Zero-house-edge sportsbooks are rapidly transforming the on-chain betting landscape, leveraging Decentralized Autonomous Organizations (DAOs) and DeFi liquidity pools to deliver a fair, transparent, and user-aligned alternative to traditional betting platforms. The core innovation? Eliminating the house edge that has historically tilted odds in favor of operators. Instead, these platforms use open-source smart contracts and community governance to create a trustless environment where bettors get the fairest possible odds.

How Zero-House-Edge Sportsbooks Work

Traditional sportsbooks extract profits through a built-in margin known as the house edge. This ensures operator profitability regardless of outcomes but systematically reduces bettor returns. In contrast, zero-house-edge sportsbooks remove this margin entirely. Here’s how:

- Liquidity Provision: Users supply assets (typically stablecoins) into DeFi pools that back all bets and payouts.

- DAO Governance: Community members participate in decision-making on platform rules, fees, and market selection via smart contracts.

- Algorithmic Odds: Odds are set dynamically based on real-time market data and demand, not by centralized bookmakers.

- Payouts and Transparency: Smart contracts handle bet resolution and payouts automatically using decentralized oracles for verifiable results.

This model means bettors face no hidden fees or unfavorable odds. Liquidity providers (LPs) earn revenue through transaction fees or small margins on bet volume rather than from an inherent house advantage.

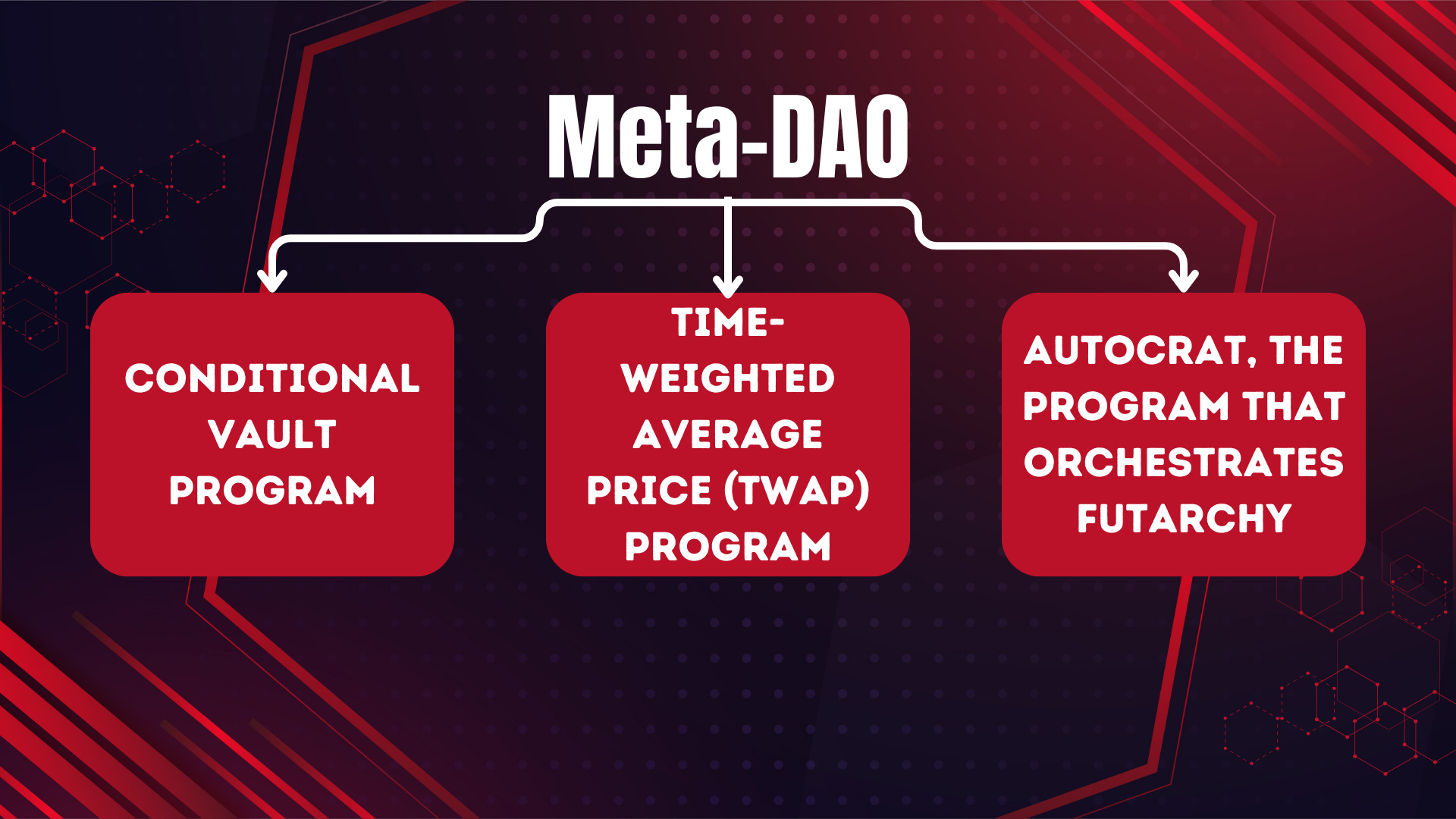

The Role of DAOs in Fair On-Chain Betting

The introduction of DAOs marks a paradigm shift in sports betting governance. Unlike traditional operators who unilaterally set terms, DAOs distribute control among token holders or stakers. For example, platforms like Betonchain empower users to vote on everything from max stake limits to fee adjustments, ensuring policies align with community interests rather than operator profit motives.

This approach increases transparency and accountability while accelerating innovation as user feedback is rapidly implemented through smart contract upgrades.

DeFi Liquidity Pools: The Backbone of Zero-House-Edge Sportsbooks

DeFi liquidity pools are essential for covering potential payouts without relying on centralized treasuries. When users deposit funds into these pools, they receive tokens (such as BETLP tokens on Betonchain) representing their share of platform liquidity and corresponding earnings from transaction fees. This system not only ensures immediate payout capability but also introduces passive income opportunities for LPs who want exposure to sports betting markets without placing individual wagers.

The result is a symbiotic ecosystem where bettors benefit from better odds while LPs diversify their yield strategies within the broader DeFi landscape.

Zero-House-Edge vs Traditional Sportsbooks: Key Advantages

-

Enhanced Fairness & Better Odds: Zero-house-edge sportsbooks like Betonchain and Rogue Protocol eliminate the operator margin, giving bettors access to more favorable odds and maximizing potential returns compared to traditional sportsbooks that build in a house edge.

-

Transparency & Trust: Platforms such as LunaFi use open-source smart contracts and decentralized oracles to ensure all bets, outcomes, and payouts are verifiable and tamper-proof—a sharp contrast to the opaque operations of traditional bookmakers.

-

Community-Driven Governance: Through DAOs, users can participate in platform governance, influencing policies, fees, and market offerings. This democratic model aligns the sportsbook’s evolution with the interests of its community, unlike the top-down control in traditional betting firms.

-

Passive Income for Liquidity Providers: Zero-house-edge models enable users to earn passive returns by supplying liquidity to betting pools, diversifying income streams within DeFi. Traditional sportsbooks offer no such direct participation or revenue-sharing for users.

-

Instant, Automated Payouts: Smart contracts automatically resolve outcomes and distribute winnings instantly, eliminating withdrawal delays and manual intervention common in legacy sportsbooks.

This community-driven structure has already inspired several high-profile projects such as Rogue Protocol, which lets LPs act as “the house” and share in platform revenue, and LunaFi’s decentralized house pools that democratize both risk and reward (read more here). Each project uses smart contracts for provably fair outcomes and instant payouts, key tenets for any credible zero-house-edge sportsbook seeking mainstream adoption.

As user adoption grows, zero-house-edge sportsbooks are beginning to reshape expectations for both bettors and liquidity providers. The removal of the house edge is more than a marketing angle, it’s a data-driven response to long-standing issues of trust, transparency, and value extraction in legacy betting markets. With on-chain verification and community control, these platforms are setting new benchmarks for fairness and efficiency.

Challenges and Future Outlook

Despite their promise, zero-house-edge sportsbooks face several hurdles. Liquidity depth remains a critical factor; without sufficient capital in pools, large bets or volatile markets can strain payout reliability. Additionally, regulatory uncertainty continues to cloud the sector’s mainstream potential, jurisdictions differ widely on the legality of decentralized betting protocols.

Another challenge is user education. Many bettors are unfamiliar with DeFi mechanics like staking or providing liquidity. Projects must invest in onboarding tools and clear documentation to lower barriers for non-crypto natives. The platforms that succeed will be those that balance technical sophistication with intuitive design.

Top Challenges and Solutions for Zero-House-Edge Sportsbooks

-

Liquidity Pool Sustainability: Maintaining adequate liquidity to cover large or unexpected payouts is critical. Solution: Platforms like Betonchain incentivize liquidity providers with a share of transaction fees and governance rights, ensuring ongoing pool health.

-

Oracle Reliability and Data Integrity: Accurate and tamper-proof event data is essential for fair bet resolution.Solution: Integrate decentralized oracles (e.g., Chainlink) to deliver verifiable results, as seen on LunaFi and similar platforms.

-

Smart Contract Security: Vulnerabilities in smart contracts can lead to fund losses or exploits.Solution: Conduct regular third-party audits and implement bug bounty programs, as practiced by Rogue Protocol and other leading DeFi sportsbooks.

-

User Experience and Onboarding: Complex DeFi interfaces can deter mainstream users.Solution: Streamline onboarding with intuitive UI/UX, wallet integrations, and educational resources, as adopted by Divvy.Bet and other user-focused platforms.

-

Regulatory Uncertainty: Evolving global regulations can impact platform operations and user access.Solution: Adopt a DAO governance model for transparency and adaptability, enabling platforms to adjust policies in response to regulatory changes while maintaining compliance.

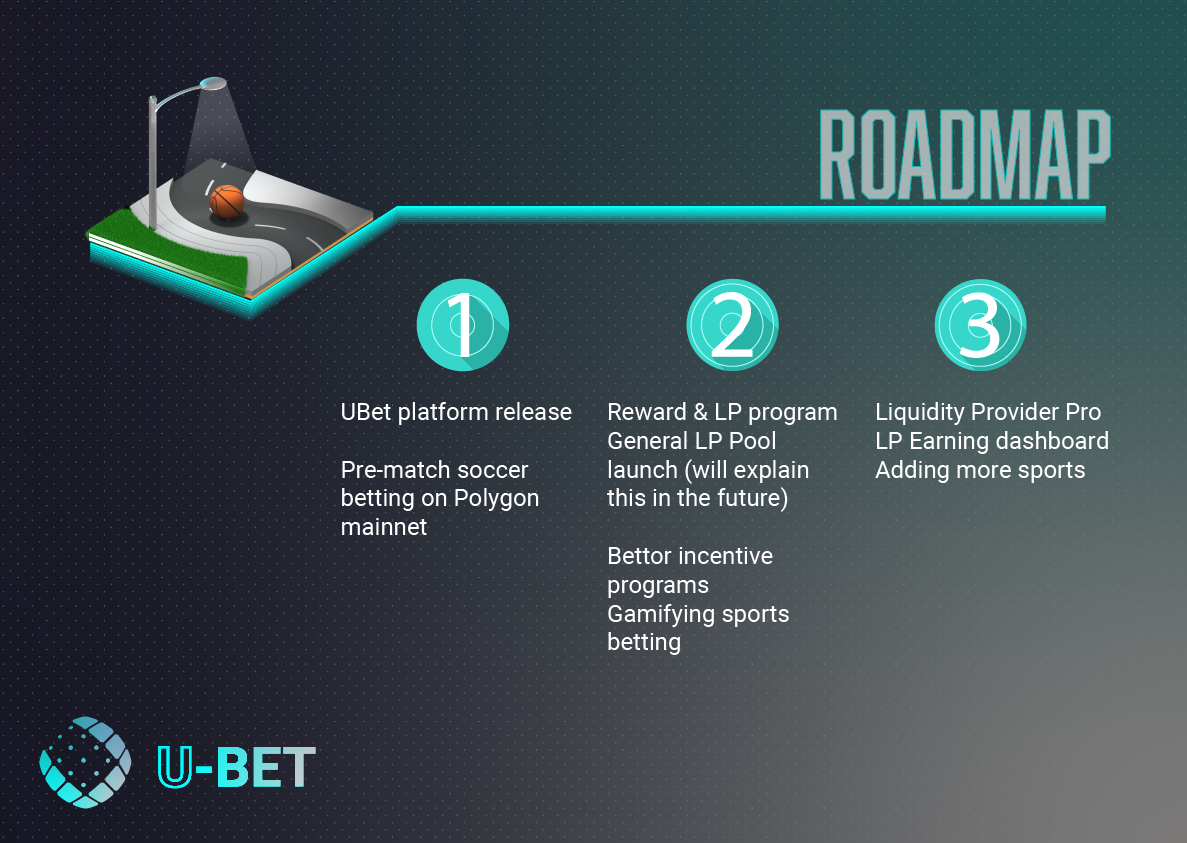

What’s Next for DAO Sports Betting?

The next wave of innovation will likely focus on refining risk management algorithms, integrating advanced oracles for real-time data accuracy, and expanding market offerings beyond mainstream sports into eSports, politics, and entertainment events. Community-driven governance models may also evolve to include reputation systems or tiered voting weights based on contribution, further aligning incentives within each protocol.

We’re also seeing increased interoperability between DeFi protocols and betting platforms. For example, LP tokens from one sportsbook could be used as collateral in other DeFi applications, multiplying yield opportunities across the ecosystem. This composability is unique to on-chain infrastructure and positions zero-house-edge sportsbooks at the intersection of sports betting and decentralized finance.

Key Takeaways: The Data-Driven Edge

For bettors seeking transparency, competitive odds, and verifiable fairness, or for crypto users wanting passive income through liquidity provision, the zero-house-edge model represents a compelling evolution in sports wagering. By leveraging DAOs for governance and DeFi pools for liquidity management, these platforms align incentives across all stakeholders.

The data doesn’t lie: community-aligned protocols with open-source smart contracts are driving higher engagement rates compared to traditional operators relying on opaque odds-setting practices. As blockchain-based betting matures, and as regulatory clarity improves, expect even greater migration from Web2 bookmakers to their Web3 counterparts.