The on-chain sports betting landscape is undergoing a radical transformation, driven by the rise of DeFi liquidity pools and the emergence of zero-house-edge sportsbooks. Traditional betting platforms have long relied on a built-in house edge to ensure profitability, often resulting in opaque practices and misaligned incentives. In contrast, decentralized sportsbooks powered by DeFi protocols are eliminating these legacy frictions, creating a transparent and trustless environment where users can both bet and supply liquidity.

DeFi Liquidity Pools: The Engine of Decentralized Sportsbooks

At the core of this innovation are liquidity pools – smart contract-based reserves of digital assets supplied by users. In the context of DeFi sports betting, these pools function as the bankroll for all wagers, replacing the traditional sportsbook operator as the counterparty. Anyone can become a liquidity provider (LP), earning a share of protocol fees and rewards while collectively acting as “the house. ” This model is exemplified by platforms like Rogue Protocol and LunaFi, which have set new standards for fairness and transparency in the sector.

“A new wave of zero-house-edge sportsbooks is emerging, powered by DAOs and DeFi liquidity pools. “

How Zero-House-Edge Models Work

Zero-house-edge sportsbooks fundamentally alter the economics of betting. Instead of extracting value from player losses, these platforms distribute risk and rewards among LPs, who provide capital to bankroll bets. Automated Market Makers (AMMs) set odds algorithmically, adjusting in real time based on pool balances and market sentiment. This not only ensures continuous liquidity but also eliminates conflicts of interest – the platform itself does not profit directly from losses, fostering a more equitable environment for all participants.

Key Advantages of DeFi-Powered Zero-House-Edge Sportsbooks

-

Provable Fairness & Transparency: Smart contracts on platforms like Rogue Protocol and LunaFi automatically manage odds, settle bets, and enforce rules, ensuring provably fair outcomes without human intervention.

-

Decentralized Risk Management: Liquidity pools distribute risk among multiple providers, aligning incentives and reducing the platform’s exposure compared to traditional sportsbooks.

-

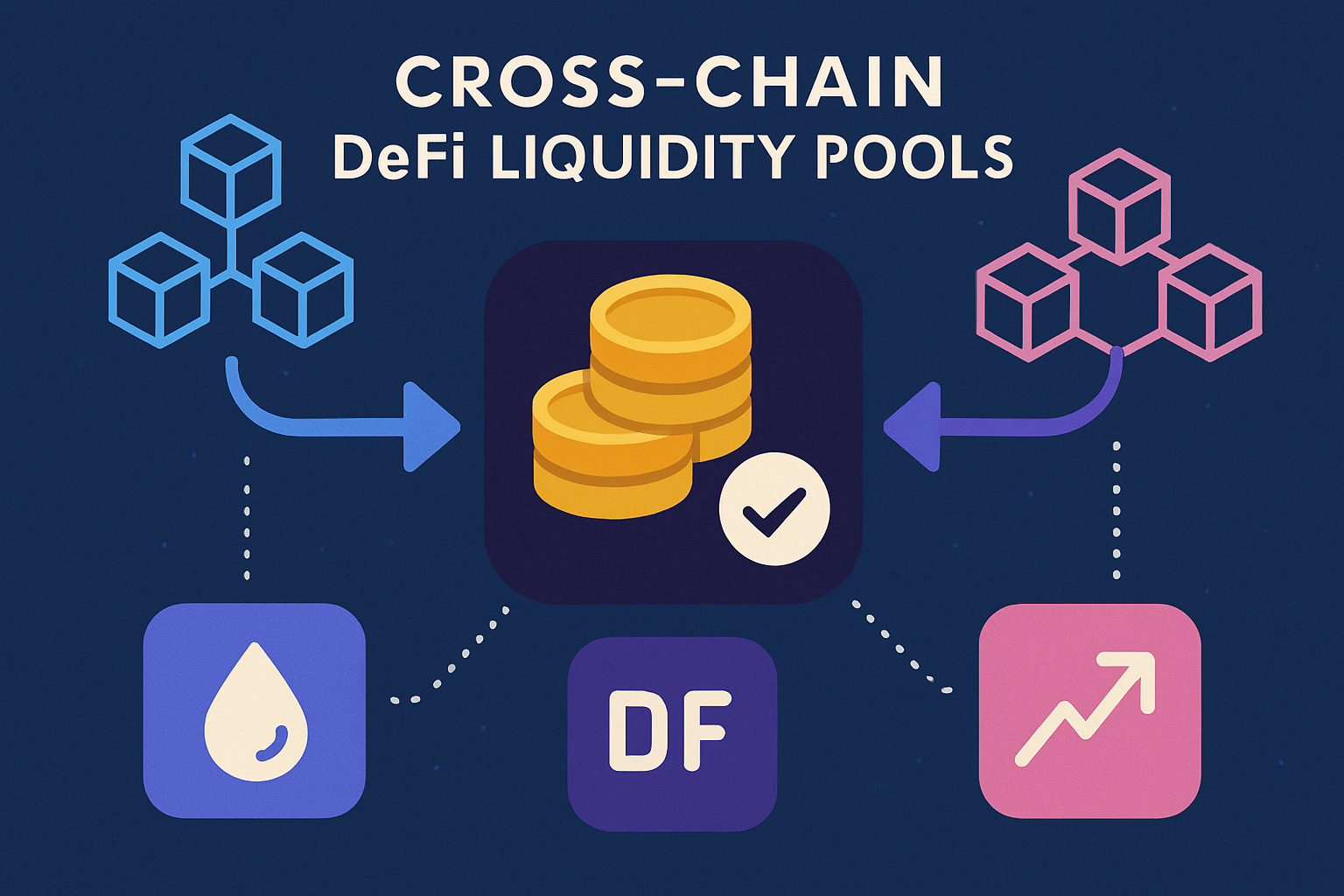

Continuous, Cross-Chain Liquidity: Automated Market Makers (AMMs) like those used by Rogue Protocol ensure real-time odds adjustment and automated settlements, while emerging cross-chain pools enable betting in multiple currencies.

-

User Empowerment & Passive Income: Anyone can become a liquidity provider—“be the house”—and earn a share of betting fees, as seen on Rogue Protocol and LunaFi.

Transparency is another critical advantage. All odds calculations, bet settlements, and fund flows are handled by open-source smart contracts, allowing anyone to audit the process. Decentralized oracles feed real-world sports data directly onto the blockchain, ensuring that outcomes are provably fair and immune to manipulation.

Real-World Examples: Rogue Protocol and LunaFi

Rogue Protocol operates a peer-to-pool AMM system where liquidity providers fund bankroll smart contracts, receiving pool tokens that represent their proportional share. As bettors place wagers, the pool’s balance fluctuates; LPs earn a percentage (typically around 1%) of all winning bets as compensation for providing liquidity and accepting risk. This model aligns incentives between bettors and LPs while removing the traditional house edge.

LunaFi, meanwhile, enables users to supply liquidity to decentralized house pools, with all bets managed transparently via smart contracts and decentralized oracles. The platform’s “bet mining” and rewards mechanisms further incentivize participation, making it possible for everyday users to earn passive income from their sports knowledge and risk appetite.

For a deeper dive into how DAOs and DeFi pools are powering fair on-chain betting, see our feature on zero-house-edge sportsbooks.

As the DeFi sports betting ecosystem matures, platforms are increasingly experimenting with cross-chain liquidity pools and AI-powered risk management to optimize both liquidity depth and market efficiency. The introduction of multi-currency pools allows users to provide liquidity in various tokens, which can be routed across different blockchains to fund wagers and jackpots. This not only increases overall liquidity but also enables bettors to stake in their preferred currency, reducing friction for global participation.

However, the peer-to-pool model is not without its challenges. Liquidity providers assume the role of the house, meaning they are directly exposed to bet outcomes and market volatility. During periods of high variance, such as major sporting events or unexpected upsets, LPs can experience short-term drawdowns. This risk is often balanced by protocol incentives, such as fee sharing, token rewards, or “bet mining” programs that compensate LPs for their capital and risk exposure.

Risks and Considerations for Liquidity Providers

Participating as an LP in a zero-house-edge sportsbook requires a clear understanding of risk-reward dynamics. Unlike traditional sportsbooks, where the house absorbs losses and profits from the edge, DeFi LPs must carefully assess:

Key Risks for DeFi Sports Betting Liquidity Providers

-

Volatility and Impermanent Loss: Liquidity providers are exposed to price fluctuations of the underlying assets (e.g., ETH, USDC) in the pool. Sudden market movements or large bets can cause impermanent loss, where the value of deposited assets becomes less than simply holding them due to AMM rebalancing.

-

Betting Outcome Risk: In peer-to-pool models like Rogue Protocol and LunaFi, LPs effectively “be the house” and must cover winning bets. A streak of unfavorable results can lead to significant drawdowns in the pool’s value.

-

Smart Contract Vulnerabilities: Liquidity pools operate via smart contracts. Bugs or exploits—such as those seen in past DeFi hacks—can lead to partial or total loss of funds. Even well-audited protocols like Uniswap have faced incidents in the broader DeFi ecosystem.

-

Oracle Manipulation: Sports betting platforms rely on decentralized oracles to fetch real-world results. If oracles are compromised or manipulated, it can lead to incorrect bet settlements and financial losses for LPs. This risk is present even on established platforms using oracles like Chainlink.

-

Liquidity Pool Fragmentation: With the rise of cross-chain liquidity pools, funds may be distributed across multiple blockchains and currencies. This can reduce available liquidity on any single platform, increase slippage, and complicate risk management for LPs.

Platforms like Fareplay and ALLIN Betting DAO are experimenting with new mechanisms to mitigate these risks, such as dynamic odds adjustment, layered risk tranching, and DAO-based governance for protocol upgrades. These innovations are designed to make DeFi sports betting more resilient and attractive to both casual and institutional LPs.

For bettors, the zero-house-edge model delivers a fundamentally different value proposition. With no centralized operator taking a cut, payouts are more generous and pricing is more competitive, especially in liquid markets. The use of decentralized oracles and open-source smart contracts further ensures that all settlements are timely, transparent, and tamper-proof. This is a crucial advantage over traditional sportsbooks, where disputes and delays can erode user trust.

The Road Ahead: Scaling and Mainstream Adoption

The next wave of growth in blockchain sports betting will hinge on scalability, user experience, and regulatory clarity. As cross-chain interoperability improves and gas fees decline, DeFi-powered sportsbooks can offer seamless, low-cost betting to a global audience. Meanwhile, DAOs are emerging as powerful governance structures, enabling communities to propose and vote on protocol upgrades, fee structures, and risk management policies.

Platforms like Divvy. Bet and Azuro are already pushing the envelope by integrating social betting, real-time analytics, and advanced risk models. As these innovations converge, the vision of a truly decentralized, zero-house-edge sportsbook is moving from theory to reality.

For a comprehensive breakdown of how these models function and their implications for both bettors and liquidity providers, explore our analysis on how zero-house-edge sportsbooks work.