The emergence of zero-house-edge sportsbooks marks a fundamental shift in how sports betting operates, moving away from the traditional bookmaker model toward a system that is transparent, community-driven, and fundamentally fairer for participants. By leveraging decentralized technologies such as DAOs and DeFi liquidity pools, these platforms are not only removing the house edge but also allowing users to directly participate in both governance and profit-sharing. As we explore this new era of on-chain betting, it is crucial to understand the building blocks that enable these protocols to function without a centralized party taking a cut.

The Role of DAOs in Zero-House-Edge Sportsbooks

At the heart of most zero-house-edge sportsbooks is the Decentralized Autonomous Organization (DAO), a self-governing entity managed by smart contracts on public blockchains. Unlike traditional sportsbooks where decisions are made behind closed doors, DAOs introduce radical transparency and collective governance. Every major protocol action – from adjusting payout ratios to selecting supported sporting events – is subject to community vote or pre-programmed logic. This ensures that no single operator can manipulate odds or outcomes for their own benefit.

For example, platforms like LunaFi have pioneered models where users can provide liquidity to betting pools and earn returns based on platform activity. Here, the DAO serves as both referee and rulemaker, enforcing fair play through code rather than relying on trust in an anonymous operator. This approach not only democratizes decision-making but also aligns incentives between bettors and liquidity providers.

DeFi Liquidity Pools: The Engine Behind Fair Betting

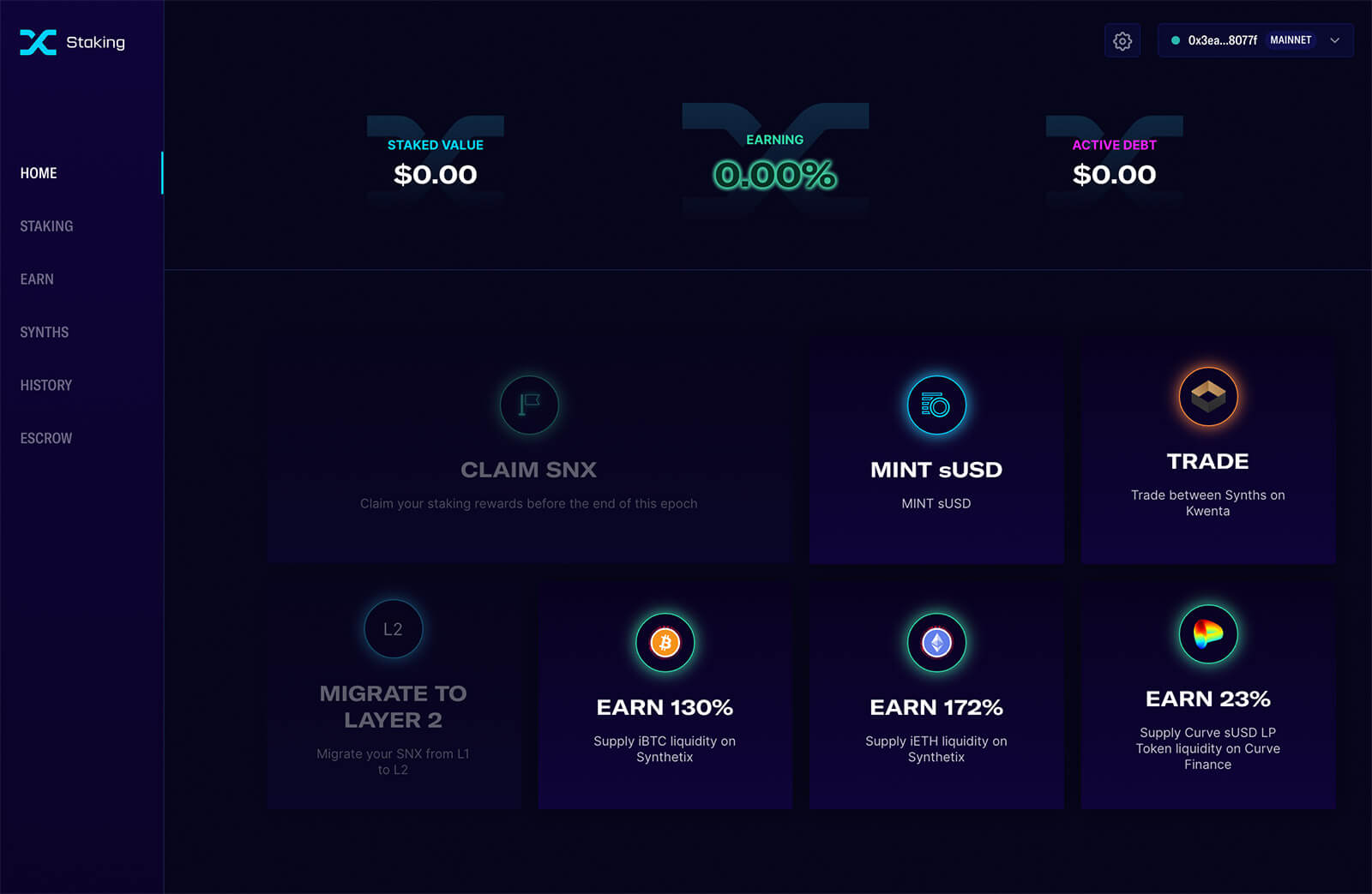

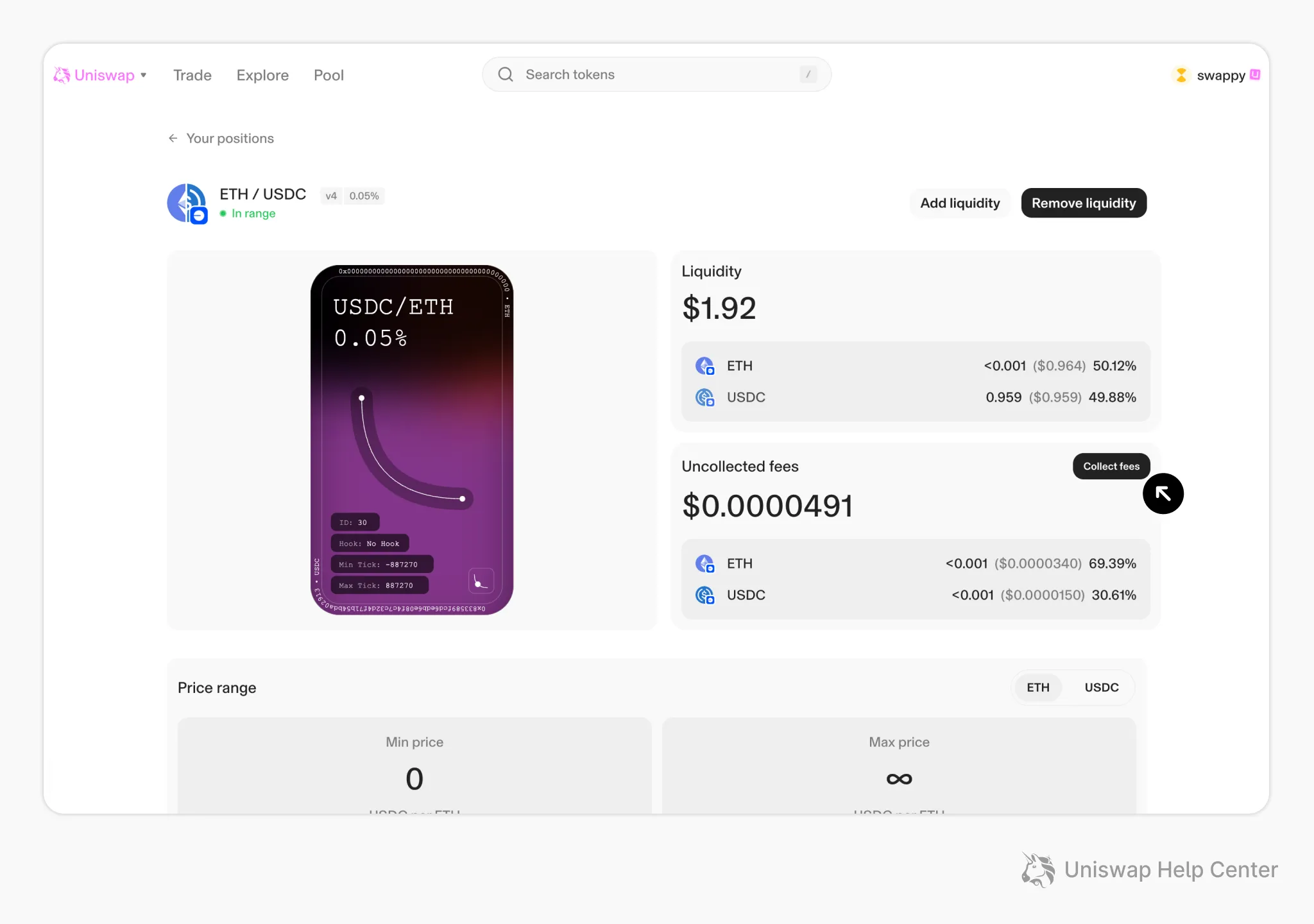

The second pillar of zero-house-edge sportsbooks is the use of DeFi liquidity pools. In this model, anyone can deposit crypto assets into smart contract-based pools that serve as the platform’s bankroll. Instead of playing against a faceless house with its own financial interests, bettors place wagers against these communal pools – often denominated in stablecoins or popular cryptocurrencies.

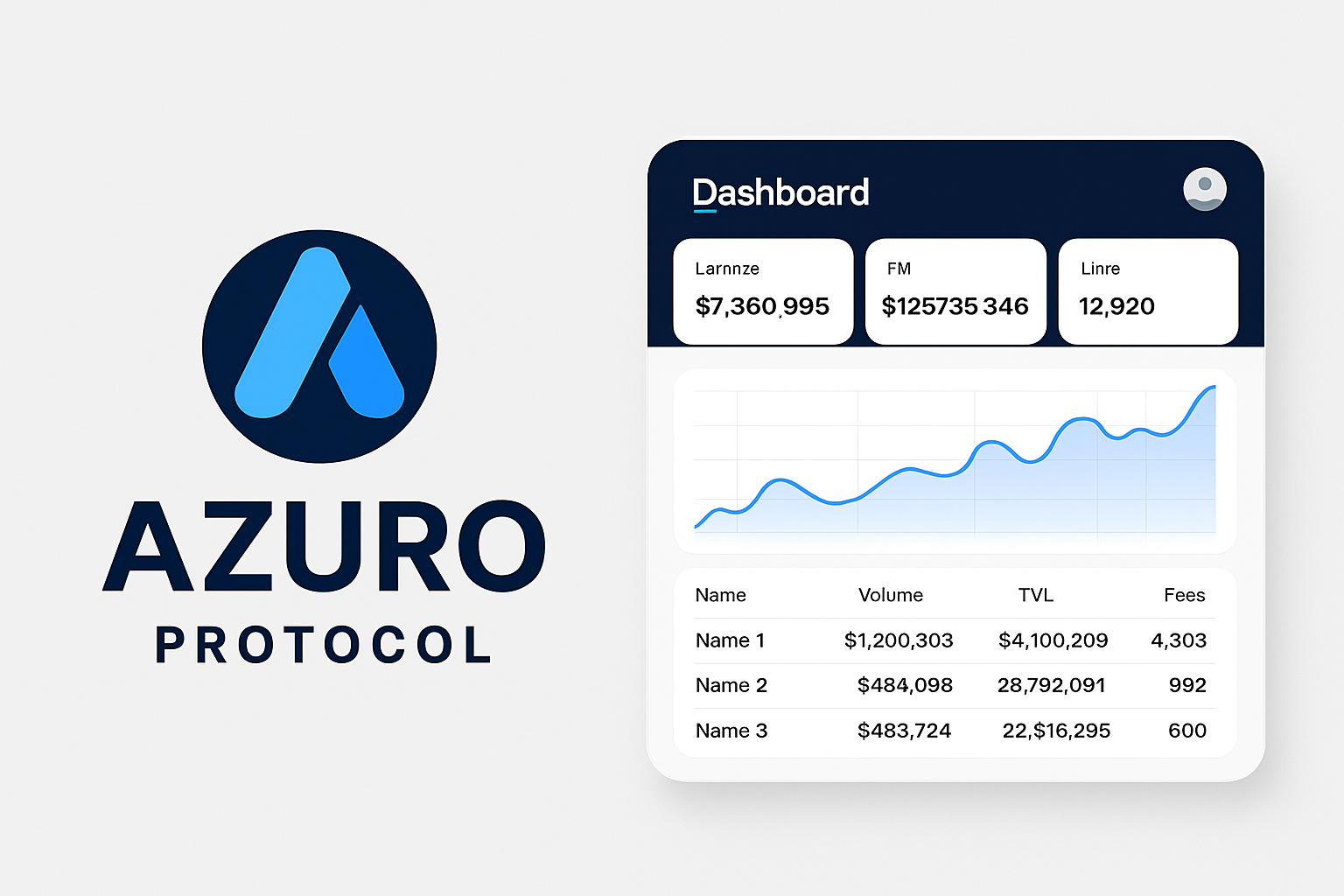

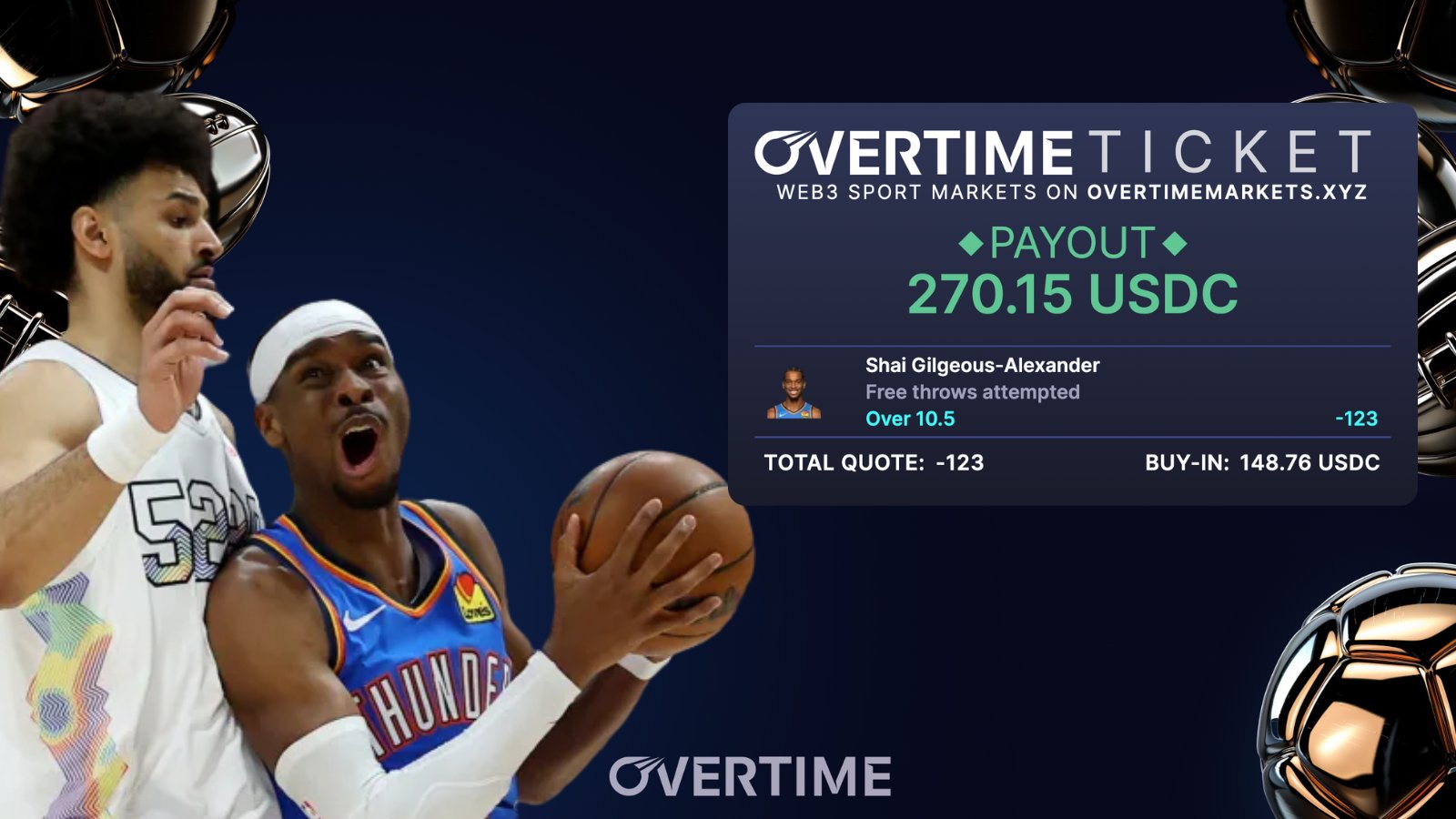

This peer-to-pool structure has already been adopted by protocols like Overtime and Azuro, which use automated market maker (AMM) mechanisms similar to those found in decentralized exchanges. By contributing capital to these pools, users effectively “become the house, ” earning a share of profits proportional to their stake whenever bets are resolved. Importantly, since there is no built-in margin or bookmaker’s cut, all odds are mathematically fair: returns reflect true probabilities minus only operational fees (which are typically minimal and transparently disclosed).

Key Advantages of DeFi Liquidity Pools for Sports Bettors

-

Enhanced Transparency: All transactions and betting activities in DeFi liquidity pools are recorded on the blockchain, ensuring a fully auditable and tamper-proof betting environment. This transparency builds trust and allows bettors to independently verify odds, bets, and payouts.

-

Zero House Edge: Platforms like LunaFi and Rogue Protocol utilize DeFi pools to eliminate the traditional bookmaker margin, offering bettors fairer odds and more favorable returns compared to conventional sportsbooks.

-

Profit-Sharing for Liquidity Providers: By contributing to DeFi pools, users can “be the house” and earn a share of the profits generated from betting activities, as seen on platforms like Divvy.Bet and Azuro. This aligns the interests of bettors and liquidity providers, creating a more participatory ecosystem.

-

Community Governance and Participation: Many DeFi betting platforms are governed by DAOs, allowing users to propose and vote on changes, ensuring the platform evolves according to the community’s needs. This participatory model is exemplified by projects like ALLIN Betting DAO.

-

Global Access and Multi-Currency Support: DeFi liquidity pools often support multiple cryptocurrencies and cross-chain functionality, enabling bettors worldwide to participate without traditional banking barriers. Innovations like cross-chain liquidity pools are expanding access and liquidity across platforms.

On-Chain Betting Mechanisms: Transparency at Every Step

The final ingredient elevating zero-house-edge sportsbooks above their centralized predecessors is full on-chain settlement. Every wager placed, every payout distributed, and every odds adjustment is immutably recorded on the blockchain. This not only guarantees provable fairness but also allows for independent verification by any participant at any time.

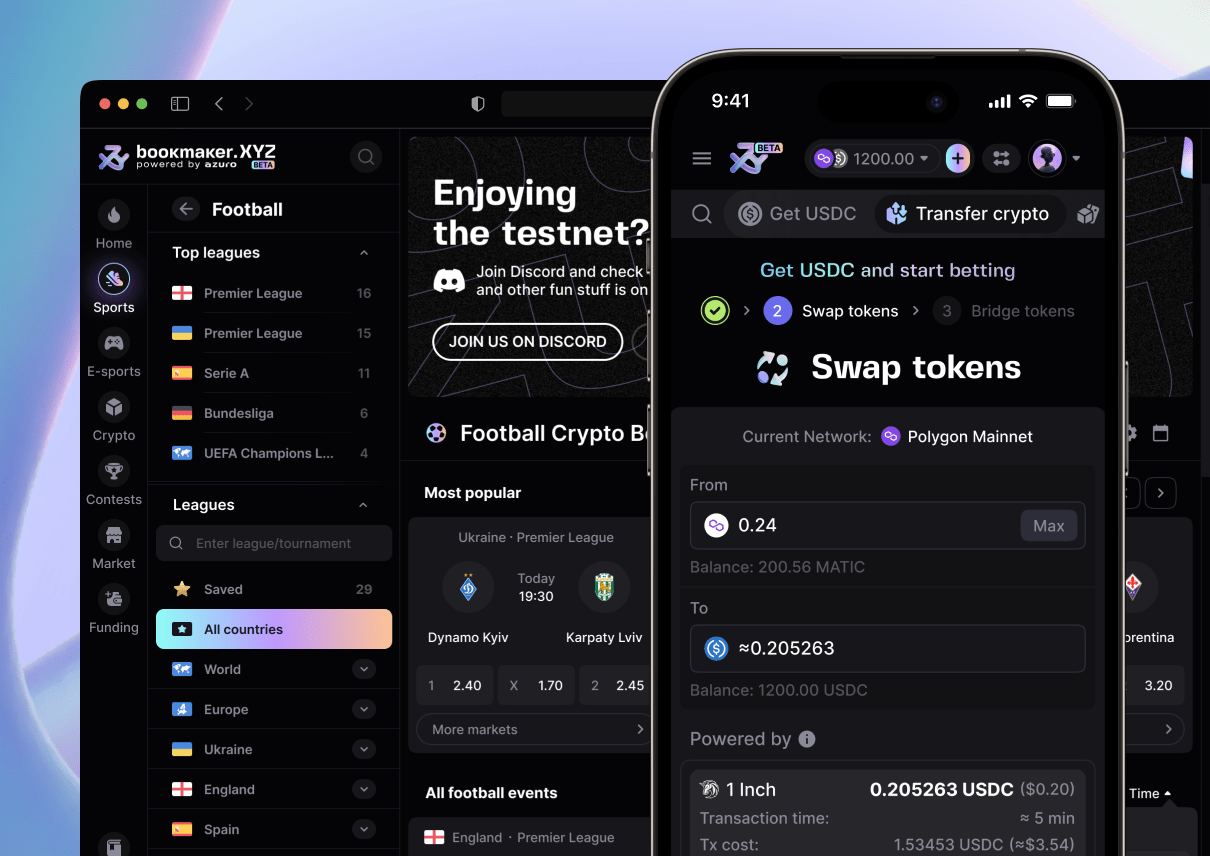

Platforms like Bookmaker. xyz exemplify this approach by routing all bets through smart contracts that resolve outcomes using decentralized data feeds (oracles). There are no custodial wallets holding user funds off-chain; everything happens transparently within auditable code. As a result, trust shifts from opaque operators to open-source protocols governed by their communities.

This level of transparency is unprecedented in sports betting and addresses many long-standing concerns about rigged odds or delayed payouts endemic to legacy platforms.

Still, these innovations come with their own set of challenges and risks. Liquidity providers, for instance, must be aware that they are exposed to the outcomes of all bets in the pool. If a majority of bettors win in a given period, the pool can suffer losses, much like a traditional bookmaker on an unlucky day. However, the open-source nature of these protocols means that risks and rewards are fully transparent, allowing users to make informed decisions about participation.

Another key consideration is platform security. While smart contracts offer automation and trustless execution, vulnerabilities in code can lead to exploits or loss of funds. This makes rigorous auditing and ongoing community oversight essential components of any reputable on-chain betting protocol. As the sector matures, we’re seeing increased adoption of decentralized insurance mechanisms and bug bounty programs to further protect participants.

How Zero-House-Edge Sportsbooks Are Changing User Experience

The user experience on zero-house-edge sportsbooks diverges significantly from traditional platforms, not just in how bets are placed, but in how users engage with the ecosystem as a whole. Bettors are no longer passive customers; they can become liquidity providers, participate in governance votes through DAOs, or even propose new markets for inclusion. This sense of ownership fosters deeper engagement and aligns incentives across all stakeholders.

Moreover, innovations such as cross-chain liquidity pools, where users provide capital across multiple blockchains and currencies, are unlocking new levels of flexibility. Platforms like Fareplay and Divvy. Bet already demonstrate how seamless it can be to move between different assets while maintaining a transparent record of all transactions on-chain.

As AI-powered risk management tools begin to integrate with these DeFi pools, expect even more dynamic odds-setting and real-time market balancing, features once reserved for large centralized operators but now available to anyone via open protocols.

Risks and Considerations for Participants

- Smart contract risk: Bugs or exploits can put user funds at risk if not properly audited.

- Liquidity volatility: Payouts depend on the health and size of the liquidity pool; thin pools may result in slippage or reduced bet sizes.

- Regulatory uncertainty: As governments catch up to decentralized betting models, compliance requirements could evolve rapidly.

Despite these challenges, the momentum behind zero-house-edge sportsbooks is undeniable. The combination of DAOs, DeFi liquidity pools, and on-chain transparency is not only reshaping sports betting but also setting new standards for fairness across online gaming more broadly.

Top Zero-House-Edge Sportsbook Platforms Using DAOs & DeFi

-

LunaFi – Decentralized Betting ProtocolEmpowers users to be the house by providing liquidity to betting pools managed by a DAO. LunaFi ensures transparent odds, profit sharing, and community-driven governance via smart contracts.

-

Azuro – Peer-to-Pool Sports BettingUtilizes a peer-to-pool Automated Market Maker (AMM) model where anyone can provide liquidity and earn a share of profits. Azuro is known for its modular infrastructure and decentralized governance.

-

Overtime Markets – On-Chain Sports BettingOffers zero-house-edge betting by letting users supply liquidity and participate in a community-governed protocol. Overtime leverages cross-chain liquidity pools for multi-currency support.

-

Divvy.Bet – Decentralized Betting EcosystemFeatures a frictionless, non-custodial betting protocol where users can be the house and earn from liquidity pools. Divvy.Bet emphasizes provable fairness and open governance.

-

Bookmaker.xyz – Smart Contract-Based BettingRuns entirely on-chain with no custodial wallets or hidden rules. Bets are resolved by decentralized data feeds, and the platform is governed by its user community.

-

Rogue Protocol – DeFi-Powered Betting PoolsImplements Uniswap-like liquidity pools for sports betting, allowing users to act as the house and earn a percentage of all winning bets. Governance is managed by a DAO.

Looking Ahead: The Future of On-Chain Sports Betting

The next wave of innovation will likely focus on interoperability (cross-chain markets), enhanced user interfaces, and further decentralization through community-driven feature development. As more sports fans become crypto-savvy, and as blockchain technology continues its march into mainstream finance, the appeal of provably fair betting environments will only grow stronger.

If you’re interested in exploring this emerging landscape or want to learn more about specific protocols powering zero-house-edge sportsbooks today, visit our deep dive at On-Chain Sports.