivizing deeper pools which further benefit bettors through improved odds stability.

The role of oracles cannot be overstated here either – with networks like Chainlink delivering tamper-proof match data directly to smart contracts, settlement becomes both instant and indisputable.

Tackling Cross-Chain Arbitrage and Fragmentation

The proliferation of blockchains brings undeniable benefits but also creates fresh challenges around cross-chain arbitrage and liquidity fragmentation. In response, leading cross-chain sportsbook platforms now deploy AI-driven arbitrage bots that actively rebalance funds between chains based on demand spikes or price discrepancies. This keeps odds consistent across all supported networks while minimizing slippage for large bets.

The result is a more unified experience for users who may never even notice which chain their bet settles on – only that their wager is matched quickly at fair market rates with full auditability baked in from start to finish.

What’s particularly striking about the multichain approach is how it democratizes access to sports betting. No longer are users siloed by their chain of choice or forced to endure high gas fees and thin order books. Instead, bettors can participate using Bitcoin, Ethereum, stablecoins, or emerging L2 tokens, whichever best suits their needs, with liquidity flowing seamlessly behind the scenes. This flexibility is a game-changer for both casual fans and high-volume traders seeking no-KYC crypto betting options.

Moreover, the use of open-source smart contracts and fully transparent liquidity pools means that every aspect of the betting process is verifiable. Odds aren’t just posted, they’re provably fair, calculated in real-time via decentralized algorithms and updated instantly as new wagers come in. For those curious about the mechanics behind this transparency, platforms like Azuro and Dexsport. io provide public dashboards where users can inspect pool balances, bet flows, and even protocol revenue on demand.

The Road Ahead: Innovation and User Empowerment

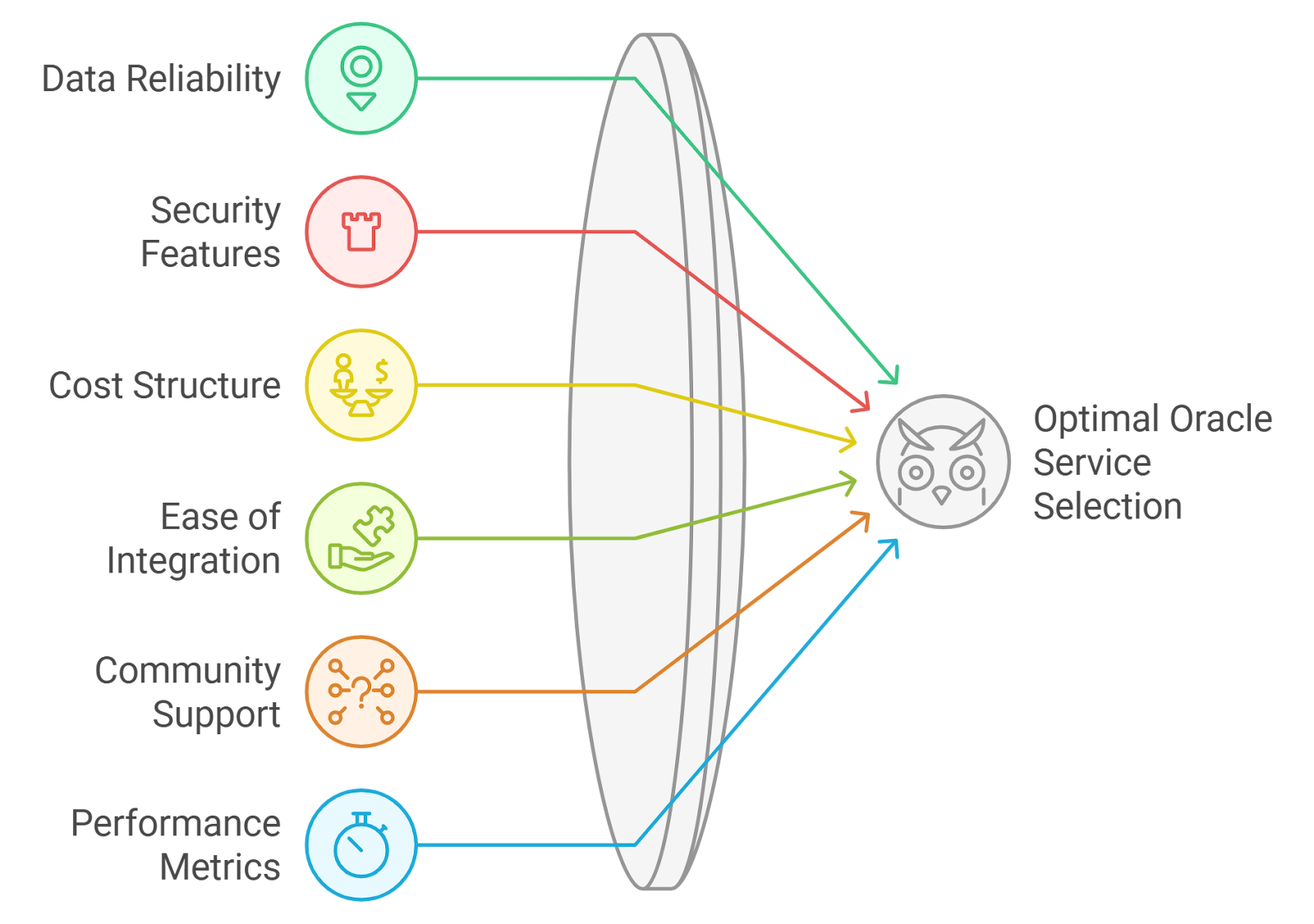

Looking forward, we’re seeing a wave of innovation aimed at making decentralized sports betting even more accessible and engaging. Custom oracle solutions, like those offered by Gora Network, are enabling industry-specific data feeds that power everything from live odds to instant result settlements. These oracles are not only improving accuracy but also reducing latency between real-world events and on-chain outcomes.

Meanwhile, hybrid DEX models are merging order books with automated market makers (AMMs), allowing for more granular control over bet sizing and risk management. This evolution empowers users to tailor their exposure while still benefiting from deep shared liquidity pools, a crucial step toward mainstream adoption of cross-chain sportsbook platforms.

Community governance is also coming to the forefront. Token holders on many platforms now vote on everything from fee structures to which sporting events get listed next. By aligning incentives between bettors, liquidity providers, and protocol developers, these systems foster a sustainable ecosystem where everyone has a stake in fair play and platform growth.

As multichain sports betting 2025 matures, expect further improvements in user experience: mobile-first interfaces for live wagering, social features that let fans share picks instantly across chains, and advanced analytics powered by AI-driven insights into market trends. All these innovations rest on a foundation of blockchain sports betting transparency that simply wasn’t possible before Web3.

Bottom Line: A New Era for On-Chain Sports Betting

The convergence of multichain integration, DeFi-powered liquidity solutions, transparent smart contracts, and cross-chain arbitrage tools is rapidly closing the gap between traditional sportsbooks and their decentralized counterparts. Bettors now enjoy deeper markets with tighter spreads while knowing every transaction is recorded immutably, and every outcome verified by code rather than trust.

The days of opaque operations and fragmented markets are fading fast. In their place stands an ecosystem that prioritizes user empowerment through transparency and efficiency at scale. For anyone interested in how blockchain continues to redefine the fairness and accessibility of sports wagering, from peer-to-pool mechanics to instant settlements, resources like this deep dive offer valuable context.